Emerging Market Potential

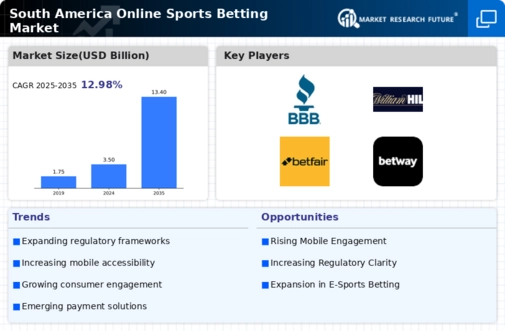

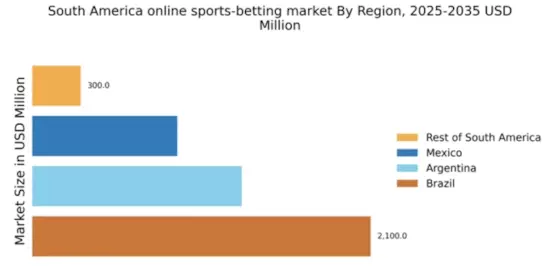

The online sports-betting market in South America is experiencing a notable surge in potential due to the increasing interest in sports, particularly football. Countries like Brazil and Argentina have a rich sporting culture, which translates into a growing audience for online betting platforms. As of 2025, the market is projected to reach approximately $1.5 billion, driven by a young demographic that is tech-savvy and eager to engage in online betting activities. This demographic shift indicates a promising future for the online sports-betting market, as more individuals seek convenient and accessible betting options. Furthermore, the rise of mobile technology facilitates easy access to betting platforms, enhancing user engagement and participation. The combination of cultural enthusiasm for sports and technological accessibility positions the online sports-betting market for substantial growth in the coming years.

Regulatory Framework Evolution

The evolution of regulatory frameworks across South America plays a crucial role in shaping the online sports-betting market. Countries such as Colombia have already established comprehensive regulations that govern online betting, leading to increased consumer trust and participation. As of November 2025, it is estimated that regulated markets could account for over 60% of total betting activities in the region. This regulatory clarity not only protects consumers but also encourages international operators to enter the market, thereby increasing competition and innovation. The establishment of clear guidelines and licensing processes is likely to enhance the legitimacy of the online sports-betting market, attracting both local and foreign investments. As more countries consider similar regulatory measures, the overall market landscape is expected to become more structured and appealing to stakeholders.

Cultural Shifts and Sports Popularity

Cultural shifts in South America are significantly influencing the online sports-betting market. The increasing popularity of various sports, including basketball and esports, alongside traditional football, is diversifying the betting landscape. As of November 2025, it is estimated that esports betting could account for approximately 15% of the total online betting market in the region. This diversification reflects changing consumer preferences and the desire for new betting experiences. Furthermore, the integration of social media platforms into betting activities is fostering community engagement and interaction among bettors. This cultural evolution not only enhances the appeal of the online sports-betting market but also encourages new entrants to explore innovative betting options that resonate with younger audiences.

Economic Growth and Disposable Income

Economic growth in South America is a pivotal driver for the online sports-betting market. As economies in countries like Chile and Peru continue to expand, there is a corresponding increase in disposable income among consumers. This rise in disposable income is likely to lead to higher spending on entertainment, including online sports betting. By 2025, it is projected that the average household income in these countries could increase by 20%, providing more individuals with the financial means to participate in online betting activities. Additionally, the growing acceptance of online gambling as a legitimate form of entertainment is likely to further boost market participation. The combination of economic prosperity and changing attitudes towards betting positions the online sports-betting market for robust growth in the foreseeable future.

Technological Integration and Innovation

Technological integration is a driving force behind the growth of the online sports-betting market in South America. The adoption of advanced technologies such as artificial intelligence and machine learning is transforming how betting platforms operate. These technologies enable personalized user experiences, predictive analytics, and enhanced security measures, which are essential for building consumer confidence. As of 2025, it is projected that the use of AI in betting platforms could increase operational efficiency by up to 30%. Additionally, the rise of blockchain technology is likely to enhance transparency and trust in transactions, further solidifying the online sports-betting market. The continuous innovation in technology not only improves user engagement but also attracts a broader audience, thereby expanding the market's reach and potential.