The Global Dietary Supplements Market is currently experiencing a dynamic evolution, driven by a confluence of consumer preferences and emerging health trends. This dietary supplement market research provides comprehensive insights into market size, trends, segmentation, and regional performance through 2035. As individuals increasingly prioritize wellness and preventive healthcare, the demand for dietary supplements has surged. Key dietary supplement market trends include rising demand for plant-based formulations, personalized nutrition, and clean-label ingredients. This market encompasses a diverse array of products, including vitamins, minerals, herbal extracts, and protein powders, catering to various health needs and lifestyle choices. The growing awareness of the importance of nutrition in maintaining overall health appears to be a significant factor influencing purchasing decisions. Furthermore, the rise of e-commerce platforms has transformed how consumers access these products, making them more readily available than ever before. In addition to changing consumer behaviors, regulatory frameworks and scientific advancements are shaping the Dietary Supplements Market.

Analysis. Dietary supplements personalized nutrition market trends emphasize customization, smart packaging, and technology-enabled health tracking.

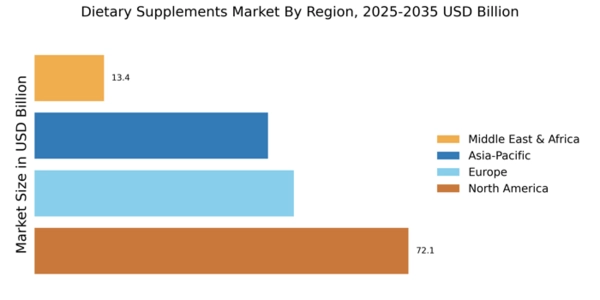

This dietary supplement market research covers revenue forecasts, competitive landscape, growth drivers, and regional analysis. Dietary supplements market trends indicate a strong shift toward personalization, plant-based ingredients, and digital distribution.

Manufacturers are increasingly focusing on transparency and quality assurance, responding to consumer demands for safe and effective products. Innovations in formulation and delivery methods, such as gummies and powders, are also gaining traction, appealing to a broader audience. As the market continues to expand, it seems poised for further growth, with potential opportunities arising from the integration of technology and personalized nutrition solutions. Overall, the Dietary Supplements Market reflects a complex interplay of health consciousness, innovation, and consumer engagement, indicating a promising future for this sector. The dietary supplements personalized nutrition market is expanding as consumers increasingly seek tailored solutions aligned with individual health needs. Dietary supplements in the age of personalized nutrition market reflect a shift toward data-driven, consumer-centric supplementation models.

Rise of Plant-Based Supplements

There is a noticeable shift towards plant-based dietary supplements, as consumers increasingly seek natural alternatives to synthetic products. This trend reflects a broader movement towards sustainability and health consciousness, with many individuals opting for supplements derived from botanical sources. Such products are perceived as safer and more aligned with holistic health practices.

Personalization in Supplementation

The concept of personalized nutrition is gaining traction within the Dietary Supplements Market. Consumers are increasingly interested in tailored supplements that address their specific health needs and preferences. This trend suggests a move towards individualized approaches, where products are designed based on genetic, lifestyle, and dietary factors.

Technological Integration in Product Development

Advancements in technology are playing a crucial role in the evolution of the Dietary Supplements Market. Innovations such as smart packaging and online health assessments are enhancing consumer engagement and product accessibility. This integration of technology not only improves the user experience but also facilitates better tracking of health outcomes.