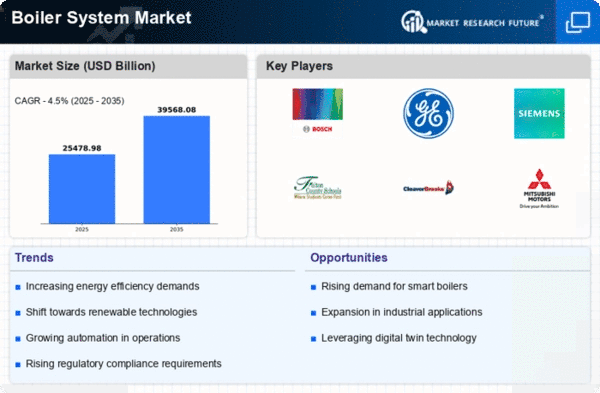

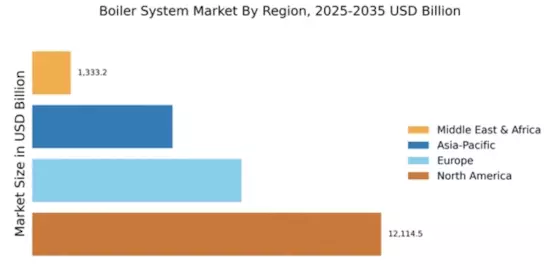

Market Growth Projections

The Boiler System Industry is poised for substantial growth, with projections indicating a market value of 19.3 USD Billion in 2024 and an anticipated increase to 28.5 USD Billion by 2035. This growth trajectory reflects the increasing adoption of advanced combi boiler technologies and the rising demand for energy-efficient solutions across various sectors. The market is expected to experience a CAGR of 3.58% from 2025 to 2035, driven by factors such as industrial expansion, regulatory support for clean energy, and technological advancements. These projections highlight the potential for significant investment and innovation within the boiler system market.

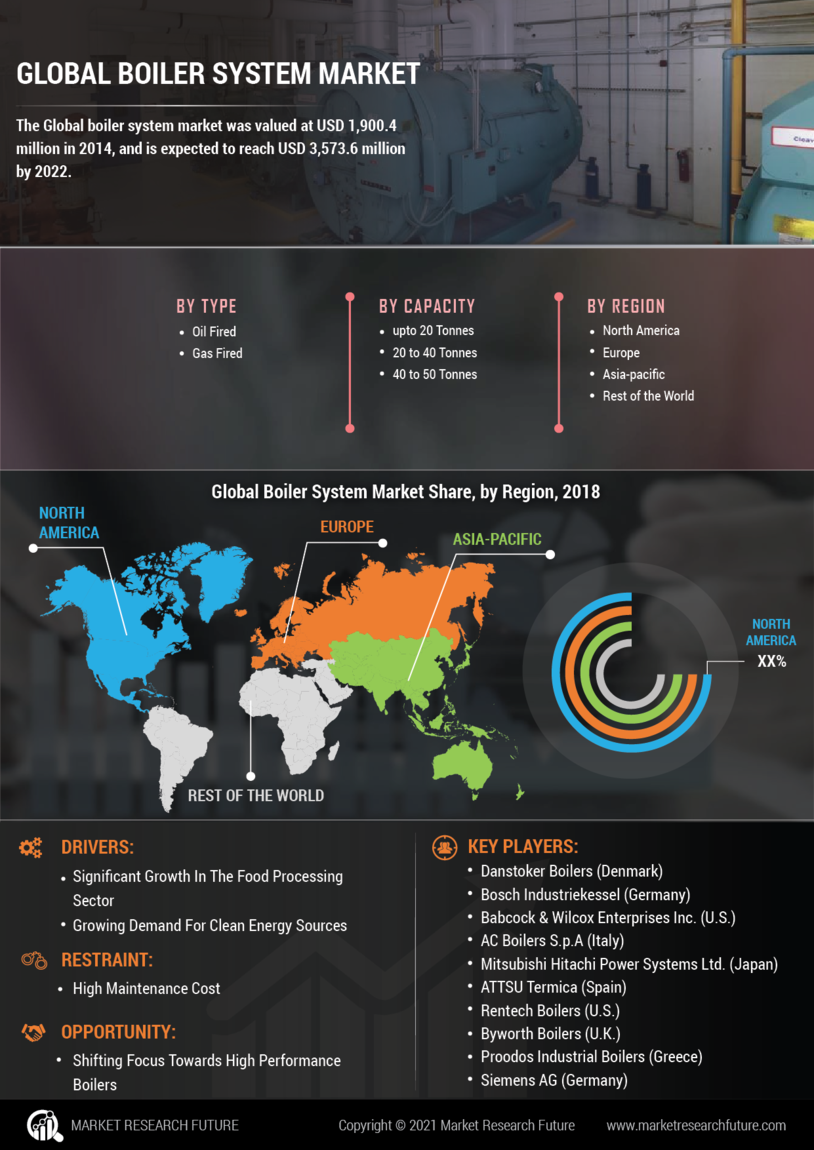

Industrial Growth and Expansion

The Global Boiler System Industry is significantly influenced by the expansion of various industrial sectors, including manufacturing, food processing, and chemicals. As these industries grow, the need for reliable and efficient heating solutions becomes paramount. For example, the manufacturing sector is increasingly investing in modern boiler systems to enhance productivity and ensure compliance with safety regulations. This industrial growth is anticipated to drive the market, with projections indicating an increase to 28.5 USD Billion by 2035. The continuous expansion of industrial activities globally suggests a sustained demand for advanced boiler systems that can meet diverse operational requirements.

Increasing Demand for Energy Efficiency

The Boiler System Industry experiences a growing demand for energy-efficient solutions as industries strive to reduce operational costs and environmental impact. Governments worldwide are implementing stringent regulations aimed at enhancing energy efficiency in industrial processes. For instance, the implementation of energy efficiency standards has led to a notable increase in the adoption of advanced boiler systems. This trend is projected to contribute to the market's growth, with the industry expected to reach 19.3 USD Billion in 2024. As industries prioritize sustainability, the demand for innovative boiler technologies that optimize fuel consumption and minimize emissions is likely to rise.

Technological Advancements in Boiler Systems

Technological innovations play a crucial role in shaping the Boiler System Industry. The introduction of smart boiler technologies, which incorporate IoT and automation, enhances operational efficiency and monitoring capabilities. These advancements enable real-time data analysis, predictive maintenance, and improved energy management. As industries adopt these technologies, they can achieve significant cost savings and operational efficiencies. The market is likely to benefit from these innovations, as they align with the growing emphasis on digital transformation in industrial processes. The integration of advanced technologies is expected to bolster the market's growth trajectory in the coming years.

Regulatory Support for Clean Energy Initiatives

The Boiler System Industry is positively impacted by regulatory frameworks promoting clean energy initiatives. Governments are increasingly incentivizing the adoption of low-emission and renewable energy technologies, which include advanced boiler systems. For instance, policies aimed at reducing greenhouse gas emissions encourage industries to transition to cleaner heating solutions. This regulatory support is likely to drive the market's growth, as companies seek to comply with environmental standards while optimizing their energy consumption. The emphasis on sustainability and clean energy is expected to foster a favorable environment for the development and deployment of innovative boiler technologies.

Rising Demand for Steam and Hot Water Applications

The Boiler System Market is witnessing a surge in demand for steam and hot water applications across various sectors, including healthcare, hospitality, and power generation. The need for reliable heating solutions in these industries drives the adoption of advanced boiler systems. For example, hospitals require consistent steam supply for sterilization processes, while hotels depend on hot water systems for guest services. This growing demand is likely to contribute to the market's expansion, with a projected CAGR of 3.58% from 2025 to 2035. The increasing reliance on efficient heating solutions in diverse applications underscores the importance of the boiler system market.