Growing Awareness of Soil Health

The rising awareness of soil health and its impact on agricultural productivity is influencing the controlled release fertilizers in foliar application Market. Farmers are increasingly recognizing that healthy soil is fundamental to sustainable crop production. Controlled release fertilizers contribute to soil health by minimizing nutrient leaching and enhancing microbial activity. This awareness is driving demand for fertilizers that not only provide nutrients but also support soil ecosystems. As educational initiatives and research highlight the benefits of controlled release technologies, the market is likely to experience growth, particularly among environmentally conscious farmers.

Increased Focus on Crop Quality and Yield

The emphasis on improving crop quality and yield is a significant driver for the Controlled Release Fertilizers in Foliar Application Market. As consumers demand higher quality produce, farmers are compelled to adopt practices that enhance both yield and nutritional value. Controlled release fertilizers offer a solution by providing a steady supply of nutrients, which can lead to improved crop performance. Market data suggests that regions with high agricultural output are increasingly turning to these fertilizers to meet consumer expectations. This trend indicates a shift towards more sophisticated agricultural practices, where controlled release fertilizers play a crucial role in achieving desired outcomes.

Regulatory Support for Sustainable Practices

Regulatory frameworks that promote sustainable agricultural practices are likely to bolster the Controlled Release Fertilizers in Foliar Application Market. Governments and agricultural bodies are increasingly implementing policies that encourage the use of environmentally friendly fertilizers. These regulations often include incentives for farmers who adopt controlled release technologies, as they contribute to reduced runoff and lower environmental impact. The alignment of agricultural practices with sustainability goals is becoming a priority, and controlled release fertilizers are well-positioned to meet these demands. As a result, the market may witness a surge in adoption rates, particularly in regions where regulatory support is robust.

Rising Demand for Efficient Nutrient Delivery

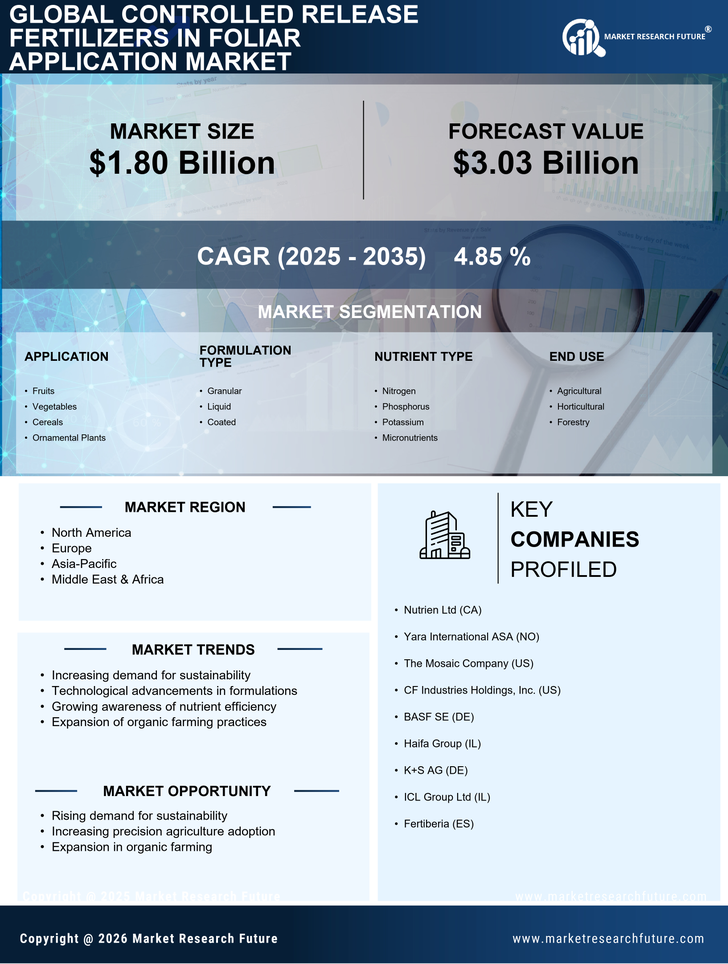

The increasing need for efficient nutrient delivery systems in agriculture appears to drive the Controlled Release Fertilizers in Foliar Application Market. Farmers are seeking methods that enhance crop yield while minimizing waste. Controlled release fertilizers provide a solution by ensuring that nutrients are available to plants over an extended period. This approach not only optimizes nutrient uptake but also reduces the frequency of applications. According to recent data, the market for controlled release fertilizers is projected to grow at a compound annual growth rate of approximately 6.5% over the next five years. This growth is indicative of a broader trend towards precision agriculture, where targeted nutrient delivery is becoming essential for sustainable farming practices.

Technological Innovations in Fertilizer Production

Technological advancements in fertilizer production are contributing to the growth of the Controlled Release Fertilizers in Foliar Application Market. Innovations such as polymer coatings and encapsulation techniques enhance the efficiency of nutrient release, allowing for better synchronization with plant growth stages. These technologies not only improve the effectiveness of fertilizers but also reduce the environmental footprint associated with traditional fertilizers. The integration of smart technologies, such as sensors and data analytics, further optimizes the application of controlled release fertilizers. As a result, the market is expected to expand, with a projected increase in market share for these innovative products.