Construction Fabrics Size

Construction Fabrics Market Growth Projections and Opportunities

The Construction Fabrics Market is influenced by a variety of factors that collectively shape its trends and growth trajectory. One of the primary drivers is the expanding construction industry, which requires durable and versatile materials for a range of applications. Construction fabrics, including geotextiles, architectural membranes, and coated fabrics, find widespread use in infrastructure projects such as roads, bridges, tunnels, and buildings. The growing global population, urbanization, and increased investments in construction projects contribute significantly to the rising demand for construction fabrics.

Global economic conditions play a pivotal role in the Construction Fabrics Market. Economic growth and urban development drive the need for improved infrastructure, leading to increased demand for construction fabrics. Developing economies, experiencing rapid urbanization and infrastructure expansion, particularly contribute to the market's growth as construction projects become integral components of their economic development.

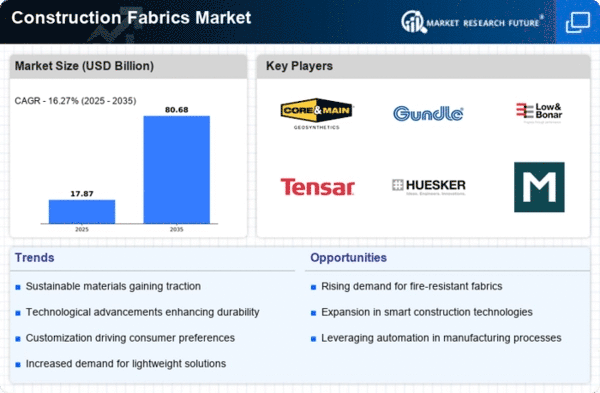

Technological advancements in fabric manufacturing processes impact the market dynamics. Ongoing research and development efforts lead to innovations in construction fabric formulations, coatings, and structural designs. Companies that invest in these technological advancements gain a competitive edge by offering high-performance construction fabrics that meet the evolving requirements of construction projects, such as improved strength, durability, and environmental sustainability.

Environmental considerations are becoming increasingly crucial in the Construction Fabrics Market. The emphasis on sustainable and eco-friendly construction practices has led to the adoption of construction fabrics with properties such as recyclability, reduced environmental impact, and energy efficiency. Companies aligning their product offerings with these sustainability goals are likely to gain favor in the market.

Geopolitical factors and trade dynamics also impact the Construction Fabrics Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can influence the supply chain and pricing of construction fabrics. Companies in the market need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Moreover, the transportation sector contributes significantly to the demand for construction fabrics. Geotextiles and coated fabrics are widely used in transportation infrastructure projects, including road construction, railway systems, and airport runways. The durability, reinforcement, and soil stabilization properties of construction fabrics make them indispensable in these applications, driving their adoption in the transportation sector.

The architecture and building construction industry is another key driver of the Construction Fabrics Market. Architectural membranes and coated fabrics are used in roofing systems, facades, and tensioned structures, providing both aesthetic appeal and functional benefits. As architects and builders seek innovative and sustainable construction solutions, the demand for construction fabrics in architectural applications continues to rise.

Raw material prices, particularly those of polymer resins and fibers used in fabric manufacturing, play a role in shaping the Construction Fabrics Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of construction fabrics. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

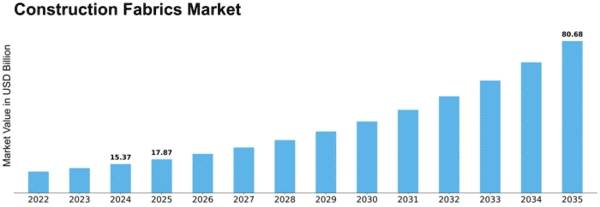

Construction Fabrics Market is projected to be worth USD 5.79 billion by 2027, registering a CAGR of 7.8% during the forecast period (2021 - 2027).

Leave a Comment