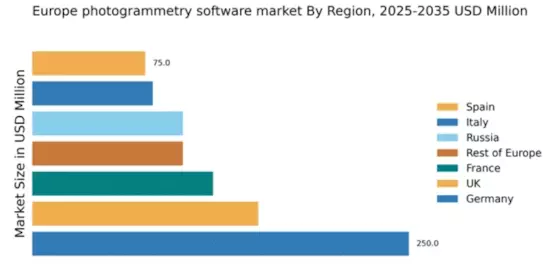

Germany : Strong Demand and Innovation Hub

Key cities such as Berlin, Munich, and Frankfurt are pivotal in driving market demand, with a strong presence of major players like Autodesk and Pix4D. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. Local dynamics favor sectors like construction, architecture, and environmental monitoring, where photogrammetry applications are increasingly utilized. The business environment is bolstered by a skilled workforce and strong infrastructure, making Germany a leader in the photogrammetry software market.

UK : Innovation and Market Expansion

London, Manchester, and Birmingham are key markets, showcasing a competitive landscape with significant players like Bentley Systems and DroneDeploy. The market is characterized by a mix of established companies and innovative startups, fostering a dynamic business environment. Local dynamics are influenced by the construction and surveying industries, where photogrammetry applications are gaining traction. The UK's focus on technological advancement and sustainability positions it well for future growth in this sector.

France : Innovation and Regulatory Support

Key cities such as Paris, Lyon, and Marseille are central to market growth, with a competitive landscape featuring major players like Pix4D and Autodesk. The business environment is characterized by a mix of established firms and innovative startups, creating opportunities for collaboration and growth. Local dynamics favor sectors like construction, architecture, and environmental management, where photogrammetry applications are increasingly utilized. France's commitment to innovation and sustainability positions it as a promising market for photogrammetry software.

Russia : Market Resilience and Development

Moscow and St. Petersburg are key markets, with a competitive landscape featuring local players like Agisoft alongside international firms. The business environment is shaped by a mix of established companies and emerging startups, fostering innovation and collaboration. Local dynamics favor sectors such as agriculture, construction, and environmental management, where photogrammetry applications are increasingly utilized. Russia's focus on modernization and digital transformation positions it for continued growth in the photogrammetry software market.

Italy : Market Growth and Technological Adoption

Key cities such as Rome, Milan, and Florence are central to market growth, with a competitive landscape featuring major players like Autodesk and Pix4D. The business environment is characterized by a mix of established firms and innovative startups, creating opportunities for collaboration and growth. Local dynamics favor sectors like construction, tourism, and environmental management, where photogrammetry applications are increasingly utilized. Italy's focus on innovation and sustainability positions it as a promising market for photogrammetry software.

Spain : Innovation and Sector-Specific Applications

Key cities such as Madrid, Barcelona, and Valencia are pivotal in driving market demand, with a competitive landscape featuring major players like DroneDeploy and Autodesk. The business environment is characterized by a mix of established firms and innovative startups, fostering a dynamic market. Local dynamics favor sectors like construction, tourism, and environmental management, where photogrammetry applications are increasingly utilized. Spain's focus on technological advancement and sustainability positions it well for future growth in this sector.

Rest of Europe : Regional Growth and Innovation Trends

Countries like Sweden, Netherlands, and Belgium are key markets, showcasing a competitive landscape with both local and international players. The business environment is characterized by a mix of established firms and innovative startups, creating opportunities for collaboration and growth. Local dynamics favor sectors like construction, agriculture, and environmental management, where photogrammetry applications are increasingly utilized. The Rest of Europe's focus on innovation and sustainability positions it as a promising market for photogrammetry software.