Rising Demand for Customer Insights

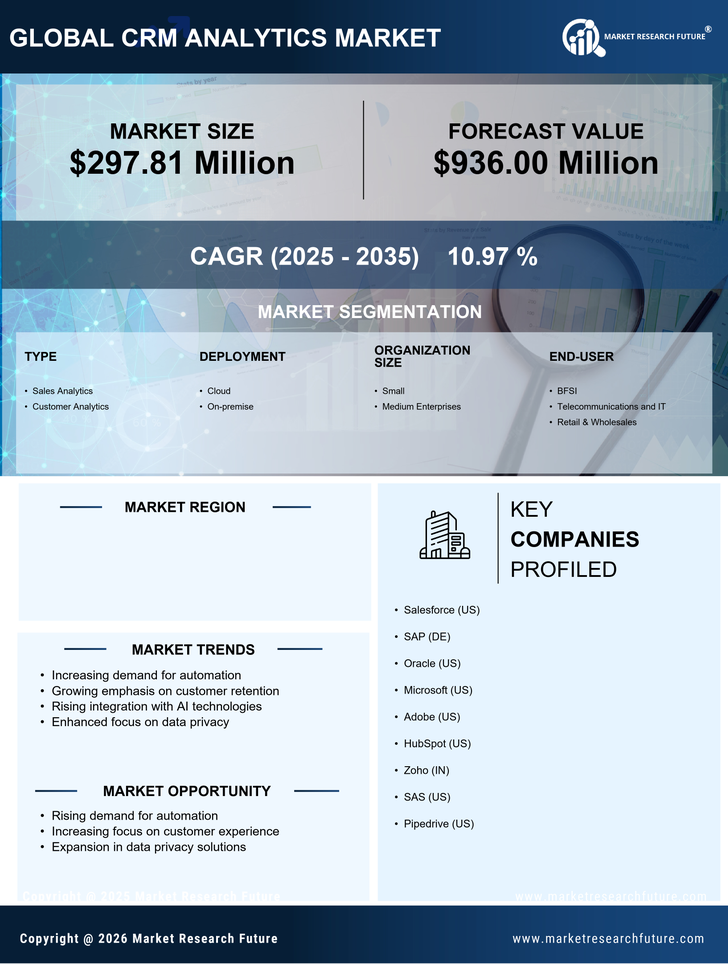

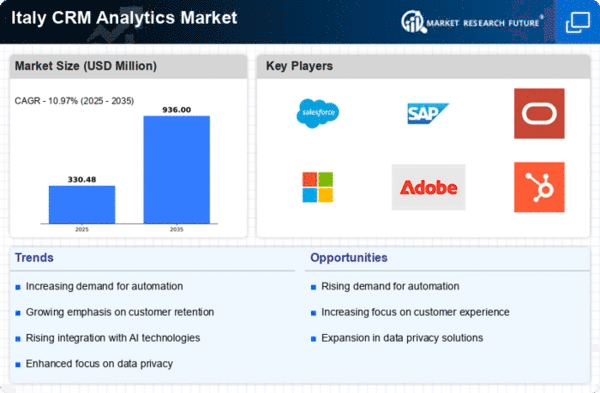

The crm analytics market in Italy is experiencing a notable surge in demand for customer insights. Businesses are increasingly recognizing the value of data-driven decision-making, which is essential for enhancing customer engagement and retention. In 2025, it is estimated that the market for customer analytics solutions will reach approximately €1.5 billion, reflecting a growth rate of around 12% annually. This trend indicates that organizations are investing in advanced analytics tools to better understand customer behavior and preferences. As a result, the crm analytics market is likely to expand, driven by the need for actionable insights that can inform marketing strategies and improve overall customer satisfaction.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools into existing business processes is a significant driver for the crm analytics market in Italy. Companies are increasingly adopting sophisticated technologies such as predictive analytics and machine learning to enhance their customer relationship management efforts. This integration allows for more accurate forecasting and personalized marketing campaigns. In 2025, the market for predictive analytics in Italy is projected to grow by 15%, indicating a strong shift towards data-centric approaches. Consequently, the The market is poised for growth as organizations seek to leverage these advanced tools to gain a competitive edge.

Regulatory Compliance and Data Governance

The crm analytics market in Italy is also influenced by the need for regulatory compliance and data governance. With the implementation of stringent data protection regulations, businesses are compelled to adopt analytics solutions that ensure compliance while maximizing data utility. This necessity is driving investments in crm analytics tools that facilitate data management and reporting. In 2025, the market for compliance analytics is expected to grow by 10%, highlighting the importance of adhering to regulations while leveraging customer data. As organizations navigate these challenges, the crm analytics market is likely to benefit from increased demand for compliant analytics solutions.

Emphasis on Customer Experience Management

In Italy, there is a growing emphasis on customer experience management, which is driving the crm analytics market. Businesses are prioritizing the creation of seamless and personalized experiences for their customers. This shift is reflected in the increasing investment in analytics solutions that provide insights into customer journeys and touchpoints. By 2025, it is anticipated that the customer experience management software market will reach €800 million, with a significant portion allocated to analytics tools. This focus on enhancing customer experiences is likely to propel the crm analytics market forward, as organizations strive to meet evolving consumer expectations.

Growth of E-commerce and Digital Transformation

The rapid growth of e-commerce and digital transformation initiatives in Italy is significantly impacting the crm analytics market. As more businesses shift to online platforms, the need for effective customer relationship management becomes paramount. E-commerce sales in Italy are projected to exceed €30 billion by 2025, driving the demand for analytics tools that can optimize online customer interactions. This trend suggests that organizations are increasingly investing in crm analytics solutions to enhance their digital marketing strategies and improve customer engagement. Consequently, the crm analytics market is expected to thrive as businesses adapt to the evolving digital landscape.