Market Trends

Introduction

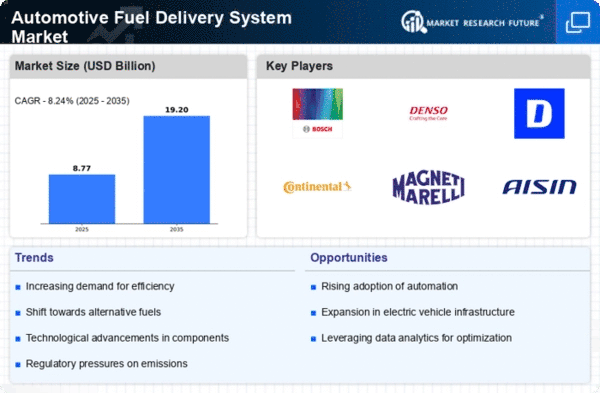

The world market for automotive fuel delivery systems will be experiencing a major transformation by 2023, driven by a confluence of macroeconomic and technological factors. A shift towards hybrid and electric vehicles is pushing manufacturers to develop new fuel delivery systems that increase efficiency and reduce emissions. The implementation of stricter regulations to reduce the carbon footprint of vehicles is also driving the industry to adopt cleaner and more effective fuel delivery systems. And changing consumer preferences towards vehicles that are more sustainable and higher performing are also influencing the design and functionality of fuel delivery systems. These trends are presenting a major strategic challenge for the industry, as it seeks to ensure compliance with regulations while meeting the demands of an increasingly discerning and eco-conscious consumer base.

Top Trends

-

Electrification of Fuel Systems

The emergence of electric vehicles is causing manufacturers to develop new fuel systems that can accommodate hybrid technology. For example, the leading car companies are investing in electric pumps to increase fuel efficiency. According to industry reports, the demand for electric fuel systems is expected to increase substantially, which will affect the use of conventional fueling systems. This may result in a reduction in the use of conventional fueling systems, which could affect the supply chains. -

Integration of Advanced Sensors

The sensors of the fuel-delivery systems are able to monitor the engine's performance and diagnose faults. Companies are developing systems that provide real-time data on fuel consumption and emissions. For example, Bosch has introduced smart injectors that adjust the injection pressure to suit the driving conditions. The trend is towards better performance and reduced emissions, in line with the new regulations. -

Focus on Sustainability

The development of a new fuel for the future, biofuels, is becoming a focus of the automobile industry. Incentive payments to governments are bringing companies to adapt their technology. Denso, for example, is working on a system that can help reduce the carbon footprint of vehicles by using alternative fuels. This trend will lead to innovation in the materials and processes used in fuel systems. -

Digitalization and Connectivity

The development of the Internet of Things and the Internet of Things is leading to a need for digitally integrated fuel supply systems. Companies are now using the Internet of Things to enhance fuel management and monitoring. For example, TI Automotive is developing systems that can communicate with the vehicle’s onboard controller to optimize fuel consumption. This is expected to increase operational efficiency and provide manufacturers with valuable data. -

Regulatory Compliance and Emission Standards

Stricter emissions regulations are driving manufacturers to develop new ways of delivering fuel to engines. Across the world governments are implementing policies that require vehicles to produce fewer emissions. This is having a major influence on design and technology. Among other things, the European Union’s tightening regulations are encouraging companies to develop cleaner fuels. This is likely to speed up the take-up of advanced fuel systems that comply with these regulations. -

Increased Investment in R&D

There has been a considerable increase in the expenditure of research and development on the improvement of the methods of fuel delivery. In this respect, the major players are putting a large budget. For example, Magneti Marelli has increased the expenditure on the development of the next generation of fuel systems. It is expected that this trend will bring about a considerable improvement in fuel efficiency and performance, with a consequent effect on market competition. -

Adoption of Lightweight Materials

The car industry is increasingly turning to light materials for its fuel systems, to improve performance and reduce vehicle weight. To replace the traditional metals, companies are developing advanced composites and plastics. UCAL Fuel System, for example, is working on lightweight designs that will enhance fuel economy. This trend is expected to bring about improvements in the performance and fuel economy of vehicles as a whole. -

Customization and Modular Systems

There is a growing trend towards a bespoke, modular fuelling system to meet the varied requirements of the individual consumer. The manufacturers are developing components which can be easily adapted to different vehicle types. For example, Delphi Automotive offers a range of bespoke fuelling systems for different applications. This is expected to increase the flexibility of production and to reduce the time taken to launch new models. -

Enhanced Safety Features

It is the first concern of the fuel-delivery systems to ensure their safety. In this respect, innovations are being made which reduce risks. The companies are introducing leak-detection devices and pressure-gauging devices in order to increase safety. For example, Infineon Technologies is developing sensors which can detect leaks in real time. This is likely to increase both confidence in the system and compliance with the safety regulations. -

Global Supply Chain Resilience

In the car fuel delivery systems market, a trend towards the construction of resilient supply chains has been observed in response to the world's crises. In order to reduce the risk of disruption, companies are diversifying their suppliers and investing in local production. The main operators, for example, are re-examining their supply chains to ensure continuity of supply. This trend should improve the stability of the operations and reduce the risks of the market.

Conclusion: Navigating Competitive Waters in Fuel Delivery

The Automotive Fuel System Market in 2023 is characterized by intense competition and significant fragmentation. The competition is between established and new players. The trend is towards innovation and sustainable development, which will encourage the established players to improve their products and the new players to use advanced technology. Suppliers are increasingly focusing on capabilities such as AI, automation, and flexibility to differentiate themselves and meet the needs of consumers. The strategy of suppliers is to invest in sustainable development and adopt agile methods to stay competitive. Those who can integrate these capabilities well will probably be the winners in this fast-changing environment.

Leave a Comment