Government Initiatives and Funding

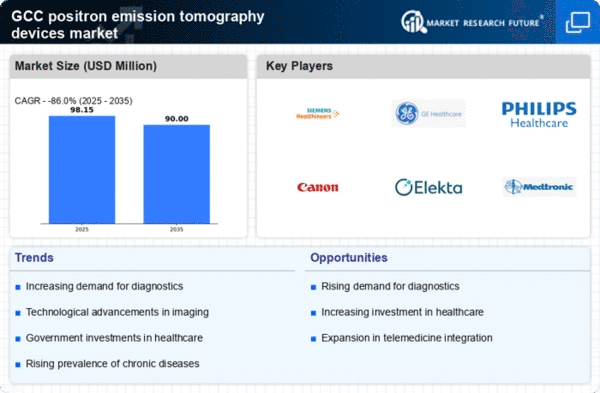

Government initiatives aimed at enhancing healthcare infrastructure in the GCC are significantly impacting the positron emission tomography devices market. Various national health programs are being implemented to improve diagnostic capabilities and access to advanced medical technologies. For example, the Saudi Arabian government has allocated over $1 billion for healthcare modernization, which includes investments in imaging technologies. Such funding is expected to facilitate the acquisition of state-of-the-art positron emission tomography devices, thereby expanding their availability in hospitals and clinics. This proactive approach by governments not only boosts the positron emission-tomography-devices market but also fosters a more robust healthcare system capable of meeting the needs of the population.

Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in the GCC region is a primary driver for the positron emission tomography devices market. Conditions such as cancer, cardiovascular diseases, and neurological disorders are on the rise, necessitating advanced diagnostic tools. For instance, cancer cases in the GCC are projected to increase by 20% by 2030, leading to a heightened demand for effective imaging technologies. Positron emission tomography (PET) devices play a crucial role in the early detection and monitoring of these diseases, thereby enhancing patient outcomes. As healthcare providers seek to improve diagnostic accuracy, the positron emission-tomography-devices market is likely to experience substantial growth, driven by the need for innovative solutions to address the growing burden of chronic illnesses.

Technological Innovations in Imaging

Technological innovations in imaging modalities are significantly influencing the positron emission tomography devices market. The introduction of hybrid imaging systems, such as PET/CT and PET/MRI, has revolutionized diagnostic capabilities, offering enhanced accuracy and efficiency. These advancements allow for simultaneous imaging, providing comprehensive insights into patient conditions. The GCC region is witnessing a rapid adoption of these technologies, with market analysts projecting a growth rate of 12% over the next five years. As healthcare facilities strive to stay competitive and provide the best possible care, the demand for cutting-edge positron emission tomography devices is expected to rise, further propelling market expansion.

Growing Awareness of Diagnostic Imaging

There is a notable increase in awareness regarding the importance of diagnostic imaging among healthcare professionals and patients in the GCC. This heightened awareness is driving the demand for advanced imaging technologies, including positron emission tomography devices. Educational campaigns and training programs are being conducted to inform stakeholders about the benefits of early diagnosis and the role of PET scans in treatment planning. As a result, the positron emission tomography devices market is witnessing a surge in adoption rates, with an estimated growth of 15% annually. This trend indicates a shift towards more proactive healthcare approaches, where diagnostic imaging is prioritized for better health outcomes.

Increasing Investment in Healthcare Infrastructure

The GCC region is experiencing a surge in investment aimed at enhancing healthcare infrastructure, which is a critical driver for the positron emission tomography devices market. Governments and private entities are channeling funds into building new hospitals and upgrading existing facilities, with a focus on incorporating advanced medical technologies. For instance, the UAE has announced plans to invest $10 billion in healthcare infrastructure over the next decade. This influx of capital is likely to facilitate the procurement of modern positron emission tomography devices, thereby improving diagnostic capabilities across the region. As healthcare systems evolve, the positron emission-tomography-devices market is poised for growth, driven by the need for state-of-the-art imaging solutions.

Leave a Comment