Regulatory Compliance

The Global Diesel Exhaust Fluid Market (AdBlue) Market Industry is significantly driven by stringent regulations aimed at reducing nitrogen oxide emissions from diesel engines. Governments worldwide are enforcing standards that mandate the use of AdBlue in heavy-duty vehicles, which is expected to bolster market growth. For instance, the European Union's Euro 6 standards have necessitated the adoption of selective catalytic reduction technology, which relies on AdBlue. This regulatory framework is likely to enhance the demand for Diesel Exhaust Fluid Market, contributing to the market's projected value of 12.3 USD Billion in 2024.

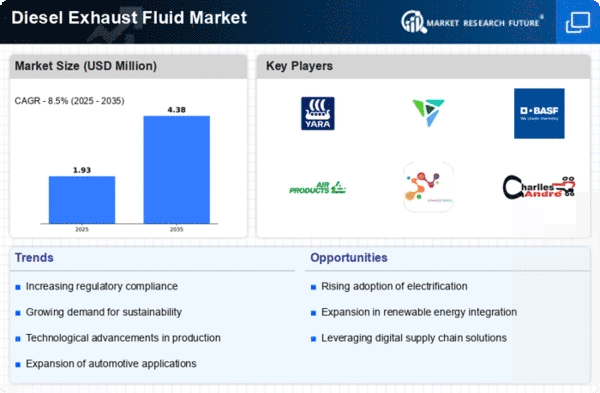

Market Growth Projections

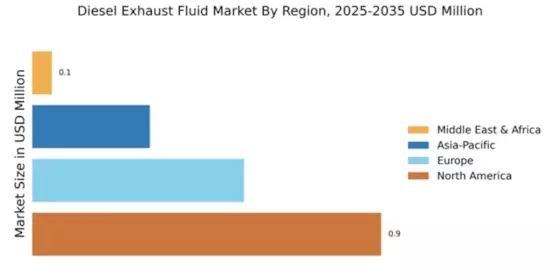

The Global Diesel Exhaust Fluid Market (AdBlue) Market Industry is projected to experience substantial growth over the coming years. With an anticipated market value of 12.3 USD Billion in 2024, the industry is set to expand significantly, reaching 37.0 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 10.58% from 2025 to 2035. Such projections indicate a robust demand for Diesel Exhaust Fluid Market, driven by regulatory pressures, technological advancements, and increasing environmental consciousness among consumers and industries alike.

Technological Advancements

Technological advancements in the production and distribution of Diesel Exhaust Fluid Market are enhancing the efficiency of the Global Diesel Exhaust Fluid Market (AdBlue) Market Industry. Innovations in manufacturing processes, such as improved purification techniques and packaging solutions, are making AdBlue more accessible and cost-effective. Additionally, advancements in logistics and supply chain management are facilitating the timely delivery of AdBlue to consumers. These developments are likely to stimulate market growth, as they address potential supply chain challenges and ensure that the fluid is readily available for end-users.

Expansion of Automotive Sector

The expansion of the automotive sector, particularly in emerging economies, is a crucial driver for the Global Diesel Exhaust Fluid Market (AdBlue) Market Industry. As countries like India and Brazil experience rapid industrialization and urbanization, the demand for commercial vehicles is surging. This increase in vehicle production and sales necessitates the use of AdBlue to meet emission standards. Consequently, the market is expected to reach 37.0 USD Billion by 2035, as more manufacturers integrate AdBlue systems into their diesel engines to comply with international regulations.

Growing Environmental Awareness

Increasing global awareness regarding environmental sustainability is propelling the Global Diesel Exhaust Fluid Market (AdBlue) Market Industry. As consumers and businesses alike become more conscious of their carbon footprints, the demand for cleaner technologies, including the use of AdBlue, is on the rise. This shift is particularly evident in the transportation sector, where companies are investing in AdBlue-compatible vehicles to comply with environmental regulations. The market is projected to grow at a CAGR of 10.58% from 2025 to 2035, reflecting a broader trend towards sustainable practices and the adoption of cleaner fuels.

Increased Adoption in Agriculture and Construction

The Global Diesel Exhaust Fluid Market (AdBlue) Market Industry is also driven by the increased adoption of AdBlue in agriculture and construction sectors. As these industries utilize diesel-powered machinery, the need for compliance with emission regulations becomes paramount. The integration of AdBlue in agricultural equipment and construction vehicles not only helps in meeting regulatory requirements but also enhances operational efficiency. This trend is expected to contribute to the overall growth of the market, as more operators recognize the benefits of using AdBlue to reduce emissions and improve equipment performance.