Research Methodology on Carbon Fiber Automotive Market

INTRODUCTION

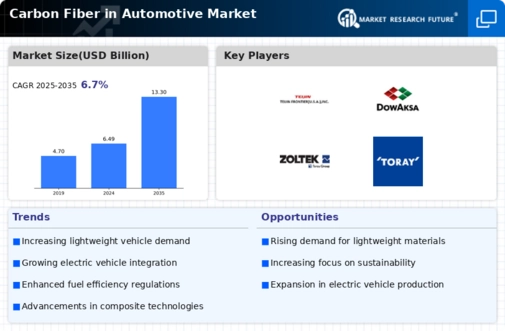

The Carbon Fiber Automotive Market is expected to reach 4.5 million tons by 2026. This market is driven by developments in the automotive industry, attractive properties of carbon fiber, a wide range of applications and advancements in producing carbon fiber with improved properties.

This research report analyses the market size of Carbon Fiber Automotive globally, regionally and individually. It also identifies competitive strategies adopted by key market players and intends to analyze the competitive landscape, value chain assessment and market dynamics including drivers, challenges, trends, opportunities and Porter’s Five Forces Analysis.

RESEARCH METHODOLOGY

This section covers the research methodology adopted for the Carbon Fiber Automotive Market report. The research methodology adopted for this report includes both primary and secondary research.

Primary Research:

The primary research methodology adopted to collect data are interviews with industry experts. Both quantitative and qualitative interviews have been conducted. The qualitative interviews mainly covered the understanding of the trends, and macro and micro-economic factors, which will likely influence the growth of the market.

Secondary Research:

Secondary research has been used to identify and collect detailed information on the carbon fiber automotive market. Extensive research has been conducted to analyze the market size, growth rate, market trends, competitive landscape and outlook. The sources of information gathered through secondary research include industry association magazines, newsletters, whitepapers, databases, company financial reports and annual reports, corporate presentations, industry analyst reports and other available sources.

MARKET SIZE ESTIMATION

The market size estimation of the Carbon Fiber Automotive Market has been conducted using the top-down and bottom-up approach. The bottom-up approach has been employed to deduce the global market size of Carbon Fiber Automotive, from the revenue of key players and their market share. The top-down approach has been employed to appraise the size of other individual markets. The dataset has been triangulated based on industry players’ revenues, production capacity and industry trends & developments. The economic and non-economic factors affecting the Carbon Fiber Automotive Market have been evaluated to estimate the market size.

MARKET STATUS

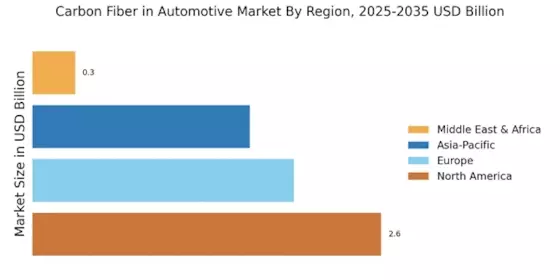

The global Carbon Fiber Automotive Market has been segmented into North America, Europe, Asia-Pacific and the rest of the world.

Europe held the largest market share in 2022, and is expected to continue this trend in the forecast period, owing to the increasing competition in the automotive industry and the advancements in technology.

Asia Pacific is expected to have the fastest growth rate because of the increasing demand in the automotive sector. Key countries including China, Japan, India and South Korea are expected to grow at a rapid pace.

North America has also grown at an impressive pace due to the shift in preference for luxury cars.

The Carbon Fiber Automotive Market in the rest of the world is expected to grow at a steady rate due to the lack of a well-established carbon fiber market base.

ANALYSIS

The Carbon Fiber Automotive Market is analyzed through Porter's Five Forces Analysis. This analysis helps in identifying the potential of buyers and suppliers and understanding the competition in the market.

It also reveals the value chain analysis, market and regional segmentation, market dynamics, pricing analysis and changing market trends, drivers and restraints.

The Carbon Fiber Automotive Market has been studied for different types, applications, major regions and major players.

CONCLUSION

The Carbon Fiber Automotive Market has seen significant growth over the past few years, owing to the increasing demand in the automotive, aerospace and defence sectors. The market is expected to witness even faster growth during the forecast period, due to the rising preference for lightweight materials and the ongoing developments in the carbon fiber automotive market. The market is likely to be driven by the increasing competition in the automotive, aerospace and defence industries, attractive properties of carbon fiber and advancements in producing carbon fiber with improved properties.