The Biologics Market is currently experiencing a dynamic evolution, characterized by a growing emphasis on innovative therapies and personalized medicine. This sector encompasses a wide range of products derived from living organisms, including monoclonal antibodies, vaccines, and cell and gene therapies.

The increasing prevalence of chronic diseases and the rising demand for targeted treatments appear to drive the expansion of this market. Continuous biologics research is essential for discovering novel pathways to treat complex autoimmune diseases and rare cancers. Scientific teams are increasingly focusing on messenger RNA and cell-based therapies to expand the boundaries of modern medicine.

Furthermore, advancements in biotechnology and regulatory frameworks are likely to facilitate the development and approval of new biologic products, enhancing patient outcomes and overall healthcare efficiency.

In addition, the Biologics Market seems to be influenced by a shift towards biosimilars, which offer cost-effective alternatives to original biologic therapies. This trend may provide greater access to essential treatments for patients while fostering competition among manufacturers. This continuous growth leads to the biosimilar market as well.

As the market continues to mature, collaboration between pharmaceutical companies, research institutions, and regulatory bodies is expected to play a crucial role in shaping the future landscape of biology. Overall, the Biologics Market is poised for substantial growth, driven by innovation, collaboration, and a commitment to improving patient care.

Rise of Personalized Medicine

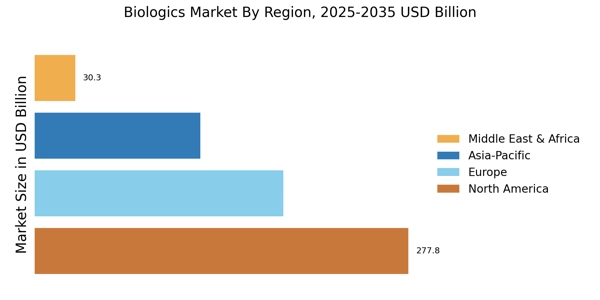

The Biologics Market is witnessing a notable shift towards personalized medicine, where treatments are tailored to individual patient profiles. This approach enhances the efficacy of therapies and minimizes adverse effects, thereby improving patient outcomes. As genetic and molecular profiling becomes more accessible, the demand for biologic that cater to specific patient needs is likely to increase. Total biologics market size continues to climb as healthcare systems worldwide prioritize high-efficacy specialty drugs. This upward trend reflects the increasing reliance on large-molecule therapies for chronic disease management.

Expansion of Biosimilars

The emergence of biosimilars is reshaping the Biologics Market by providing cost-effective alternatives to original biologic products. This trend may enhance patient access to essential therapies while fostering competition among manufacturers. As regulatory pathways for biosimilars become more established, their presence in the market is expected to grow, potentially leading to reduced healthcare costs.

Technological Advancements in Biomanufacturing

Innovations in biomanufacturing technologies are significantly impacting the Biologics Market. Enhanced production processes, such as continuous manufacturing and advanced cell culture techniques, may improve efficiency and reduce costs. These advancements could facilitate the rapid development of new biologic therapies, ultimately benefiting patients and healthcare systems.

The biologics industry is characterized by complex manufacturing processes that require specialized facilities and highly trained personnel. Emerging technologies like single-use bioreactors are currently revolutionizing how these organizations scale their production.