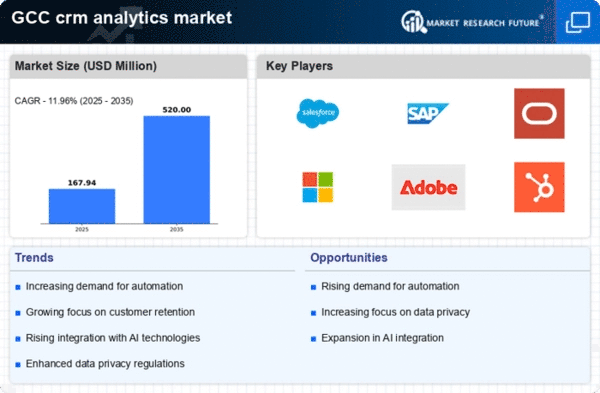

The crm analytics market is currently characterized by a dynamic competitive landscape, driven by the increasing demand for data-driven decision-making and customer-centric strategies. Key players such as Salesforce (US), SAP (DE), and Oracle (US) are at the forefront, leveraging their technological prowess to enhance customer engagement and operational efficiency. Salesforce (US) focuses on innovation through its AI-driven analytics tools, while SAP (DE) emphasizes integration capabilities across various business functions. Oracle (US) is strategically positioned with its cloud-based solutions, catering to a diverse clientele in the GCC region. Collectively, these strategies foster a competitive environment that prioritizes technological advancement and customer satisfaction.

In terms of business tactics, companies are increasingly localizing their operations to better serve regional markets, optimizing supply chains to enhance efficiency. The market appears moderately fragmented, with a mix of established players and emerging startups. The collective influence of these key players shapes the market structure, as they engage in strategic partnerships and collaborations to expand their reach and capabilities.

In October 2025, Salesforce (US) announced a partnership with a leading regional telecommunications provider to enhance its analytics offerings tailored for the GCC market. This collaboration is expected to facilitate improved data integration and customer insights, thereby strengthening Salesforce's position in the region. The strategic importance of this move lies in its potential to enhance customer engagement through localized solutions, addressing specific market needs.

In September 2025, SAP (DE) launched a new suite of analytics tools designed specifically for small and medium-sized enterprises (SMEs) in the GCC. This initiative aims to democratize access to advanced analytics capabilities, allowing SMEs to leverage data for strategic decision-making. The significance of this launch is underscored by the growing recognition of SMEs as vital contributors to economic growth in the region, positioning SAP as a key enabler of their digital transformation.

In August 2025, Oracle (US) expanded its cloud infrastructure in the GCC, enhancing its service delivery capabilities. This expansion is crucial as it allows Oracle to offer more robust and scalable analytics solutions, catering to the increasing demand for cloud-based services. The strategic importance of this move is evident in its alignment with the broader trend of digital transformation across industries, positioning Oracle as a leader in cloud analytics.

As of November 2025, the crm analytics market is witnessing trends such as digitalization, sustainability, and AI integration, which are reshaping competitive dynamics. Strategic alliances are becoming increasingly important, as companies seek to leverage complementary strengths to enhance their offerings. Looking ahead, competitive differentiation is likely to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition underscores the necessity for companies to invest in advanced analytics capabilities to maintain a competitive edge.