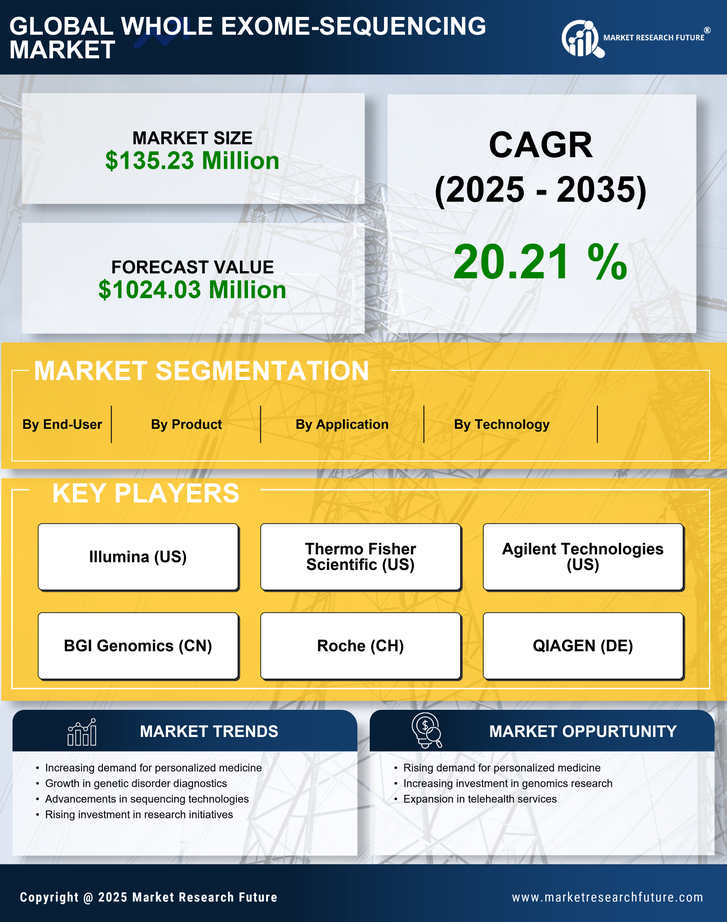

Rising Demand for Genetic Testing

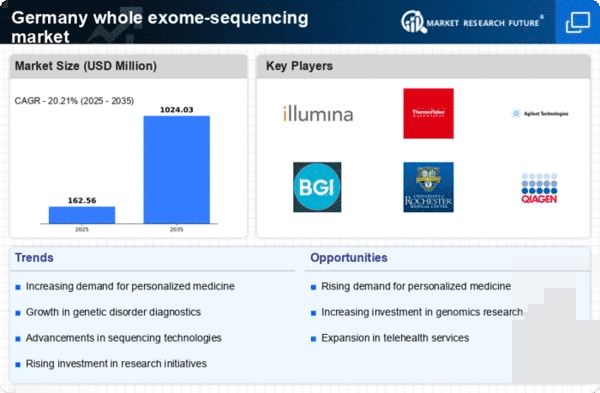

The increasing awareness of genetic disorders and the importance of early diagnosis is driving the whole exome-sequencing market in Germany. As healthcare providers and patients recognize the value of genetic testing, the demand for whole exome sequencing is expected to rise. In 2025, the market is projected to reach approximately €300 million, reflecting a growth rate of around 15% annually. This trend is fueled by the need for personalized medicine, where treatments are tailored based on individual genetic profiles. Furthermore, the integration of genetic testing into routine healthcare practices is likely to enhance patient outcomes, thereby solidifying the role of whole exome sequencing in clinical settings.

Supportive Government Initiatives

Government initiatives aimed at promoting genetic research and precision medicine are likely to bolster the whole exome-sequencing market in Germany. Funding programs and grants for research institutions are being established to encourage the development of genetic testing technologies. In 2025, it is estimated that government funding for genetic research will exceed €50 million, which could significantly enhance the capabilities of laboratories and healthcare providers. These initiatives not only support the advancement of whole exome sequencing but also aim to improve public health outcomes by facilitating early detection and treatment of genetic disorders. The collaboration between government and private sectors may further accelerate market growth.

Growing Focus on Personalized Medicine

The shift towards personalized medicine is a key driver for the whole exome-sequencing market. As healthcare systems in Germany increasingly prioritize individualized treatment plans, the demand for genetic insights is expected to rise. By 2025, it is anticipated that over 30% of new therapies will be based on genetic information, highlighting the importance of whole exome sequencing in drug development and patient care. This trend is likely to encourage pharmaceutical companies to invest in genetic research, thereby expanding the market. The integration of whole exome sequencing into clinical workflows is expected to enhance treatment efficacy and patient satisfaction, further solidifying its role in modern healthcare.

Advancements in Sequencing Technologies

Technological innovations in sequencing methodologies are significantly impacting the whole exome-sequencing market. The introduction of next-generation sequencing (NGS) platforms has reduced the cost and time required for exome sequencing, making it more accessible to healthcare providers in Germany. As of 2025, the cost of sequencing a whole exome has decreased to approximately €1,000, which is a substantial reduction from previous years. This affordability, combined with improved accuracy and speed of results, is likely to encourage more laboratories to adopt whole exome sequencing. Consequently, the market is expected to expand as more healthcare institutions integrate these advanced technologies into their diagnostic processes.

Increased Collaboration Between Academia and Industry

The collaboration between academic institutions and the biotechnology industry is fostering innovation in the whole exome-sequencing market. Research partnerships are emerging to explore new applications of whole exome sequencing in various fields, including oncology and rare diseases. By 2025, it is projected that collaborative research projects will account for approximately 25% of the market's growth. These partnerships not only facilitate knowledge exchange but also accelerate the development of novel sequencing technologies and applications. As a result, the whole exome-sequencing market is likely to benefit from enhanced research capabilities and the introduction of cutting-edge solutions that address unmet medical needs.