Diesel Engines Market Summary

As per Market Research Future analysis, the Diesel Engine Market Size was estimated at 189.39 USD Billion in 2024. The Diesel Engine industry is projected to grow from 201.4 USD Billion in 2025 to 372.41 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.3% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Diesel Engine Market is poised for growth driven by technological advancements and increasing demand across various sectors.

- Technological advancements are reshaping the diesel engine landscape, enhancing performance and efficiency.

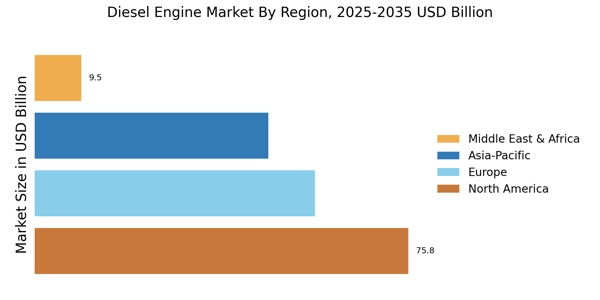

- North America remains the largest market, while the Asia-Pacific region is emerging as the fastest-growing area for diesel engines.

- The 2-4 MW segment dominates the market, whereas the 1-2 MW segment is witnessing rapid growth due to evolving applications.

- Rising demand for heavy-duty vehicles and infrastructure development initiatives are key drivers propelling market expansion.

Market Size & Forecast

| 2024 Market Size | 189.39 (USD Billion) |

| 2035 Market Size | 372.41 (USD Billion) |

| CAGR (2025 - 2035) | 6.34% |

Major Players

Caterpillar Inc (US), Cummins Inc (US), MAN SE (DE), Volvo Penta (SE), Deutz AG (DE), Mitsubishi Heavy Industries (JP), Perkins Engines Company Limited (GB), Wärtsilä Corporation (FI), Scania AB (SE)