Advancements in Cloud Computing

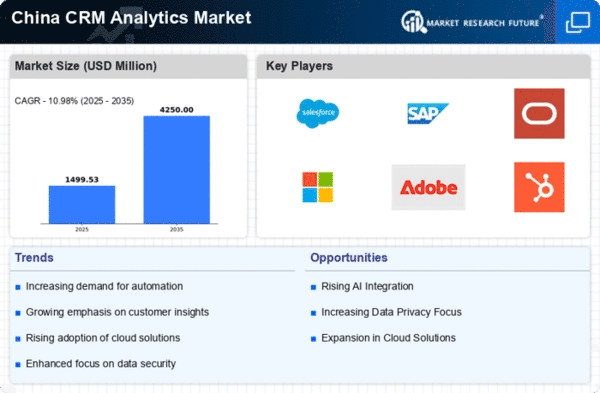

The crm analytics market in China is significantly influenced by advancements in cloud computing technologies. As organizations migrate to cloud-based solutions, they gain access to scalable and flexible analytics tools that enhance their operational efficiency. The cloud enables real-time data processing and storage, which is crucial for businesses aiming to respond swiftly to market changes. In 2025, it is estimated that cloud-based crm analytics solutions will account for over 60% of the market share, reflecting a shift towards more agile and cost-effective analytics capabilities. This transition is likely to empower companies to harness large volumes of data, thereby driving innovation within the crm analytics market.

Rising Demand for Customer Insights

The crm analytics market in China is experiencing a notable surge in demand for customer insights. Businesses are increasingly recognizing the value of data-driven decision-making, which is essential for enhancing customer engagement and loyalty. In 2025, the market is projected to grow by approximately 15%, driven by the need for organizations to understand customer behavior and preferences. This trend is particularly evident in sectors such as retail and e-commerce, where companies leverage analytics to tailor their offerings. The ability to analyze customer data effectively allows businesses to identify trends and optimize marketing strategies, thereby improving overall performance in the crm analytics market.

Emergence of Mobile Analytics Solutions

The crm analytics market in China is witnessing the emergence of mobile analytics solutions, which cater to the growing demand for on-the-go data access. As mobile device usage continues to rise, businesses are increasingly adopting mobile-friendly analytics tools that allow for real-time insights. This trend is expected to contribute to a market growth of approximately 14% by 2025, as organizations seek to empower their workforce with mobile capabilities. The ability to analyze data from anywhere enhances decision-making processes and fosters a culture of agility within companies. Consequently, the proliferation of mobile analytics is likely to play a crucial role in shaping the future of the crm analytics market.

Regulatory Compliance and Data Governance

The crm analytics market in China is increasingly shaped by the need for regulatory compliance and robust data governance frameworks. As data privacy regulations become more stringent, organizations are compelled to adopt analytics solutions that ensure compliance while maintaining customer trust. This shift is likely to drive the adoption of secure and transparent analytics tools, with a projected market growth of 10% in 2025. Companies are investing in technologies that facilitate data governance, enabling them to manage customer data responsibly. This focus on compliance not only mitigates risks but also enhances the credibility of businesses within the crm analytics market.

Increased Investment in Digital Transformation

In China, the crm analytics market is benefiting from increased investment in digital transformation initiatives. Organizations are allocating substantial budgets to upgrade their technology infrastructure, which includes implementing advanced analytics solutions. This trend is expected to result in a market growth rate of around 12% annually as companies seek to enhance their competitive edge. The focus on digital transformation is particularly pronounced in industries such as finance and telecommunications, where data analytics plays a pivotal role in optimizing operations and improving customer experiences. As businesses continue to embrace digital tools, the crm analytics market is poised for robust expansion.