Expansion of Payment Options

The online sports-betting market is benefiting from the expansion of diverse payment options, which is crucial for attracting a wider audience. As consumers increasingly seek convenience and security in their transactions, platforms that offer multiple payment methods, including e-wallets, cryptocurrencies, and traditional banking options, are likely to gain a competitive edge. In 2025, it is projected that nearly 40% of online bettors will prefer using alternative payment methods, reflecting a shift in consumer preferences. This trend not only facilitates smoother transactions but also enhances user trust, thereby driving growth in the online sports-betting market.

Increased Popularity of Esports Betting

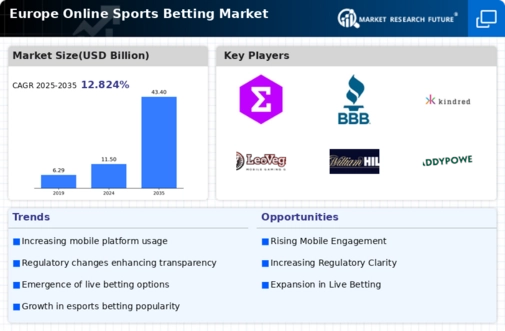

The online sports-betting market is witnessing a notable rise in the popularity of esports betting, which is becoming a significant driver of market growth. With the increasing viewership of esports events, particularly among younger demographics, betting on these events is gaining traction. In 2025, it is estimated that esports betting could account for around 15% of the total online betting market in Europe. This shift not only diversifies the betting options available but also attracts a new audience that may not engage with traditional sports betting. The integration of esports into mainstream betting platforms is likely to further enhance the industry's appeal.

Growing Interest in Live Streaming Services

The online sports-betting market is experiencing a growing interest in live streaming services, which are becoming integral to the betting experience. By providing real-time access to events, platforms can enhance user engagement and encourage in-play betting. This trend appears to be particularly appealing to bettors who prefer to make informed decisions based on live game dynamics. As of 2025, it is estimated that platforms offering live streaming could see an increase in user participation by approximately 25%. This integration of live streaming not only enriches the betting experience but also positions platforms to capitalize on the increasing demand for interactive and dynamic betting options.

Enhanced User Engagement through Gamification

The online sports-betting market is increasingly adopting gamification strategies to enhance user engagement and retention. By incorporating elements such as rewards, leaderboards, and interactive features, betting platforms are creating a more immersive experience for users. This approach appears to resonate particularly well with younger bettors, who are drawn to the competitive aspects of gamified betting. As a result, platforms that effectively implement these strategies may see an increase in user activity and loyalty. Reports suggest that gamification could potentially boost user retention rates by up to 30%, thereby contributing to the overall growth of the online sports-betting market.

Technological Advancements in Betting Platforms

The online sports-betting market is experiencing a surge in technological advancements, which are reshaping user experiences and operational efficiencies. Innovations such as artificial intelligence and machine learning are being integrated into betting platforms, enhancing predictive analytics and personalized user interfaces. This technological evolution is likely to attract a broader demographic, particularly younger audiences who are more tech-savvy. Furthermore, the implementation of blockchain technology is anticipated to increase transparency and security in transactions, addressing concerns related to fraud. As of 2025, the market is projected to reach a valuation of approximately €10 billion, indicating a robust growth trajectory driven by these advancements.