Rising Demand for 3D Modeling

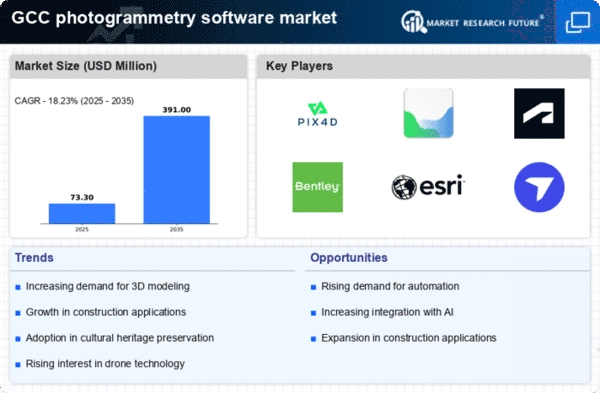

The photogrammetry software market experiences a notable surge in demand for 3D modeling applications across various sectors, particularly in architecture and urban planning. As cities in the GCC region expand, the need for accurate and detailed 3D models becomes paramount. This demand is driven by the necessity for precise planning and visualization, which enhances decision-making processes. The market is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust interest in 3D modeling solutions. Additionally, the integration of photogrammetry with Building Information Modeling (BIM) is likely to enhance the capabilities of architects and engineers, propelling the growth of the photogrammetry software market.

Advancements in Sensor Technology

Advancements in sensor technology are significantly impacting the photogrammetry software market, particularly in the GCC region. The development of high-resolution cameras and LiDAR systems has enhanced the accuracy and efficiency of data collection processes. These technological improvements enable users to capture detailed images and generate precise 3D models more effectively. As a result, industries such as surveying, construction, and environmental monitoring are increasingly adopting photogrammetry solutions. The market is expected to expand as organizations recognize the benefits of integrating advanced sensor technologies into their workflows, potentially leading to a growth rate of around 12% over the next few years.

Government Initiatives and Investments

Government initiatives in the GCC region play a crucial role in fostering the growth of the photogrammetry software market. Various national projects aimed at urban development and infrastructure enhancement are increasingly incorporating advanced technologies, including photogrammetry. For instance, the UAE's Vision 2021 emphasizes smart city initiatives, which rely heavily on accurate data collection and analysis. Investments in these projects are expected to exceed $100 billion by 2030, creating a favorable environment for photogrammetry software adoption. This trend suggests that as governments prioritize technological advancements, the photogrammetry software market will likely benefit from increased funding and support.

Growing Interest in Heritage Preservation

The photogrammetry software market is witnessing a growing interest in heritage preservation and cultural documentation within the GCC region. As nations recognize the importance of safeguarding their historical sites, photogrammetry offers a viable solution for creating detailed digital records. This trend is particularly evident in countries like Saudi Arabia and Oman, where significant investments are being made in cultural heritage projects. The market for photogrammetry software in this context is projected to grow by approximately 10% annually, as institutions and governments seek to utilize advanced imaging techniques for preservation efforts. This focus on heritage preservation indicates a broader application of photogrammetry beyond traditional sectors.

Increased Use in Environmental Monitoring

The photogrammetry software market is experiencing increased utilization in environmental monitoring applications across the GCC region. As concerns regarding climate change and environmental degradation rise, organizations are turning to photogrammetry for effective data collection and analysis. This technology allows for the monitoring of land use changes, vegetation health, and natural resource management. The market is projected to grow by approximately 8% annually as environmental agencies and private firms adopt photogrammetry solutions to enhance their monitoring capabilities. This trend indicates a shift towards more sustainable practices, where photogrammetry plays a vital role in supporting environmental initiatives.