Government Initiatives and Investments

Government initiatives in China are playing a pivotal role in the expansion of the satellite enabled IoT software market. The Chinese government has been actively investing in satellite infrastructure and IoT technologies, aiming to enhance national capabilities in various sectors. For instance, the National Space Administration has outlined plans to increase the number of operational satellites, which will facilitate better connectivity and data transmission for IoT applications. This strategic focus is expected to bolster the satellite enabled-iot-software market, as enhanced satellite networks will provide the necessary backbone for IoT solutions. Furthermore, government policies promoting smart city initiatives and digital agriculture are likely to drive further adoption of satellite enabled-iot-software, creating a favorable environment for market growth. The anticipated investment in satellite technology could reach upwards of $10 billion by 2030, underscoring the government's commitment to advancing this sector.

Increased Focus on Disaster Management

The satellite enabled IoT software market is increasingly recognized for its potential in disaster management within China. With the country facing various natural disasters, including floods and earthquakes, the need for effective monitoring and response systems has become paramount. Satellite technology, combined with IoT software, offers real-time data and analytics that can significantly enhance disaster preparedness and response efforts. For instance, the ability to monitor environmental conditions and infrastructure integrity can lead to timely interventions, potentially saving lives and reducing economic losses. The market for disaster management solutions is projected to grow by approximately 20% annually, reflecting the urgent need for advanced technologies in this area. As such, the satellite enabled-iot-software market is likely to play a crucial role in shaping China's disaster management strategies.

Expansion of Smart Agriculture Practices

The satellite enabled IoT software market is witnessing significant growth due to the expansion of smart agriculture practices in China. Farmers are increasingly adopting IoT solutions to optimize crop yields and resource management. By utilizing satellite technology, farmers can access critical data regarding soil conditions, weather patterns, and crop health. This data-driven approach enables more informed decision-making, leading to improved agricultural productivity. Reports indicate that the smart agriculture market in China is expected to reach $30 billion by 2026, with a substantial portion attributed to satellite enabled-iot-software applications. As the agricultural sector continues to modernize, the integration of satellite technology with IoT software is likely to become a standard practice, further driving the growth of the satellite enabled-iot-software market.

Rising Demand for Remote Monitoring Solutions

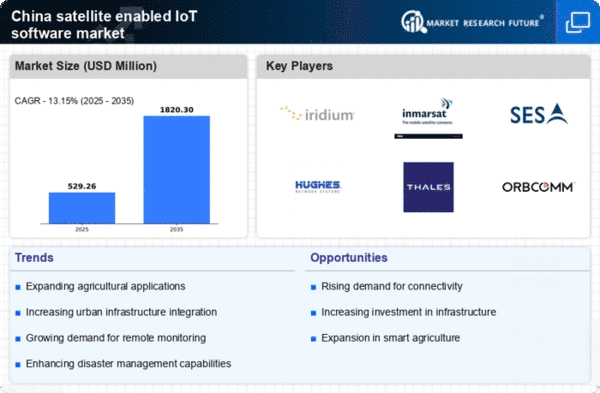

The satellite enabled IoT software market in China is experiencing a surge in demand for remote monitoring solutions. This trend is driven by the increasing need for real-time data collection in various sectors, including agriculture, energy, and transportation. As industries seek to enhance operational efficiency, the integration of satellite technology with IoT software provides a robust framework for monitoring assets in remote locations. According to recent estimates, the market for remote monitoring solutions is projected to grow at a CAGR of approximately 15% over the next five years. This growth is indicative of the broader shift towards digital transformation, where businesses are leveraging satellite enabled-iot-software to gain insights and improve decision-making processes. Consequently, the demand for such solutions is likely to continue rising, positioning the satellite enabled-iot-software market as a critical component of China's technological landscape.

Growing Interest in Smart Transportation Systems

The satellite enabled IoT software market is benefiting from the growing interest in smart transportation systems across China. As urbanization accelerates, cities are increasingly adopting IoT solutions to improve traffic management, reduce congestion, and enhance public transportation services. Satellite technology provides the necessary infrastructure for real-time tracking and data analysis, enabling more efficient transportation networks. The market for smart transportation solutions is expected to reach $50 billion by 2027, with a significant contribution from satellite enabled-iot-software applications. This trend indicates a shift towards more sustainable and efficient urban mobility solutions, where satellite technology plays a vital role in facilitating connectivity and data exchange. Consequently, the satellite enabled-iot-software market is poised for substantial growth as cities invest in smart transportation initiatives.

Leave a Comment