Growing Demand for Energy Efficiency

The increasing emphasis on energy efficiency is a critical driver in the Distribution Automation Market. Utilities are under pressure to optimize their energy consumption and reduce waste, which has led to the adoption of automated distribution systems. These systems facilitate better load management and enhance the overall efficiency of energy distribution. According to recent data, energy efficiency measures could potentially reduce energy consumption by up to 30% in certain regions. This growing demand for energy-efficient solutions is likely to propel investments in distribution automation technologies, thereby shaping the future landscape of the Distribution Automation Market.

Integration of Advanced Technologies

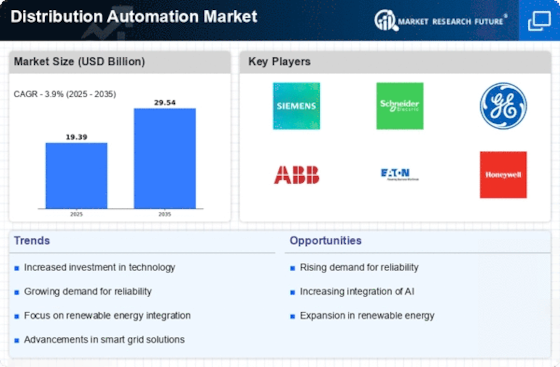

The Distribution Automation Market is experiencing a notable shift due to the integration of advanced technologies such as artificial intelligence and machine learning. These technologies enhance the efficiency and reliability of distribution systems by enabling predictive maintenance and real-time monitoring. As a result, utilities can reduce operational costs and improve service quality. The market for AI in distribution automation is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 20% in the coming years. This integration not only streamlines operations but also supports the transition towards more sustainable energy practices, making it a pivotal driver in the Distribution Automation Market.

Rising Urbanization and Population Growth

Urbanization and population growth are exerting significant pressure on existing energy distribution networks, thereby driving the need for advanced distribution automation solutions. As cities expand, the demand for reliable and efficient energy distribution becomes paramount. The Distribution Automation Market is responding to this challenge by implementing smart grid technologies that can manage increased loads and enhance service reliability. Projections indicate that by 2030, urban areas will house nearly 60% of the global population, necessitating substantial upgrades to distribution systems. This trend underscores the importance of automation in ensuring that energy distribution keeps pace with urban development.

Increased Investment in Infrastructure Development

Investment in infrastructure development is a vital driver for the Distribution Automation Market. Governments and private entities are recognizing the need to modernize aging electrical grids to accommodate new technologies and improve resilience against outages. This modernization often involves the deployment of automated distribution systems that enhance operational efficiency and reliability. Recent reports indicate that infrastructure investment in the energy sector is expected to reach trillions of dollars over the next decade. Such investments are likely to create a favorable environment for the growth of the Distribution Automation Market, as utilities seek to leverage automation to meet evolving energy demands.

Focus on Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Distribution Automation Market. Governments are implementing stricter regulations to ensure the safety and reliability of energy distribution systems. This regulatory landscape compels utilities to adopt automated solutions that not only enhance operational efficiency but also ensure compliance with safety standards. The market is witnessing a surge in demand for technologies that facilitate real-time monitoring and reporting, which are essential for meeting regulatory requirements. As utilities strive to align with these regulations, the Distribution Automation Market is likely to see accelerated growth driven by the need for compliance and enhanced safety measures.