Advancements in Bioinformatics

The rapid evolution of bioinformatics tools is significantly influencing the whole exome-sequencing market. Enhanced data analysis capabilities allow for more accurate interpretation of genetic information, which is essential for effective clinical decision-making. In India, the availability of sophisticated software and algorithms has improved the efficiency of whole exome sequencing, making it more accessible to healthcare providers. This technological progress is expected to facilitate the integration of genomic data into routine clinical practice. Furthermore, as the volume of genetic data continues to grow, the demand for advanced bioinformatics solutions is likely to increase, thereby propelling the whole exome-sequencing market forward. The collaboration between technology firms and healthcare institutions may also foster innovation in this sector.

Supportive Regulatory Framework

A supportive regulatory framework is essential for the growth of the whole exome-sequencing market. In India, regulatory bodies are increasingly recognizing the importance of genetic testing and are establishing guidelines to ensure the quality and safety of these services. This regulatory support is likely to enhance consumer confidence in whole exome sequencing, encouraging more individuals to seek genetic testing. Furthermore, the establishment of clear regulations may facilitate the entry of new players into the market, fostering competition and innovation. As the regulatory landscape evolves, it is expected to create a conducive environment for the whole exome-sequencing market to thrive. This development could lead to improved access to genetic testing services across the country.

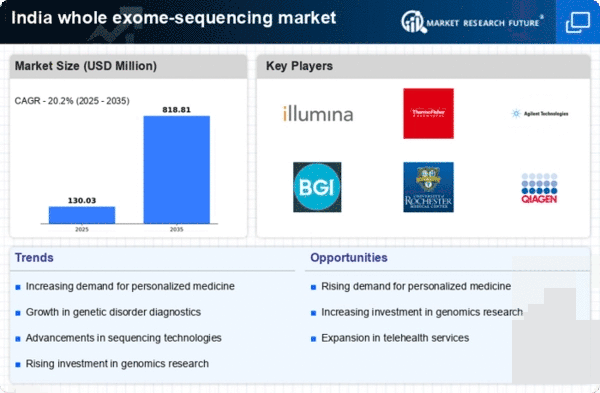

Growing Investment in Genomic Research

Investment in genomic research is a significant driver for the whole exome-sequencing market. In India, both public and private sectors are increasingly allocating funds towards genomic studies, which aim to unravel the complexities of genetic diseases. This financial support is crucial for advancing research initiatives and developing new applications for whole exome sequencing. According to recent reports, the Indian government has earmarked substantial budgets for biotechnology and genomics, indicating a commitment to fostering innovation in this field. As research progresses, the findings are likely to enhance the understanding of genetic disorders, thereby increasing the demand for whole exome sequencing. This trend suggests a promising future for the market as new discoveries pave the way for improved diagnostic and therapeutic options.

Rising Awareness of Personalized Medicine

The growing awareness of personalized medicine is driving the whole exome-sequencing market in India. Patients and healthcare providers are increasingly recognizing the benefits of tailored treatment plans based on individual genetic profiles. This shift towards personalized healthcare is prompting a surge in demand for genetic testing, including whole exome sequencing. As more healthcare professionals advocate for precision medicine, the market is likely to expand. Additionally, educational campaigns aimed at informing the public about the advantages of genetic testing are contributing to this trend. The potential for improved treatment outcomes and reduced adverse effects associated with personalized therapies may further stimulate interest in whole exome sequencing, positioning it as a vital component of modern healthcare.

Increasing Prevalence of Genetic Disorders

The rising incidence of genetic disorders in India is a crucial driver for the whole exome-sequencing market. With an estimated 6-8 million people affected by rare genetic diseases, the demand for precise diagnostic tools is escalating. This trend is further supported by the growing awareness among healthcare professionals and patients regarding genetic testing. As healthcare systems increasingly recognize the importance of early diagnosis, the whole exome-sequencing market is expected to experience substantial growth. Moreover, the Indian government has initiated various health programs aimed at addressing genetic disorders, which may further bolster the market. The integration of whole exome sequencing into clinical practice could potentially enhance patient outcomes and reduce healthcare costs, thereby driving market expansion.