Government Support and Initiatives

The Chinese government plays a pivotal role in fostering the modern manufacturing-execution-system market through various support initiatives. Policies aimed at promoting technological innovation and digital transformation are being implemented, which encourages manufacturers to invest in modern systems. The 'Made in China 2025' initiative, for instance, emphasizes the importance of advanced manufacturing technologies, including manufacturing-execution-systems. Financial incentives, grants, and subsidies are also provided to companies that adopt these systems, making it more feasible for small and medium-sized enterprises to transition. This government backing is expected to stimulate market growth, with projections indicating that the market could expand by over 30% in the next few years as more manufacturers align with national strategies for modernization.

Growing Emphasis on Quality Control

Quality control is increasingly becoming a focal point within the modern manufacturing-execution-system market in China. As manufacturers strive to meet stringent quality standards and customer expectations, the implementation of modern systems that facilitate real-time monitoring and quality assurance is essential. These systems enable manufacturers to track production processes closely, identify defects early, and ensure compliance with industry regulations. The demand for quality management solutions is projected to grow, with estimates suggesting a potential increase of 18% in the next few years. This emphasis on quality not only enhances customer satisfaction but also reduces costs associated with rework and returns, making modern manufacturing-execution-systems a critical investment for manufacturers.

Rising Demand for Smart Manufacturing

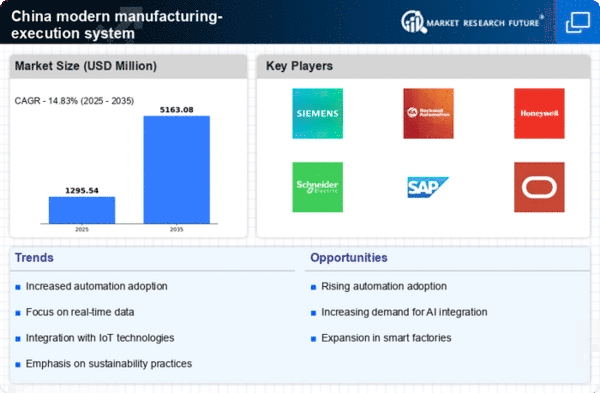

The modern manufacturing-execution-system market in China is experiencing a notable surge in demand for smart manufacturing solutions. This trend is driven by the need for enhanced operational efficiency and productivity. As industries increasingly adopt Industry 4.0 principles, the integration of advanced technologies such as IoT, AI, and machine learning into manufacturing processes becomes essential. According to recent data, the smart manufacturing sector in China is projected to grow at a CAGR of approximately 25% over the next five years. This growth is likely to propel the adoption of modern manufacturing-execution-systems, as companies seek to optimize their production lines and reduce downtime. The emphasis on real-time data collection and analysis further supports this driver, as manufacturers aim to make informed decisions that enhance their competitive edge.

Increased Focus on Supply Chain Resilience

In the context of the modern manufacturing-execution-system market, the focus on supply chain resilience has become increasingly pronounced in China. Manufacturers are recognizing the necessity of robust supply chains that can withstand disruptions and fluctuations in demand. The integration of modern manufacturing-execution-systems allows for better visibility and control over supply chain operations, enabling companies to respond swiftly to changes. Recent studies suggest that organizations that implement these systems can improve their supply chain efficiency by up to 20%. As a result, the demand for such systems is likely to rise, as businesses seek to enhance their operational agility and ensure continuity in production processes.

Technological Advancements in Manufacturing

Technological advancements are a key driver of the modern manufacturing-execution-system market in China. Innovations in automation, robotics, and data analytics are transforming traditional manufacturing processes, leading to the adoption of more sophisticated execution systems. The introduction of cloud-based solutions and edge computing is enabling manufacturers to access real-time data and analytics, which enhances decision-making capabilities. As companies strive to remain competitive, the integration of these technologies into manufacturing operations is becoming essential. Market analysts indicate that the adoption of advanced manufacturing technologies could lead to a productivity increase of up to 15% in the coming years, further propelling the growth of the modern manufacturing-execution-system market.