Growing Demand for Data-Driven Insights

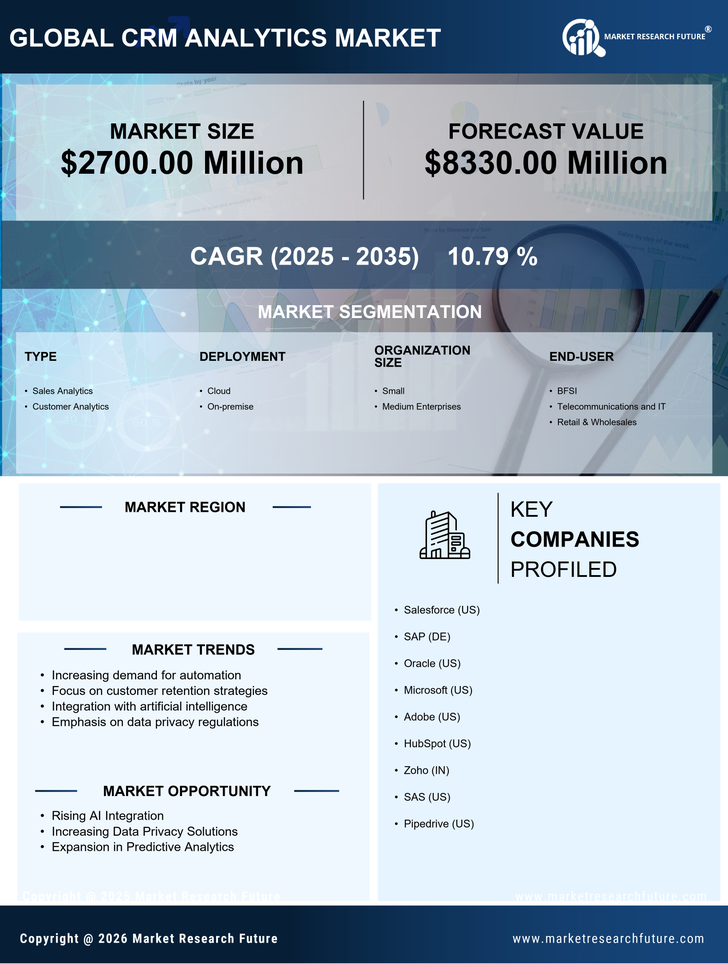

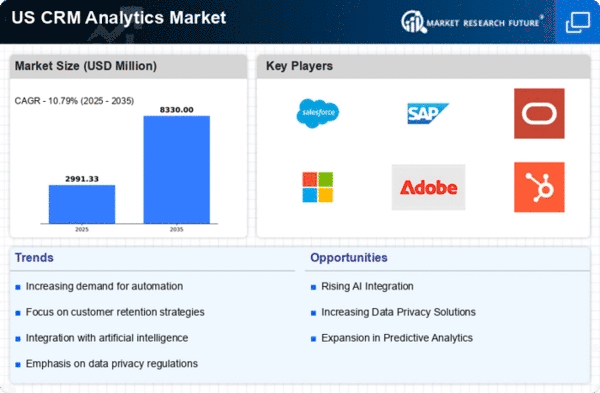

The crm analytics market is experiencing a notable surge in demand for data-driven insights. Organizations are increasingly recognizing the value of leveraging customer data to inform strategic decisions. In 2025, it is estimated that the market will reach a valuation of approximately $10 billion, reflecting a compound annual growth rate (CAGR) of around 15% from previous years. This growth is largely attributed to businesses seeking to enhance customer engagement and retention through informed decision-making. As companies strive to remain competitive, the ability to analyze customer behavior and preferences becomes paramount. Consequently, the crm analytics market is positioned to expand as organizations invest in advanced analytics tools to derive actionable insights from their data.

Rising Importance of Customer Experience

In the crm analytics market, the emphasis on customer experience is becoming increasingly pronounced. Companies are prioritizing the enhancement of customer interactions to foster loyalty and satisfaction. Research indicates that organizations that effectively utilize crm analytics can improve customer retention rates by up to 30%. This focus on customer experience drives the demand for sophisticated analytics solutions that can provide insights into customer journeys and preferences. As businesses strive to create personalized experiences, the crm analytics market is likely to see continued growth. The integration of customer feedback and behavior analysis into business strategies is essential for organizations aiming to differentiate themselves in a competitive landscape.

Emergence of Advanced Predictive Analytics

The crm analytics market is increasingly characterized by the emergence of advanced predictive analytics capabilities. Organizations are leveraging predictive models to forecast customer behavior and trends, enabling proactive decision-making. This trend is particularly relevant as businesses aim to anticipate customer needs and preferences. By 2025, it is expected that predictive analytics will account for a significant share of the crm analytics market, driven by the need for organizations to stay ahead of the competition. The ability to utilize historical data to predict future outcomes enhances the strategic planning process, making predictive analytics a critical component of the crm analytics market.

Growing Regulatory Compliance Requirements

In the crm analytics market, the landscape is being shaped by increasing regulatory compliance requirements. Organizations are under pressure to ensure that their data handling practices align with evolving regulations, such as data privacy laws. This has led to a heightened focus on analytics solutions that not only provide insights but also ensure compliance with legal standards. As businesses navigate these complexities, the demand for crm analytics tools that incorporate compliance features is likely to rise. By 2025, it is anticipated that compliance-related functionalities will become a standard expectation within crm analytics solutions, influencing purchasing decisions in the market.

Increased Investment in Marketing Automation

The crm analytics market is witnessing a significant uptick in investment related to marketing automation. As businesses seek to optimize their marketing efforts, the integration of analytics tools into marketing strategies is becoming essential. In 2025, the marketing automation sector is projected to exceed $6 billion, with a substantial portion allocated to crm analytics solutions. This trend indicates a shift towards data-driven marketing approaches, where organizations leverage analytics to refine targeting and improve campaign effectiveness. The ability to analyze customer interactions and preferences allows businesses to tailor their marketing strategies, thereby enhancing overall performance in the crm analytics market.