Rising Demand for Efficiency

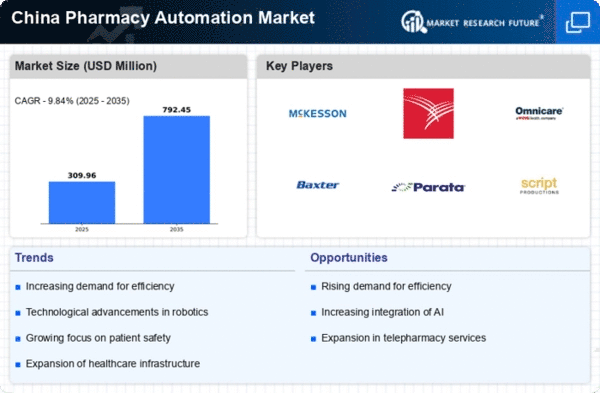

The market in China is experiencing a notable surge in demand for efficiency within healthcare settings. As the population ages and the prevalence of chronic diseases increases, pharmacies are under pressure to enhance operational efficiency. Automation technologies, such as robotic dispensing systems, are being adopted to streamline workflows, reduce human error, and improve patient safety. Reports indicate that the market is projected to grow at a CAGR of approximately 15% over the next five years, driven by the need for faster service and accurate medication dispensing. This trend suggests that pharmacies are increasingly recognizing the value of automation in meeting the growing demands of patients and healthcare providers alike.

Government Initiatives and Support

Government initiatives aimed at promoting healthcare efficiency are significantly impacting the pharmacy automation market in China. Policies encouraging the adoption of technology in healthcare are being implemented to improve service delivery and patient care. The government has introduced funding programs and incentives for pharmacies to invest in automation technologies. This support is likely to accelerate the transition towards automated systems, as pharmacies seek to comply with regulatory standards and enhance their operational capabilities. As a result, the market is expected to witness a steady increase in automation adoption, with projections indicating a potential growth rate of 12% annually over the next few years.

Increasing Focus on Patient Safety

The emphasis on patient safety is driving the pharmacy automation market in China. With rising concerns over medication errors and adverse drug events, pharmacies are increasingly turning to automation solutions to mitigate these risks. Automated dispensing systems and barcoding technologies are being implemented to ensure accurate medication administration and tracking. This focus on safety not only enhances patient trust but also aligns with regulatory requirements for quality assurance in healthcare. Market analysis suggests that the demand for automation solutions aimed at improving patient safety could contribute to a growth rate of approximately 10% in the pharmacy automation market over the coming years.

Competitive Pressure Among Pharmacies

Competitive pressure among pharmacies in China is a significant driver of the pharmacy automation market. As the healthcare landscape evolves, pharmacies are seeking ways to differentiate themselves and enhance service offerings. Automation technologies provide a means to achieve this by improving efficiency, reducing wait times, and enhancing customer satisfaction. Pharmacies that adopt automation solutions are likely to gain a competitive edge, attracting more customers and increasing their market share. Current market trends indicate that pharmacies investing in automation could see revenue growth of up to 15% as they capitalize on the benefits of streamlined operations and improved service delivery.

Technological Advancements in Automation

Technological advancements are playing a pivotal role in shaping the pharmacy automation market in China. Innovations in robotics, artificial intelligence, and machine learning are enabling pharmacies to implement sophisticated automation solutions. For instance, automated medication dispensing systems are becoming more prevalent, allowing for precise inventory management and reducing the risk of medication errors. The integration of these technologies is expected to enhance operational efficiency and improve patient outcomes. Market data indicates that the adoption of advanced automation solutions could lead to a reduction in operational costs by up to 20%, making it a financially viable option for pharmacies looking to optimize their services.