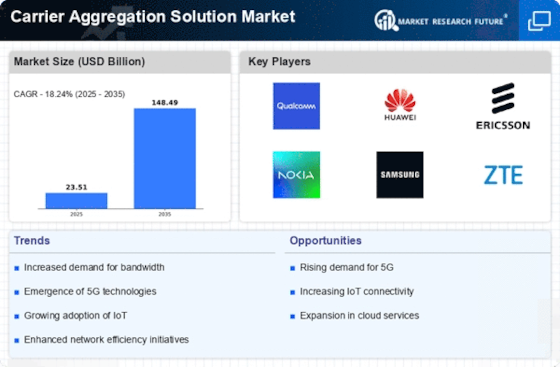

Emergence of 5G Technology

The advent of 5G technology is a pivotal driver for the Carrier Aggregation Solution Market. With its promise of ultra-low latency and significantly higher data rates, 5G is set to revolutionize mobile connectivity. The integration of carrier aggregation techniques is essential for maximizing the potential of 5G networks, allowing operators to combine multiple frequency bands to achieve optimal performance. As 5G deployment accelerates, the need for advanced carrier aggregation solutions becomes increasingly critical. Industry forecasts suggest that by 2026, 5G subscriptions could reach over 1.5 billion, further propelling the demand for sophisticated aggregation technologies that can support diverse applications, from IoT to enhanced mobile broadband.

Rising Mobile Data Consumption

The Carrier Aggregation Solution Market is experiencing a surge in mobile data consumption, driven by the proliferation of smartphones and mobile applications. As users increasingly rely on mobile devices for streaming, gaming, and social media, the demand for higher data rates becomes paramount. Reports indicate that mobile data traffic is expected to grow exponentially, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This trend compels telecommunications providers to adopt carrier aggregation solutions to enhance network capacity and deliver seamless user experiences. Consequently, the industry is witnessing a shift towards more robust and efficient network architectures that can accommodate this escalating demand.

Growing Internet of Things (IoT) Applications

The proliferation of Internet of Things (IoT) applications is emerging as a significant driver for the Carrier Aggregation Solution Market. As more devices become interconnected, the demand for reliable and high-speed connectivity is paramount. Carrier aggregation plays a crucial role in ensuring that IoT devices can communicate effectively, particularly in environments where multiple devices operate simultaneously. Industry projections suggest that the number of connected IoT devices could exceed 30 billion by 2030, necessitating robust network solutions that can handle the increased data traffic. This trend underscores the importance of carrier aggregation in facilitating seamless connectivity for a diverse range of applications, from smart homes to industrial automation.

Increased Competition Among Telecom Operators

Intensifying competition among telecom operators is significantly influencing the Carrier Aggregation Solution Market. As service providers strive to differentiate themselves in a saturated market, the implementation of carrier aggregation becomes a strategic imperative. By leveraging this technology, operators can offer superior data speeds and improved service quality, thereby attracting and retaining customers. Market analysis indicates that operators who adopt advanced carrier aggregation solutions are likely to see a marked increase in customer satisfaction and loyalty. This competitive landscape is driving innovation and investment in network infrastructure, as companies seek to enhance their service offerings and maintain a competitive edge.

Regulatory Initiatives Supporting Network Expansion

Regulatory initiatives aimed at supporting network expansion are playing a vital role in shaping the Carrier Aggregation Solution Market. Governments and regulatory bodies are increasingly recognizing the importance of robust telecommunications infrastructure for economic growth and social development. Policies that promote spectrum allocation and investment in network upgrades are encouraging operators to adopt carrier aggregation solutions. As a result, the industry is witnessing a wave of infrastructure development, with operators seeking to enhance their service capabilities. This regulatory support not only facilitates the deployment of advanced technologies but also fosters a competitive environment that drives innovation and improves service delivery across the telecommunications sector.