Rising Demand for Customer Insights

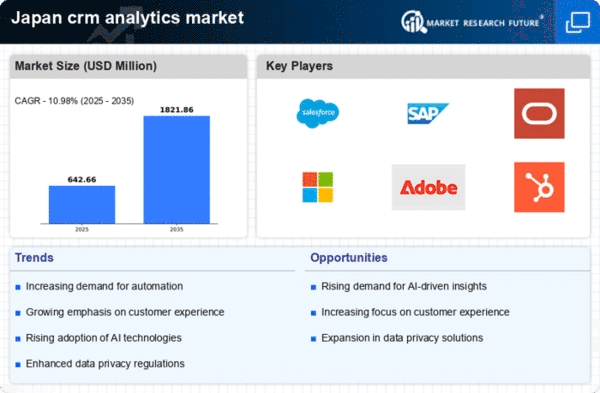

The crm analytics market in Japan is experiencing a notable surge in demand for customer insights. Businesses are increasingly recognizing the value of data-driven decision-making to enhance customer experiences. In 2025, the market is projected to grow by approximately 15%, driven by the need for personalized marketing strategies. Companies are leveraging analytics to understand customer behavior, preferences, and trends, which allows them to tailor their offerings effectively. This trend is particularly evident in sectors such as retail and e-commerce, where understanding customer journeys is crucial. As organizations strive to remain competitive, the integration of advanced analytics tools becomes essential, thereby propelling the crm analytics market forward.

Advancements in Predictive Analytics

The crm analytics market in Japan is being propelled by advancements in predictive analytics technologies. These innovations enable businesses to forecast customer behavior and market trends with greater accuracy. By 2025, it is anticipated that predictive analytics will account for a significant portion of the crm analytics market, as organizations seek to leverage data for strategic planning. This capability allows companies to anticipate customer needs and preferences, thereby enhancing their service offerings. The integration of machine learning algorithms into crm analytics tools further enhances predictive capabilities, making it a critical driver of growth in the market.

Integration of Cloud-Based Solutions

The shift towards cloud-based solutions is significantly influencing the crm analytics market in Japan. Organizations are increasingly adopting cloud technologies to enhance their data management capabilities. By 2025, it is estimated that over 60% of businesses will utilize cloud-based crm analytics tools, facilitating real-time data access and collaboration. This transition not only reduces operational costs but also improves scalability and flexibility. As companies seek to streamline their operations and enhance customer engagement, the demand for cloud-integrated analytics solutions is expected to rise. This trend underscores the importance of cloud technology in shaping the future of the crm analytics market.

Increased Investment in Marketing Automation

The crm analytics market in Japan is experiencing a surge in investment in marketing automation technologies. Businesses are recognizing the importance of automating marketing processes to improve efficiency and effectiveness. By 2025, it is expected that the market for marketing automation tools will grow by approximately 25%, driven by the need for data-driven marketing strategies. These tools enable organizations to analyze customer data and optimize marketing campaigns in real-time. As companies strive to enhance their marketing efforts and achieve better ROI, the integration of crm analytics with marketing automation becomes increasingly vital, thereby fueling growth in the crm analytics market.

Growing Focus on Customer Retention Strategies

In Japan, the crm analytics market is witnessing a growing emphasis on customer retention strategies. Businesses are increasingly aware that retaining existing customers is often more cost-effective than acquiring new ones. As a result, companies are investing in analytics tools to identify at-risk customers and develop targeted retention campaigns. It is projected that by 2025, organizations that effectively utilize crm analytics for retention purposes could see a 20% increase in customer loyalty. This focus on retention not only enhances profitability but also fosters long-term relationships with customers, thereby driving growth in the crm analytics market.