Rising Data Center Construction

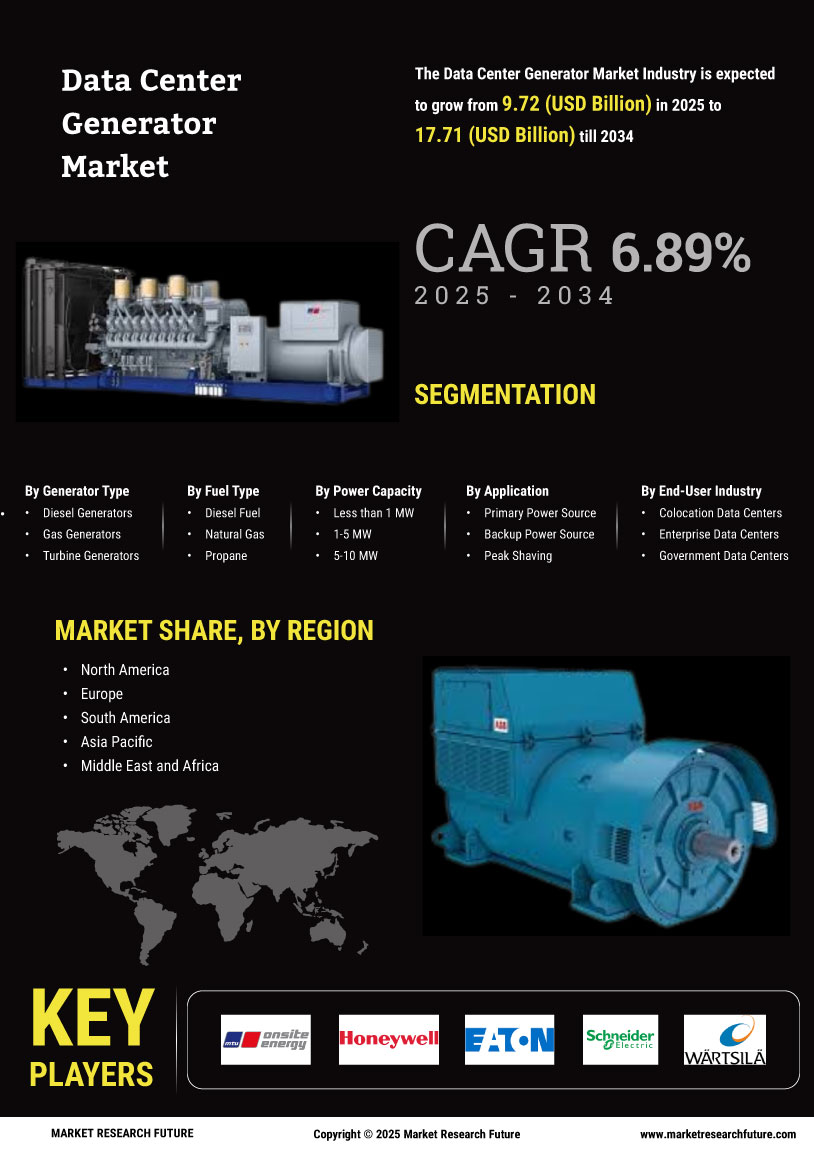

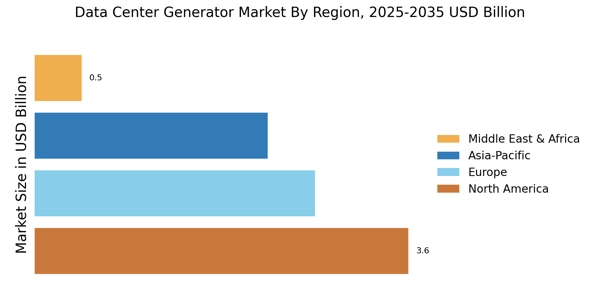

The Data Center Generator Market is experiencing a surge in demand due to the rapid construction of new data centers. As organizations increasingly rely on digital infrastructure, the need for reliable power sources becomes paramount. In 2025, the number of data centers is projected to reach over 8 million worldwide, necessitating robust generator solutions to ensure uninterrupted operations. This trend is driven by the expansion of cloud computing, big data analytics, and the Internet of Things, all of which require substantial power resources. Consequently, the demand for generators that can support these facilities is likely to grow, propelling the Data Center Generator Market forward. Furthermore, the construction of data centers in regions with unstable power grids amplifies the need for dependable backup power solutions, further solidifying the market's growth trajectory.

Growing Demand for Edge Computing

The rise of edge computing is significantly impacting the Data Center Generator Market, as organizations increasingly deploy localized data processing solutions. This trend necessitates the establishment of smaller, distributed data centers that require reliable power sources. In 2025, the edge computing market is projected to reach 15 billion USD, driving the need for efficient generator systems to support these facilities. As businesses seek to enhance data processing speed and reduce latency, the demand for generators that can cater to these smaller setups is likely to increase. This shift towards edge computing not only diversifies the Data Center Generator Market but also presents opportunities for manufacturers to innovate and provide tailored solutions that meet the specific power requirements of edge data centers.

Increased Focus on Energy Security

Energy security remains a critical concern for organizations operating data centers, thereby influencing the Data Center Generator Market. As power outages can lead to significant financial losses and data integrity issues, companies are investing in advanced generator systems to mitigate these risks. In 2025, it is estimated that the global market for data center generators will exceed 5 billion USD, reflecting the heightened emphasis on ensuring continuous power supply. This focus on energy security is particularly pronounced in sectors such as finance, healthcare, and telecommunications, where downtime can have severe repercussions. As a result, the Data Center Generator Market is likely to see increased adoption of high-capacity generators that can provide reliable backup power, thereby enhancing operational resilience and safeguarding critical data.

Regulatory Compliance and Standards

The Data Center Generator Market is significantly influenced by the evolving landscape of regulatory compliance and standards. Governments and regulatory bodies are increasingly mandating stringent requirements for energy efficiency and emissions reductions. In 2025, it is anticipated that compliance with these regulations will drive the adoption of cleaner and more efficient generator technologies. This shift is likely to result in a growing demand for generators that meet or exceed these standards, thereby enhancing the overall sustainability of data center operations. Companies that proactively invest in compliant generator solutions may gain a competitive edge, as they align with both regulatory expectations and consumer preferences for environmentally responsible practices. Consequently, the Data Center Generator Market is poised for growth as organizations seek to navigate the complexities of compliance while maintaining operational efficiency.

Technological Innovations in Power Generation

Technological advancements are reshaping the Data Center Generator Market, leading to the development of more efficient and reliable power generation solutions. Innovations such as hybrid systems, which combine traditional generators with renewable energy sources, are gaining traction. In 2025, the market for hybrid generators is expected to grow by over 20%, reflecting a shift towards sustainable energy practices. These innovations not only enhance the efficiency of power generation but also reduce operational costs for data centers. As organizations seek to optimize their energy consumption and minimize their carbon footprint, the demand for advanced generator technologies is likely to rise. This trend indicates a transformative phase for the Data Center Generator Market, where cutting-edge solutions will play a pivotal role in meeting the evolving needs of data center operators.

Leave a Comment