Automotive Fuel Delivery System Size

Market Size Snapshot

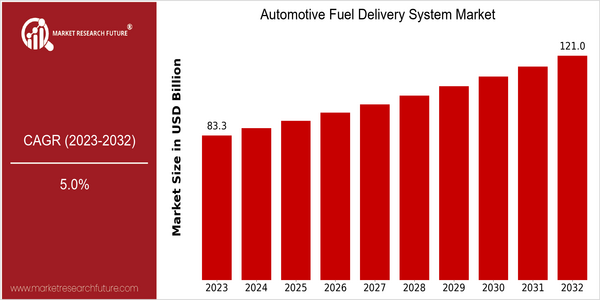

| Year | Value |

|---|---|

| 2023 | USD 83.3 Billion |

| 2032 | USD 121.0 Billion |

| CAGR (2023-2032) | 5.0 % |

Note – Market size depicts the revenue generated over the financial year

The global automobile fuel delivery systems market is estimated to reach $111.0 billion by 2032, at a CAGR of 5.0%. This growth is driven by the increasing production of vehicles and the rising demand for fuel efficiency and low-emissions vehicles. As automobile manufacturers strive to meet stringent regulatory standards and consumer demands, the market is witnessing substantial investments in new fuel delivery systems and components to enhance performance and efficiency. The transition to electric and hybrid vehicles, which require sophisticated fuel delivery systems, is also driving market growth. The advancement of fuel injection technology to improve engine efficiency is also driving the market. Furthermore, the increasing trend of connected vehicles is promoting the development of smart fuel delivery systems that integrate with vehicle management systems. Strategic initiatives undertaken by the leading players in the market, such as Robert Bosch, Denso, and Delphi Technologies, to enhance their market share and capitalize on emerging opportunities, are driving the market. For instance, Robert Bosch has been at the forefront in developing next-generation fuel delivery systems for both conventional and alternative fuel vehicles, establishing itself as a leader in the market.

Regional Market Size

Regional Deep Dive

The market for automotive fuel delivery systems is experiencing significant growth across the world, driven by technological advances, regulatory changes, and changing customer preferences. The market in North America is characterized by strong focus on innovation and sustainable development, with a large number of companies investing in advanced fuel delivery systems. The European market is characterized by stringent regulations, which are pushing manufacturers towards more efficient fuel delivery systems. The Asian-Pacific region is expanding rapidly, driven by the growing vehicle production and the growing middle class, while the Middle East and Africa are characterized by a growing demand for fuel-efficient vehicles. Latin America is influenced by economic conditions and government initiatives to promote the use of cleaner fuels. Each region is characterized by its own opportunities and challenges, which together shape the global market for fuel delivery systems.

Europe

- The European Union's Green Deal is pushing for a significant reduction in carbon emissions, leading to increased investments in electric and hybrid vehicle fuel delivery systems.

- Major automotive manufacturers such as Volkswagen and BMW are collaborating with technology firms to develop next-generation fuel delivery systems that support alternative fuels, showcasing a shift towards greener technologies.

Asia Pacific

- China's push for electric vehicles has led to a surge in demand for advanced fuel delivery systems that can accommodate hybrid technologies, with companies like Bosch and Continental investing heavily in R&D.

- India's automotive market is rapidly evolving, with government initiatives promoting cleaner fuels and fuel-efficient vehicles, driving local manufacturers to innovate in fuel delivery technologies.

Latin America

- Brazil's government has implemented policies to promote ethanol as a fuel alternative, leading to innovations in fuel delivery systems that can efficiently handle biofuels.

- The automotive market in Mexico is growing, with manufacturers adapting fuel delivery systems to meet both local and export demands, reflecting a trend towards increased production capabilities.

North America

- The U.S. Environmental Protection Agency (EPA) has introduced new regulations aimed at reducing vehicle emissions, prompting manufacturers to innovate fuel delivery systems that comply with these standards.

- Companies like Delphi Technologies and Denso are leading the charge in developing advanced fuel injection systems that enhance fuel efficiency and performance, reflecting a trend towards more sustainable automotive technologies.

Middle East And Africa

- The UAE is investing in smart city initiatives that include the development of fuel-efficient transportation systems, influencing the demand for advanced fuel delivery technologies.

- Local companies are increasingly focusing on biofuels and alternative energy sources, driven by government policies aimed at diversifying energy sources and reducing reliance on fossil fuels.

Did You Know?

“Did you know that nearly 90% of new vehicles sold in Brazil are equipped to run on ethanol, showcasing the country's commitment to alternative fuels?” — Brazilian National Agency of Petroleum, Natural Gas and Biofuels (ANP)

Segmental Market Size

The Fuel System in the Automotive Market plays a vital role in the global market, which is currently growing steadily on the back of the increase in the fuel efficiency standards and the growing share of alternative fuel vehicles. The fuel injection technology is in the process of developing further, thereby enhancing the performance and efficiency of the fuel system. In order to meet these new requirements, the companies such as Bosch and Denso are constantly innovating. The market penetration of the advanced fuel injection systems is currently in the 'widespread' stage, especially in North America and Europe. The manufacturers are introducing the systems into new models. Gasoline and diesel engines are the main applications. Hybrid and electric vehicles also use the systems, which are equipped with highly developed fuel management systems. The trends such as the trend towards sustainable mobility and the mandates for the use of cleaner technology are pushing the growth of the market. Direct injection and the use of the latest control units will shape the future of the market.

Future Outlook

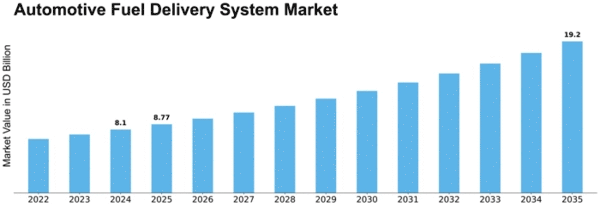

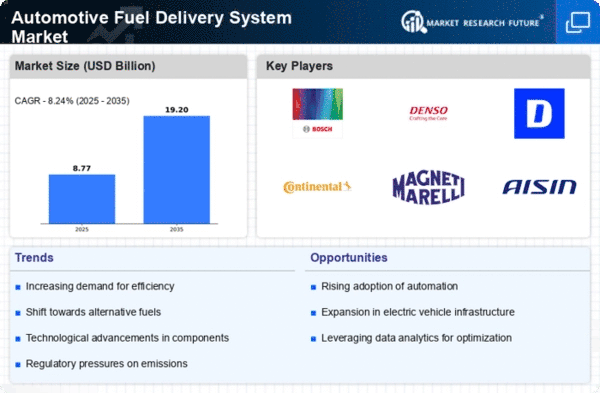

The market for automobile fuel-delivery systems will grow at a CAGR of 5.0% between 2023 and 2032, compared with the market size of $83,337,750,000 in 2023. This growth is driven by the increasing demand for fuel-efficient vehicles, as well as stricter emissions regulations that drive innovations in fuel-delivery technology. With a growing number of manufacturers adopting direct fuel injection and hybrid vehicles, the penetration of these systems is expected to increase, particularly in regions with high vehicle production and sales, such as North America and Asia-Pacific. The development of alternative fuel-delivery methods, such as electric fuel injection and fuel cells, will also have a significant impact on the market. Also, the transition to electric vehicles (EVs) and the growing focus on sustainability will influence the market for fuel-delivery systems as manufacturers respond to changing preferences and regulatory frameworks. Future trends, such as the connected car and the Internet of Things (IoT), will enhance the performance and efficiency of fuel-delivery systems, ensuring that the market remains dynamic and responsive to changing automobile trends. The market for automobile fuel-delivery systems will evolve considerably over the next 15 years, as innovation, regulations and changing consumer preferences drive growth.

Leave a Comment