Market Growth Projections

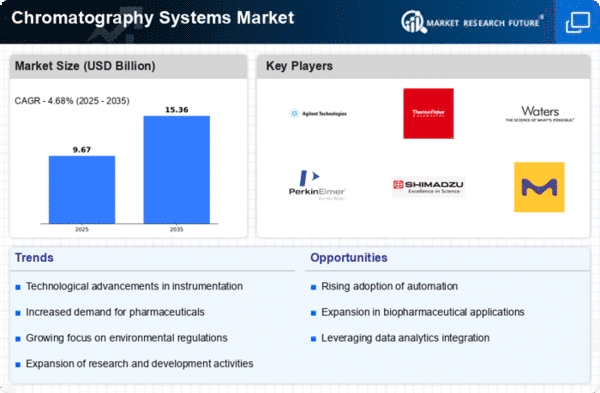

The Global Chromatography System Market Industry is projected to experience substantial growth, with estimates indicating a market size of 9.03 USD Billion in 2024 and a potential increase to 18.9 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 6.96% from 2025 to 2035. Various factors, including technological advancements, increased regulatory scrutiny, and the expansion of key sectors such as pharmaceuticals and biotechnology, contribute to this optimistic outlook. The market's evolution is likely to be shaped by ongoing innovations and the continuous adaptation of chromatography technologies to meet diverse analytical needs.

Expansion of Biotechnology Sector

The expansion of the biotechnology sector is a key driver of the Global Chromatography System Market Industry. As biopharmaceutical companies increasingly utilize chromatography for the purification and characterization of biomolecules, the demand for advanced chromatography systems is expected to rise. This trend is particularly evident in the production of monoclonal antibodies and recombinant proteins, where chromatography is essential for achieving high purity levels. The biotechnology industry's growth, fueled by innovations in genetic engineering and personalized medicine, suggests a sustained increase in the adoption of chromatography technologies. Consequently, this sector is likely to contribute significantly to the overall market growth in the coming years.

Growing Focus on Environmental Testing

The Global Chromatography System Market Industry is significantly impacted by the increasing emphasis on environmental testing and monitoring. Governments and regulatory bodies worldwide are implementing stringent environmental regulations to ensure public safety and ecological preservation. Chromatography serves as a vital analytical tool for detecting pollutants and contaminants in air, water, and soil samples. This heightened focus on environmental sustainability is likely to drive the demand for advanced chromatography systems, as industries seek to comply with regulatory standards. As a result, the market is poised for growth, with projections indicating a potential market size of 18.9 USD Billion by 2035.

Technological Advancements in Chromatography

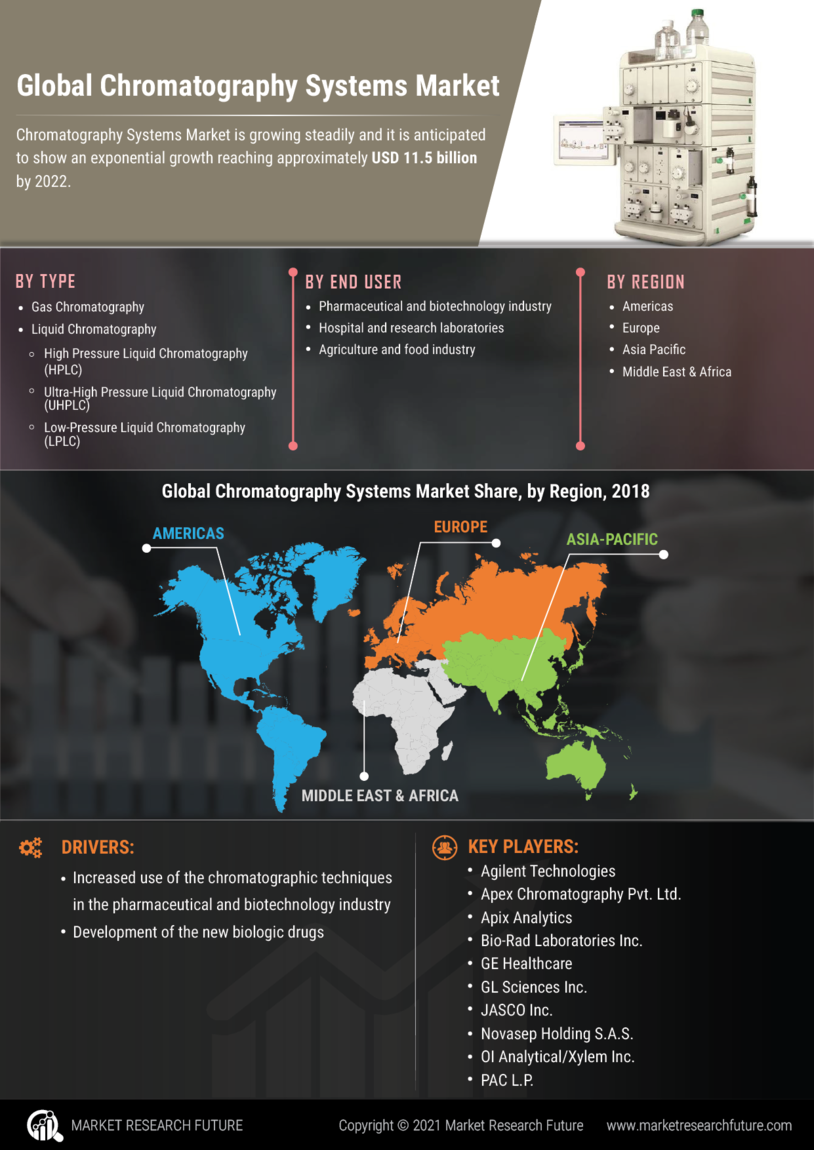

Technological innovations significantly influence the Global Chromatography System Market Industry, enhancing the efficiency and effectiveness of chromatographic techniques. Recent advancements, including the development of ultra-high-performance liquid chromatography (UHPLC) and automated systems, have improved resolution and reduced analysis time. These innovations enable laboratories to process larger sample volumes with greater accuracy, thereby meeting the increasing demands of various sectors, including food and beverage, environmental testing, and clinical research. As a result, the market is expected to witness a robust growth trajectory, with a projected CAGR of 6.96% from 2025 to 2035, reflecting the industry's adaptability to evolving technological landscapes.

Rising Demand for Pharmaceutical Applications

The Global Chromatography System Market Industry experiences a notable surge in demand driven by the pharmaceutical sector. As pharmaceutical companies increasingly rely on chromatography for drug development and quality control, the market is projected to reach 9.03 USD Billion in 2024. This growth is attributed to stringent regulatory requirements that necessitate precise analytical methods. Chromatography plays a crucial role in ensuring the purity and efficacy of pharmaceutical products, thereby enhancing patient safety. The industry's reliance on advanced chromatography techniques, such as high-performance liquid chromatography (HPLC), underscores its significance in the pharmaceutical landscape.

Increased Investment in Research and Development

Increased investment in research and development (R&D) across various sectors, including pharmaceuticals, food and beverage, and environmental sciences, is propelling the Global Chromatography System Market Industry forward. Organizations are allocating substantial resources to enhance analytical capabilities and improve product quality, which often necessitates the use of advanced chromatography systems. This trend is particularly pronounced in regions with robust R&D infrastructures, where companies are striving to innovate and maintain competitive advantages. As R&D activities expand, the demand for sophisticated chromatography solutions is expected to rise, further solidifying the market's growth trajectory.

Leave a Comment