Emergence of 5G Technology

The rollout of 5G technology is poised to revolutionize the virtual mobile-infrastructure market in the GCC. With its promise of ultra-fast data speeds and low latency, 5G is expected to enhance mobile connectivity and enable new applications that require robust infrastructure. As telecom operators invest heavily in 5G networks, businesses are likely to leverage this technology to improve their mobile services. The virtual mobile-infrastructure market stands to gain from the increased capabilities offered by 5G, as organizations seek to optimize their operations and enhance user experiences. This technological advancement may lead to innovative solutions that redefine mobile infrastructure in the region.

Growing Mobile Data Consumption

The virtual mobile-infrastructure market is significantly influenced by the increasing consumption of mobile data in the GCC region. With the proliferation of smartphones and mobile applications, data usage has surged, leading to a demand for more efficient mobile infrastructure. Recent statistics reveal that mobile data traffic in the GCC is projected to grow by over 40% annually, prompting businesses to invest in scalable mobile solutions. This trend indicates a pressing need for virtual mobile-infrastructure that can handle the escalating data demands while ensuring seamless connectivity and performance. As mobile data consumption continues to rise, the market is likely to expand, driven by the necessity for advanced infrastructure.

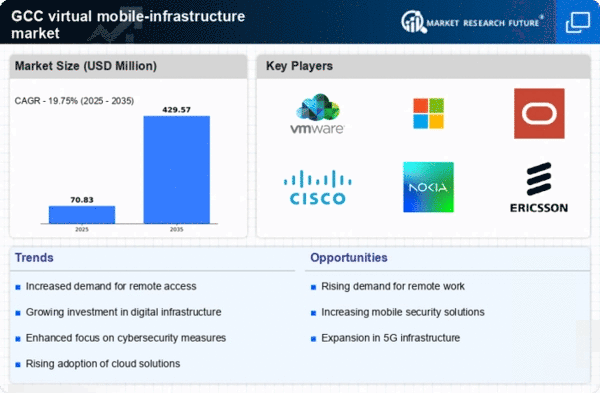

Rising Demand for Remote Work Solutions

The virtual mobile-infrastructure market is experiencing a notable surge in demand for remote work solutions across the GCC region. As organizations increasingly adopt flexible work arrangements, the need for robust mobile infrastructure becomes paramount. This shift is driven by the desire for enhanced productivity and employee satisfaction. Recent data indicates that approximately 60% of companies in the GCC have implemented remote work policies, necessitating advanced mobile solutions. The virtual mobile-infrastructure market is poised to benefit from this trend. Businesses seek to provide employees with secure and efficient access to corporate resources from any location. This demand is likely to continue growing, as remote work becomes a permanent fixture in many organizations' operational strategies.

Increased Focus on Data Privacy Regulations

The virtual mobile-infrastructure market is also shaped by the growing emphasis on data privacy regulations within the GCC region. As governments implement stricter data protection laws, businesses are compelled to adopt mobile solutions that ensure compliance with these regulations. This focus on data privacy is likely to drive demand for secure virtual mobile-infrastructure that safeguards sensitive information. Companies are increasingly investing in technologies that enhance data security and privacy, reflecting a broader trend towards responsible data management. The virtual mobile-infrastructure market may see a rise in solutions designed to meet regulatory requirements, thereby fostering trust among consumers and businesses alike.

Government Initiatives Supporting Digital Transformation

Government initiatives across the GCC are playing a crucial role in fostering the virtual mobile-infrastructure market. Various national strategies aim to enhance digital transformation, with significant investments in technology infrastructure. For instance, the UAE's Vision 2021 and Saudi Arabia's Vision 2030 emphasize the importance of digital innovation. These initiatives are expected to drive the adoption of mobile infrastructure solutions, as public and private sectors align their goals with national objectives. The virtual mobile-infrastructure market is likely to see increased funding and support, facilitating the development of advanced mobile solutions that cater to the evolving needs of businesses and consumers alike.