Carbon Fiber Wrap Size

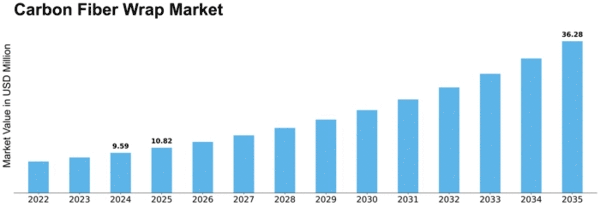

Carbon Fiber Wrap Market Growth Projections and Opportunities

The Carbon Fiber Market Wrap Industry is subjected to numerous driving forces and factors that influence its operation dynamics and growth primarily. One of the chief driving forces for this market is the increased replacement demand for carbon fiber wrap by the automotive and aerospace industries. CARBON in some way is how light carbon fiber glass which is famous for its lightweight and high strength characteristics is used to reinforce the structural strength and performance of vehicles, aircraft, and other advanced applications. The shrinking of the carbon footprint among automobiles, the increase of strength-to-weight ratios & design aesthetics makes way to the development of carbon wraps’ fields and implications are seen in modern transportation systems too that helps to source sad greenhouse gases.

The role of global economy in this market regarding the dynamics of Carbon Fiber wraps cannot be overlooked. Wave of economic growth or destination is frequently reflected on consumer spending, industrial sector and construction field, by which the demand for carbon fiber wrapping will be affected. Overall, times of good economic development lead to higher car production, infrastructure within the industry, and manufacturing of consumer goods, thus increasing demand for light materials which in return improves the market condition. On the contrary, when there is recession, the construction industry and industrial output falls --( which may affect the Carbon Fiber Wrap Market).

On the one hand, inventions in the field of technology and also improvements in the manufacturing techniques are two of the most defining factors underlying the carbon fiber wrap market growth. The progressive efforts and process of research and development are useful in modifying the manner of production and attributes of application of wrapper of carbon fiber. With these technologies taking a position in the competitiveness of these items, their posturing to market trends which are been noticed is enabled as well as the development of new applications in industries which are at least marine, sports and leisure and construction.

The regression model used the automotive industry as the exogenous variable. High-strength carbon fiber wraps are the choice of material to provide reinforcement and customization for automobiles, adding both aesthetics and impact performance to vehicles. The growing number of customized automotive solutions and the continuous rise in electric vehicles are a factor to the market's size development. Besides that, the carrying capacity of spots/leisure commodity, including applications in bicycles, motorcycles and sports equipment has represented a potential market for carbon fiber wraps recently.

Environmental restrictions and sustainability drives are major influencing factors for the carbon fiber wrap industry. In the face of green initiatives that are gaining momentum in the industrial sector, materials with the lower environmental effect move to the focus as they present a viable option for companies to consider. The increasing demand for tighter environmental regulations and the improved sustainability attitudes can be considered the two most important factors in the formation of the market. Industry's actions toward the cleaning of emissions, reduction of carbon footprints, and general switching to sustainability is the return of the market.

Leave a Comment