Increasing Cybersecurity Threats

The managed detection-response market is experiencing growth due to the escalating frequency and sophistication of cyber threats in the GCC region. Organizations are increasingly recognizing the need for robust security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses in the GCC upwards of $6 trillion annually. This alarming trend drives companies to invest in managed detection-response services, which offer proactive threat detection and rapid incident response. As cyber threats evolve, the demand for advanced security solutions is likely to rise, positioning the managed detection-response market as a critical component of organizational security strategies.

Adoption of Advanced Technologies

The managed detection-response market is benefiting from the rapid adoption of advanced technologies such as artificial intelligence and machine learning within the GCC. These technologies enhance the capabilities of security solutions, enabling organizations to detect and respond to threats more effectively. As businesses increasingly rely on digital infrastructure, the need for sophisticated security measures becomes paramount. The integration of AI-driven analytics in managed detection-response services is expected to improve threat detection rates by up to 30%. This technological advancement not only streamlines security operations but also positions the managed detection-response market as a vital player in the overall cybersecurity landscape.

Growing Awareness of Data Privacy

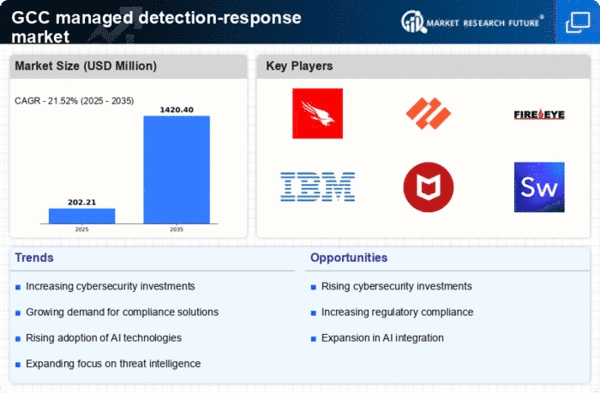

In the GCC, there is a heightened awareness regarding data privacy and protection, which significantly influences the managed detection-response market. With the implementation of stringent data protection regulations, organizations are compelled to adopt comprehensive security measures. The market is projected to grow at a CAGR of 15% from 2025 to 2030, driven by the need for compliance with these regulations. Companies are increasingly turning to managed detection-response services to ensure they meet legal requirements while safeguarding customer data. This trend indicates a shift towards prioritizing data privacy, thereby enhancing the demand for specialized security solutions in the managed detection-response market.

Investment in Digital Transformation

The ongoing investment in digital transformation initiatives across the GCC is significantly influencing the managed detection-response market. As organizations embrace digital technologies to enhance operational efficiency, they also face increased cybersecurity risks. The market is expected to expand as businesses recognize the necessity of integrating security measures into their digital strategies. In 2025, it is estimated that the GCC will invest over $20 billion in digital transformation, with a substantial portion allocated to cybersecurity solutions. This trend highlights the critical role of managed detection-response services in safeguarding digital assets and ensuring the success of transformation efforts.

Shift Towards Remote Work Environments

The transition to remote work environments in the GCC has created new challenges for cybersecurity, thereby impacting the managed detection-response market. As organizations adapt to flexible work arrangements, the attack surface for cyber threats expands, necessitating enhanced security measures. The market is projected to grow as companies seek managed detection-response services to secure remote access and protect sensitive information. In 2025, it is anticipated that 60% of the workforce in the GCC will be working remotely, further driving the demand for comprehensive security solutions. This shift underscores the importance of managed detection-response services in maintaining organizational security in a changing work landscape.

Leave a Comment