Growing Focus on Data Security

As the industrial ai market in Europe expands, the focus on data security is becoming increasingly paramount. With the rise of AI technologies, concerns regarding data privacy and cybersecurity are at the forefront of organizational strategies. Companies are investing in robust security measures to protect sensitive information, which is essential for maintaining trust with customers and partners. The European Union's General Data Protection Regulation (GDPR) has set stringent guidelines that companies must adhere to, thereby influencing the operational frameworks within the industrial ai market. This heightened emphasis on data security is likely to drive innovation in AI solutions that prioritize secure data handling, ultimately fostering growth in the market.

Advancements in AI Technologies

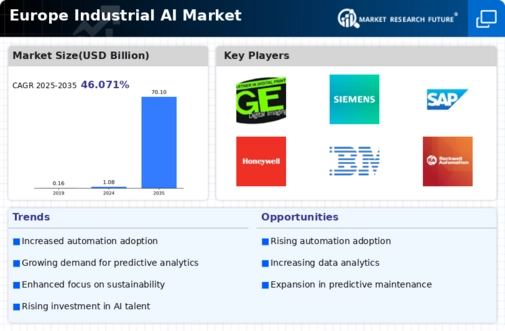

Technological advancements are playing a crucial role in shaping the industrial ai market in Europe. Innovations in machine learning, natural language processing, and computer vision are enabling industries to harness the full potential of AI. For instance, the implementation of predictive maintenance solutions has been shown to reduce downtime by up to 30%, thereby enhancing productivity. As these technologies continue to evolve, they are expected to drive further adoption across various sectors, including manufacturing, logistics, and energy. The industrial ai market is likely to expand as companies seek to leverage these advancements to improve their operational capabilities. This trend indicates a growing recognition of the transformative power of AI technologies in enhancing industrial processes.

Increased Investment in AI Startups

Investment in AI startups is witnessing a significant uptick in Europe, contributing to the growth of the industrial ai market. Venture capital funding for AI-related ventures has surged, with estimates indicating a rise of over 40% in investments compared to previous years. This influx of capital is enabling startups to develop innovative solutions tailored to industrial applications. As these startups emerge, they are likely to introduce disruptive technologies that challenge traditional practices within industries. The industrial ai market stands to benefit from this dynamic ecosystem, as established companies increasingly collaborate with startups to leverage cutting-edge technologies. This trend suggests a vibrant future for the industrial ai market in Europe, driven by innovation and investment.

Regulatory Support for AI Integration

The regulatory landscape in Europe is increasingly supportive of AI integration within industries. Governments are implementing policies that encourage the adoption of AI technologies, particularly in manufacturing and logistics. For example, the European Commission has proposed initiatives aimed at fostering AI innovation, which could lead to an estimated €15 billion investment in AI research and development by 2027. This regulatory support is likely to create a conducive environment for the industrial ai market to flourish. As companies align their strategies with these regulations, the industrial ai market is expected to witness accelerated growth. The emphasis on compliance and ethical AI practices further enhances the attractiveness of this market for investors and stakeholders.

Rising Demand for Operational Efficiency

There is a notable surge in demand for operational efficiency in Europe. Companies are increasingly adopting AI technologies to streamline processes, reduce waste, and enhance productivity. According to recent estimates, the integration of AI in manufacturing could lead to a 20% increase in operational efficiency. This trend is driven by the need to remain competitive in a rapidly evolving market. As industries face pressure to optimize their operations, the industrial ai market is positioned to benefit significantly. The focus on efficiency not only reduces costs but also improves product quality, thereby attracting more investments into the sector. Consequently, the industrial ai market in Europe is likely to see substantial growth as organizations prioritize efficiency-driven solutions.