Germany Property Insurance Market

Germany Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

Germany Property Insurance Market Overview

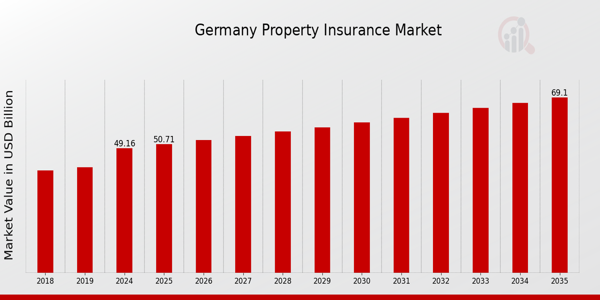

As per MRFR analysis, the Germany Property Insurance Market Size was estimated at 47.61 (USD Billion) in 2023.The Germany Property Insurance Market is expected to grow from 49.16(USD Billion) in 2024 to 69.1 (USD Billion) by 2035. The Germany Property Insurance Market CAGR (growth rate) is expected to be around 3.144% during the forecast period (2025 - 2035).

Key Germany Property Insurance Market Trends Highlighted

The Germany Property Insurance Market is witnessing several important trends that reflect the evolving needs of consumers and changes in the regulatory environment. One key driver is the increasing awareness among property owners regarding the importance of insurance in protecting assets against natural disasters and other unforeseen events. With Germany experiencing more extreme weather patterns, such as heavy floods and storms, homeowners are seeking comprehensive insurance coverage.

This demand has been further fueled by government initiatives promoting risk awareness, encouraging property owners to invest in solid insurance policies to secure their properties.Insurers have a lot of chances to come up with new ideas and offer products that are made just for certain customers. For instance, using technology to manage policies and process claims can improve the customer experience and make operations run more smoothly.

Also, adding smart home devices to insurance policies gives insurers a unique selling point, since they can offer discounts or incentives for homes that have this technology. Germany has a growing number of young homeowners, especially in cities. Insurers can look for ways to reach this group of people through digital platforms.

Recent trends in the market indicate a shift towards more personalized insurance products, driven by consumer preferences for flexibility and customized coverage options. The rise of insurtech companies in Germany is also transforming traditional insurance models, leading to increased competition and innovation.

As property owners look for more convenience and tailored solutions, traditional insurers are adapting to offer tech-driven services. Overall, the dynamic nature of the Germany Property Insurance Market presents a landscape filled with potential for growth, driven by a combination of evolving consumer expectations, technological advancements, and the increasing need for robust protection against various risks.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Germany Property Insurance Market Drivers

Increasing Awareness of Property Protection

In Germany, there has been a notable increase in awareness about property risks among homeowners and businesses, driven largely by recent natural disasters and rising crime rates. Data from the Federal Statistical Office indicates that damages from natural disasters like floods and storms have surged, leading to a 25% rise in insured damages over the last five years.

This growing awareness has been further catalyzed by organizations such as the German Insurance Association, which actively promotes risk management and property insurance.As a result, the Germany Property Insurance Market is witnessing an increasing number of individuals and businesses opting for comprehensive property insurance coverage, indicating a strong growth trajectory. The continuous push for awareness and education regarding property safeguarding is expected to further fuel the market expansion, as homeowners increasingly recognize the financial implications of being underinsured or uninsured against potential catastrophes.

Regulatory Support and Government Initiatives

The German government has implemented several initiatives aimed at enhancing property safety and insurance uptake among homeowners and businesses. The Building Energy Act and its amendments encourage property owners to invest in energy-efficient buildings and risk mitigation measures. These regulatory changes have indirectly boosted the demand for property insurance as new structures often require comprehensive coverage.

Additionally, the Federal Ministry of the Interior's recent policies focus on disaster preparedness and enhancing infrastructure resilience.This regulatory environment nurtures the growth of the Germany Property Insurance Market by providing a framework that not only mandates insurance coverage but also incentivizes protective measures, reflecting a strategic alignment of government policy and market demands.

Technological Advancements in Insurtech

Technological innovations are significantly reshaping the Germany Property Insurance Market. The rise of Insurtech firms in Germany has fostered advancements in underwriting processes, claims management, and customer engagement.

According to recent reports from industry associations, approximately 70% of established insurance companies are now investing in digital transformation efforts to streamline operations and enhance customer service experiences.By utilizing artificial intelligence and big data analytics, these firms are better equipped to assess risk more accurately and personalize insurance offerings, which boosts access to property insurance among consumers. As technology continues to facilitate efficient risk assessment and premium calculation, the Germany Property Insurance Market is expected to witness enhanced growth as more individuals turn to digital platforms for their insurance needs.

Germany Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

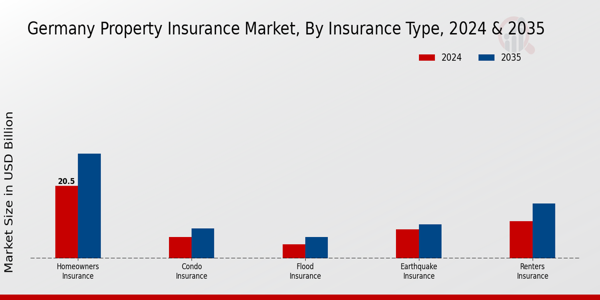

The Germany Property Insurance Market, particularly under the Insurance Type segment, showcases diverse offerings tailored to meet the varied needs of property owners and tenants. Homeowners Insurance remains a critical component, as it provides essential coverage for individuals, safeguarding their residences against unexpected damages and liabilities. It is a preferred choice for many, bolstered by increasing property ownership rates in Germany, which foster a sense of security among homeowners.

Renters Insurance reflects the growing trend of renting, particularly in urban areas, where a significant portion of the population seeks protection for personal belongings from risks such as theft or damage, thus reinforcing the importance of this insurance type in a renting-dominant environment.Condo Insurance is essential for owners of condominium units, covering shared spaces and emphasizing the need to protect personal property against internal and external risks.

Meanwhile, the significance of Flood Insurance is underscored by recent climatic changes that have increased flood-related incidents across Germany, making it an essential part of property insurance discussions and risk management strategies for affected regions. Earthquake Insurance, albeit less prominent in a country where seismic activity is relatively low compared to other regions, still holds significance as a preventive measure in areas where geological surveys indicate potential risks.

Each of these insurance types plays a vital role in the overall landscape of the Germany Property Insurance Market, reflecting the evolving nature of property ownership, environmental challenges, and urban living dynamics, thereby driving the country’s insurance industry forward while adapting to consumer needs and market demands. As the market continues to evolve, the diversity within the Insurance Type segment will likely grow, reflecting the ever-changing landscape of risks and consumer preferences in Germany.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Coverage Type segment of the Germany Property Insurance Market plays a pivotal role in defining how policyholders secure their assets. Each type offers distinct advantages tailored to different needs, reflecting the preferences of the German populace. Actual Cash Value (ACV) is favored for its straightforward approach to settling claims, taking depreciation into account, which appeals to cost-conscious consumers. In contrast, Replacement Cost coverage is gaining traction as it reimburses policyholders for the cost of replacing damaged items without depreciation, addressing the growing need for immediate financial relief after incidents.

Extended Replacement Cost offers added security, providing a buffer against rising construction costs, while Guaranteed Replacement Cost assures policyholders that they will receive adequate compensation, which is increasingly important in an unpredictable economic climate. The emphasis on having diverse coverage types is indicative of a maturing market that seeks to address varying customer needs amid changing societal conditions in Germany. As homeowners become more aware of potential risks, demands for comprehensive coverage types will likely continue to grow, ensuring the market remains competitive and customer-focused.

Property Insurance Market End Use Insights

The Germany Property Insurance Market focuses on various End Use sectors, which are critical for understanding coverage demand across different property types. The residential segment is significant, as it safeguards homeowners against risks like fire, theft, and natural disasters, reflecting a high ownership rate of properties in Germany. Commercial property insurance plays a vital role as businesses seek protection against potential liabilities and asset loss, driven by a robust economy that encourages entrepreneurial activity.

Meanwhile, the industrial segment is essential, given Germany's strong manufacturing base, necessitating insurance to cover machinery, inventory, and facilities against unforeseen events.The growth of digitalization and increased property values are both driving the need for comprehensive insurance solutions across these sectors. As urbanization continues and infrastructure developments advance, the demand for property insurance becomes increasingly significant in mitigating risks associated with these transitions. This landscape presents opportunities for insurers to innovate and tailor products specific to the unique needs of each segment, ensuring comprehensive protection in a rapidly evolving market environment.

Property Insurance Market Distribution Channel Insights

In the Germany Property Insurance Market, the Distribution Channel plays a vital role in shaping how insurance products reach consumers. The overall market has shown significant growth, with direct sales being a prominent method, allowing insurers to engage directly with customers and streamline policy issuance. Brokerage remains a vital player, providing personalized advice to clients while enhancing market accessibility. Online platforms have increasingly gained traction, reflecting the growing trend towards digitalization in insurance purchasing, where convenience and ease of access are prioritized by consumers.

Additionally, banks serve as key intermediaries in the distribution of property insurance, leveraging their established customer bases and trust. The rise of digital solutions and changing consumer behaviors in Germany are transforming these distribution channels, indicating evolving market dynamics driven by technological advancements and shifting consumer expectations. These elements collectively influence the landscape of the Germany Property Insurance Market segmentation, paving the way for new opportunities and growth drivers while enhancing competition within the industry.

Germany Property Insurance Market Key Players and Competitive Insights

The Germany Property Insurance Market is characterized by a diverse array of insurance providers that offer various products aimed at protecting property owners against potential risks. The competitive landscape is dominated by a combination of established players and emerging companies, each striving to enhance their market share through innovative products, customer service excellence, and strategic partnerships. The regulatory environment plays a significant role in shaping market dynamics, with compliance and consumer protection dictating many aspects of operation.

The increasing frequency of climate-related risks has also propelled the demand for property insurance, prompting insurers to adapt their offerings and pricing strategies to remain competitive. Additionally, advancements in technology and data analytics have empowered companies to better assess risks and tailor their products to meet the changing needs of consumers, thus intensifying competition across the market.Signal Iduna stands out in the Germany Property Insurance Market due to its well-established presence and customer-centric approach. The company has gained significant recognition for its ability to offer comprehensive property insurance solutions that cater to both individual homeowners and commercial entities.

Signal Iduna's strengths lie in its strong brand reputation, long-standing relationships with customers, and a keen focus on risk management and assessment. This position allows the company to effectively address consumer needs while navigating the complexities of the insurance landscape in Germany. Furthermore, Signal Iduna's robust distribution network enhances its accessibility, enabling it to reach a wide range of clients across the country, thereby solidifying its competitive positioning within the market.Baloise maintains a significant presence in the Germany Property Insurance Market, known for its innovative insurance solutions and customer-oriented approach. The company offers a wide range of products, including property insurance for homeowners, renters, and commercial properties, designed to meet the diverse needs of the German market.

Baloise's strengths include a commitment to digital transformation, allowing for seamless customer interactions and streamlined claims processing. The company's strategy includes mergers and acquisitions aimed at expanding its market share and enhancing its service offerings within Germany. By continuously adapting to market demands and focusing on sustainability, Baloise reinforces its competitive edge, positioning itself as a key player capable of responding to the evolving risks faced by property owners in the region.

Key Companies in the Germany Property Insurance Market Include:

- Signal Iduna

- Baloise

- Generali

- ERGO

- LVM Versicherung

- Continentale

- Debeka

- HukCoburg

- Axa

- Allianz

- R+V Versicherung

- Munich Re

- VHV

Germany Property Insurance Market Developments

The Germany Property Insurance Market has experienced various recent developments, reflecting its dynamic nature. In April 2023, Munich Re announced a strategic initiative to enhance its offerings in digital insurance solutions, aiming to cater to the evolving technological landscape and customer demands. Additionally, ERGO has taken steps towards sustainability by launching eco-friendly property insurance products to attract environmentally conscious consumers, a trend gaining traction across Europe. In terms of market valuation, Allianz has reported an increase in its property insurance premiums due to rising reconstruction costs, primarily driven by inflation and supply chain disruptions observed over the past year.

Furthermore, in June 2022, Debeka acquired a significant stake in a tech startup focused on risk assessment, reinforcing its commitment to innovation in property insurance. The merger and acquisition landscape saw Baloise Group acquire a smaller competitor to bolster its market presence in Germany, which was confirmed in March 2023. Over the last few years, the sector has witnessed increased competition and consolidation, alongside a growing emphasis on digital transformation and sustainability as key drivers of future growth within the property insurance domain in Germany's evolving economy.

Germany Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the projected market size of the Germany Property Insurance Market in 2024?

The Germany Property Insurance Market is expected to be valued at 49.16 billion USD in 2024.

What will be the market value of the Germany Property Insurance Market by 2035?

By 2035, the Germany Property Insurance Market is projected to reach a value of 69.1 billion USD.

What is the expected CAGR for the Germany Property Insurance Market from 2025 to 2035?

The expected CAGR for the Germany Property Insurance Market from 2025 to 2035 is 3.144%.

Which insurance type holds the largest market share in the Germany Property Insurance Market?

Homeowners Insurance constitutes the largest segment, valued at 20.5 billion USD in 2024.

What is the estimated market size for Renters Insurance in Germany by 2035?

Renters Insurance is expected to reach a market size of 15.5 billion USD by 2035.

Who are the key players in the Germany Property Insurance Market?

Major players include Allianz, Axa, Munich Re, and several others actively competing in the market.

How much is the Flood Insurance segment expected to grow by 2035?

The Flood Insurance segment is anticipated to grow to a value of 6.0 billion USD by 2035.

What is the market size forecast for Earthquake Insurance by 2035?

Earthquake Insurance is projected to have a market size of 9.6 billion USD by 2035.

What are the growth drivers for the Germany Property Insurance Market?

The growth drivers include increasing urbanization, climate change impacts, and a growing awareness of property risks.

How does the Germany Property Insurance Market outlook appear for the coming decade?

The market outlook remains positive with steady growth anticipated across various insurance segments until 2035.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”