Rise of Esports Betting

The online sports-betting market is experiencing a notable rise in esports betting, reflecting changing consumer interests and the growing popularity of competitive gaming. As of November 2025, esports betting accounts for approximately 15% of the total online betting volume, indicating a significant shift in the types of events being wagered on. This trend is particularly appealing to younger audiences who are more engaged with digital entertainment. The online sports-betting market is adapting to this demand by offering specialized platforms and betting options tailored to esports events. This diversification may attract new customers and increase overall market participation, suggesting a promising avenue for future growth.

Enhanced Payment Solutions

The online sports-betting market is benefiting from enhanced payment solutions that facilitate seamless transactions for users. The introduction of various payment methods, including digital wallets, cryptocurrencies, and instant bank transfers, is likely to improve user experience and increase transaction volumes. As of 2025, it is estimated that around 40% of online sports bets are placed using alternative payment methods, reflecting a shift towards more flexible and secure payment options. This trend not only caters to consumer preferences but also enhances the overall efficiency of the betting process. The online sports-betting market is thus positioned to capitalize on these advancements, potentially leading to increased customer retention and higher revenue streams.

Expansion of Legal Frameworks

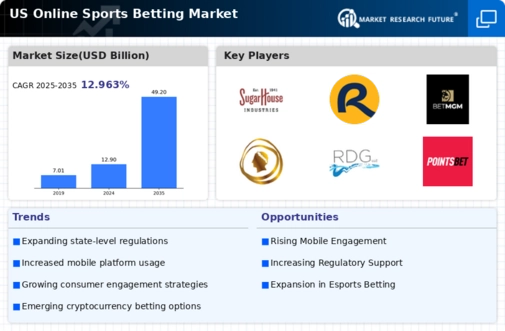

The online sports-betting market is witnessing an expansion of legal frameworks across various states, which is likely to enhance market growth. As of November 2025, over 30 states have legalized some form of online sports betting, contributing to a market valuation exceeding $10 billion. This regulatory shift not only legitimizes the industry but also encourages responsible gambling practices. States are implementing robust regulatory measures to ensure consumer protection and fair play, which may foster greater trust among users. The online sports-betting market is thus benefiting from this evolving legal landscape, as it provides a structured environment for operators and consumers alike, potentially leading to increased participation and revenue generation.

Increased Mobile Accessibility

The online sports-betting market is experiencing a surge in mobile accessibility, driven by the proliferation of smartphones and mobile applications. As of 2025, approximately 70% of all sports bets are placed via mobile devices, reflecting a significant shift in consumer behavior. This trend is likely to continue as technology evolves, making betting more convenient and user-friendly. The rise of mobile betting apps has enabled operators to reach a broader audience, particularly younger demographics who prefer mobile platforms. Furthermore, the integration of features such as live betting and in-app promotions enhances user engagement, potentially increasing overall market revenue. The online sports-betting market is thus positioned to benefit from this mobile-centric approach, as operators invest in optimizing their platforms for mobile users.

Integration of Advanced Analytics

The online sports-betting market is increasingly integrating advanced analytics and data-driven strategies to enhance user experience and operational efficiency. Operators are leveraging big data to analyze betting patterns, consumer preferences, and market trends, which may lead to more personalized offerings. As of 2025, it is estimated that around 60% of operators utilize predictive analytics to optimize their betting platforms. This trend not only improves customer satisfaction but also aids in risk management and fraud detection. The online sports-betting market is thus evolving into a more sophisticated ecosystem, where data analytics plays a crucial role in decision-making and strategy formulation, potentially driving higher engagement and profitability.