Growing Focus on Rare Diseases

The whole exome-sequencing market is increasingly influenced by the rising focus on rare diseases within the GCC. As healthcare systems prioritize the identification and management of rare genetic disorders, whole exome sequencing emerges as a vital tool for accurate diagnosis. The market is witnessing a shift towards personalized treatment plans, which are often informed by genetic insights. Reports indicate that the prevalence of rare diseases in the region is approximately 7%, underscoring the need for effective diagnostic solutions. This growing emphasis on rare diseases is likely to drive demand for whole exome sequencing, positioning it as a cornerstone of modern healthcare strategies.

Rising Demand for Genetic Testing

The whole exome-sequencing market is experiencing a notable surge in demand for genetic testing services across the GCC region. This increase is driven by a growing awareness of genetic disorders and the importance of early diagnosis. As healthcare providers and patients alike recognize the value of genetic insights, the market is projected to expand significantly. According to recent estimates, the genetic testing market in the GCC is expected to reach approximately $1.5 billion by 2026, with whole exome sequencing playing a pivotal role in this growth. The integration of advanced technologies in healthcare is likely to further enhance the accessibility and affordability of these services, thereby propelling the whole exome-sequencing market forward.

Increased Investment in Genomic Research

Investment in genomic research is a key driver of the whole exome-sequencing market in the GCC. Governments and private entities are allocating substantial funds to advance genomic studies, which are essential for understanding genetic diseases and developing targeted therapies. This influx of capital is expected to foster collaborations between research institutions and healthcare providers, enhancing the overall infrastructure for genomic research. As a result, the whole exome-sequencing market is poised for growth, with projections indicating a potential increase in funding by 30% over the next five years. Such investments are likely to accelerate the development of innovative sequencing technologies and applications.

Technological Advancements in Sequencing

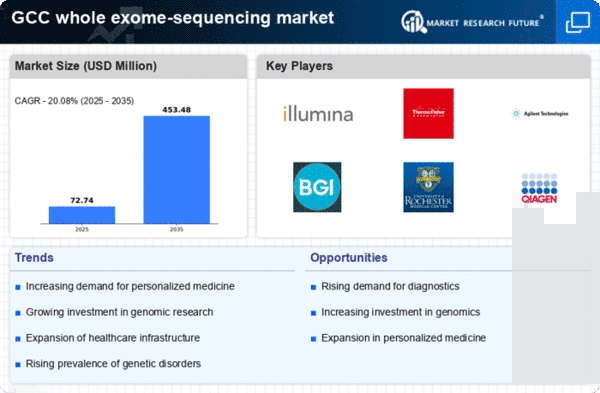

Technological innovations are transforming the landscape of the whole exome-sequencing market. The advent of next-generation sequencing (NGS) technologies has significantly reduced the time and cost associated with exome sequencing. These advancements enable faster turnaround times for results, which is crucial for clinical decision-making. In the GCC, the implementation of high-throughput sequencing platforms is expected to increase, potentially leading to a market growth rate of over 20% annually. As laboratories adopt these cutting-edge technologies, the whole exome-sequencing market is likely to benefit from enhanced accuracy and efficiency, making it an attractive option for both healthcare providers and patients.

Rising Awareness of Preventive Healthcare

The whole exome-sequencing market is benefiting from a growing awareness of preventive healthcare among the GCC population. As individuals become more proactive about their health, there is an increasing interest in genetic testing as a means of identifying predispositions to various conditions. This trend is supported by educational campaigns and initiatives aimed at promoting genetic literacy. The market is expected to see a compound annual growth rate (CAGR) of around 15% as more people seek out whole exome sequencing for preventive purposes. This shift towards preventive healthcare is likely to reshape the landscape of the whole exome-sequencing market, making it an integral part of routine health assessments.