Advancements in Bioinformatics

The evolution of bioinformatics tools is significantly impacting the whole exome-sequencing market. Enhanced data analysis capabilities allow for more accurate interpretation of sequencing results, which is crucial for clinical applications. In the UK, the integration of artificial intelligence and machine learning in bioinformatics is streamlining the analysis process, reducing the time required to obtain actionable insights. This technological progress is expected to increase the adoption of whole exome sequencing, as healthcare professionals seek efficient methods to interpret complex genetic data. The market is likely to witness a surge in demand as these advancements facilitate the identification of genetic variants associated with diseases, thereby improving patient outcomes.

Rising Demand for Genetic Testing

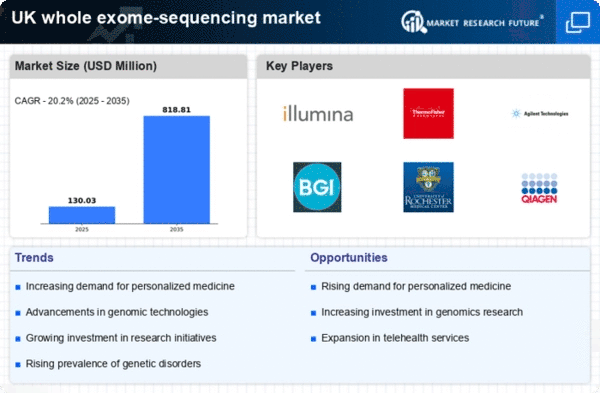

The increasing awareness of genetic disorders and the benefits of early diagnosis is driving the whole exome-sequencing market. In the UK, the prevalence of genetic conditions is estimated to affect 1 in 25 individuals, leading to a heightened demand for comprehensive genetic testing solutions. This trend is further supported by the growing number of healthcare providers integrating genetic testing into routine clinical practice. As a result, the market is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the urgent need for effective diagnostic tools. The whole exome-sequencing market is thus positioned to meet this demand, providing critical insights into genetic predispositions and enabling personalized treatment plans.

Government Initiatives and Funding

Government support plays a pivotal role in the growth of the whole exome-sequencing market. In the UK, initiatives aimed at promoting genomic research and precision medicine are gaining momentum. The UK government has allocated substantial funding to genomics projects, with an investment of over £200 million in the last fiscal year alone. Such financial backing not only fosters innovation but also encourages collaboration between public and private sectors. This environment is conducive to the development of new technologies and services in the whole exome-sequencing market, ultimately enhancing accessibility and affordability for patients. As funding continues to flow, the market is expected to expand, providing more opportunities for advancements in genetic testing.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is a key driver for the whole exome-sequencing market. In the UK, healthcare providers are increasingly recognizing the importance of tailoring treatments based on individual genetic profiles. This approach not only improves treatment efficacy but also minimizes adverse effects, leading to better patient satisfaction. The whole exome-sequencing market is at the forefront of this transformation, offering comprehensive insights into genetic variations that influence drug response. As more clinicians adopt personalized treatment strategies, the demand for whole exome sequencing is anticipated to rise, potentially leading to a market growth rate of around 12% annually. This trend underscores the critical role of genetic testing in modern healthcare.

Growing Research and Development Activities

The surge in research and development activities within the field of genomics is propelling the whole exome-sequencing market forward. In the UK, academic institutions and biotech companies are increasingly investing in R&D to explore the applications of whole exome sequencing in various therapeutic areas. This focus on innovation is expected to yield new discoveries that could revolutionize disease treatment and prevention strategies. The whole exome-sequencing market stands to benefit from these advancements, as new findings may lead to the development of novel diagnostic tools and therapies. With R&D expenditures in genomics projected to reach £1 billion by 2026, the market is likely to experience robust growth driven by continuous scientific exploration.