UK Property Insurance Market

UK Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost,Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

UK Property Insurance Market Overview

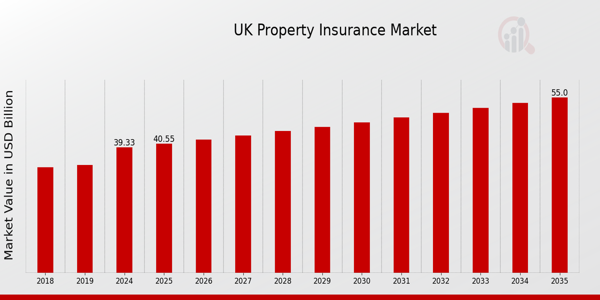

As per MRFR analysis, the UK Property Insurance Market Size was estimated at 38.09 (USD Billion) in 2023.The UK Property Insurance Market is expected to grow from 39.33(USD Billion) in 2024 to 55 (USD Billion) by 2035. The UK Property Insurance Market CAGR (growth rate) is expected to be around 3.096% during the forecast period (2025 - 2035).

Key UK Property Insurance Market Trends Highlighted

The UK Property Insurance Market is experiencing significant shifts largely driven by changing consumer preferences and advancements in technology. Residents are increasingly opting for comprehensive coverage options that not only safeguard property but also cover personal belongings and additional living expenses. The rise in awareness regarding climate change has led to a growing demand for insurance products that protect against flooding and other natural disasters. This shift emphasizes the need for insurers to offer tailored solutions that reflect the diverse risks faced by homeowners across various regions in the UK.

Opportunities in the UK market revolve around the integration of technology to streamline insurance processes.Customers have a better experience when they can submit claims and manage their policies in real time through digital platforms and mobile apps. The rise of smart home technologies is one of the things that is driving this trend. These technologies let insurers collect data to assess risk, which opens up the possibility of more tailored insurance products.

Also, the ongoing development of data analytics tools helps insurers understand how customers act and what they want, which lets them make their products better to meet market needs. The UK Property Insurance Market has put a lot of focus on sustainability in recent years. The government wants property owners to use energy-efficient solutions and environmentally friendly methods, which can affect the terms and prices of insurance.

Insurers are beginning to recognize the importance of promoting environmentally friendly properties, leading to potential discounts for policyholders who implement green measures. This trend reflects a broader societal shift towards sustainability, aligning insurance offerings with the values of today's environmentally conscious consumers in the UK.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

UK Property Insurance Market Drivers

Growing Need for Property Protection

The increasing number of households in the United Kingdom is driving the demand for property insurance. According to the Office for National Statistics, the number of households in the UK reached approximately 28 million in 2021 and is projected to continue to rise. Homeownership has traditionally been a priority for British citizens, with around 65% of the population owning their homes.

As the number of households grows, the UK Property Insurance Market is likely to see increased demand for property insurance products.Additionally, governmental initiatives aimed at supporting homebuyers, particularly first-time buyers, further bolster this trend. Established insurers such as Aviva and AXA are adapting their offerings to capture this burgeoning market, ultimately leading to higher premiums and growth within the sector.

Impact of Climate Change on Property Risk

As the effects of climate change become increasingly evident, the threat of extreme weather events is prompting more homeowners in the United Kingdom to seek property insurance. The Environment Agency has reported a significant rise in the instances of flooding due to climate-related changes, with projections indicating the potential for a 50% increase in flood risk areas by the mid-2030s.

Such risks can lead to severe damage to residential properties, pushing homeowners to invest in robust insurance solutions.Insurers like Zurich and RSA Insurance Group are revising their policies to account for these emerging risks, thereby propelling growth in the UK Property Insurance Market as consumers seek to mitigate their financial liabilities.

Technological Advancements in Insurance Services

The integration of technology in the property insurance sector is revolutionizing how policies are sold and managed, significantly benefiting the UK Property Insurance Market. Insurtech companies are introducing innovative digital platforms, making it easier for consumers to compare policies and purchase insurance online.

British Insurers are increasingly utilizing data analytics and machine learning to enhance underwriting processes, risk assessment, and fraud detection.The Financial Conduct Authority reported a rise in consumer engagement with these digital solutions, evidencing a shift in consumer behavior. Industry players such as Direct Line and Admiral are investing heavily in technology to streamline their services, ensuring sustained market growth as digital adoption continues to rise.

Regulatory Changes Enhancing Consumer Protection

Regulatory changes aimed at enhancing consumer protection are also fueling growth in the UK Property Insurance Market. The Insurance Act 2015 established comprehensive guidelines that require insurers to adopt fairer practices, such as clearer disclosures and better claims handling processes.

This legislation has empowered consumers, making them more confident in purchasing property insurance. Subsequently, increased transparency is anticipated to lead to higher levels of policy initiation.Insurers like Hiscox have restructured their operations to comply with these regulations, while also promoting greater trust among consumers. As the industry adapts to these changes, growth within the property insurance sector is expected to be sustained.

UK Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

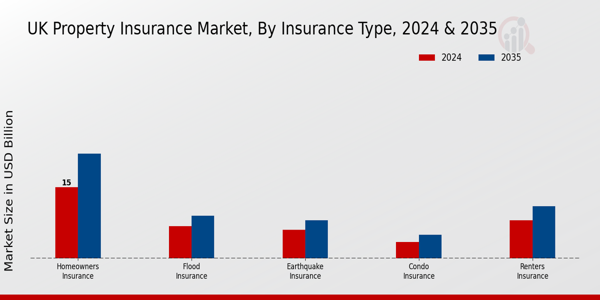

The UK Property Insurance Market has been experiencing significant growth, driven largely by the diverse range of insurance types available to meet varied consumer needs. The market is primarily segmented into Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, and Earthquake Insurance.

Each of these insurance types plays a crucial role in providing protection against different risks and ensures financial security for both homeowners and renters in the UK. Homeowners Insurance is particularly essential as it safeguards properties against common risks such as theft, fire, and natural disasters, making it a staple for individuals investing in real estate. Renters Insurance, while often overlooked, is gaining traction among tenants who want to protect their personal belongings from damage or theft.

In urban areas, where a significant portion of the population lives in rental properties, this type of insurance is becoming increasingly crucial.Condo Insurance specifically caters to individuals residing in condominiums, and it is tailored to cover both personal property and shared spaces, addressing the unique challenges faced in community living setups.

Flood Insurance is also a critical segment within the market, especially for residents in areas vulnerable to flooding, and it has gained importance due to changing climate patterns and increasing incidences of severe weather. The demand for this type of insurance is expected to rise as more consumers become aware of the risks associated with flooding.

Similarly, Earthquake Insurance, though it holds a smaller proportion of the market, is vital in regions of the UK that may experience seismic activity. The importance of this insurance type has been amplified by increasing awareness of environmental risks. Collectively, these insurance types underline the resilience and adaptability of the UK Property Insurance Market. The dynamic needs of consumers, coupled with ongoing market trends, highlight the growing inclination for comprehensive and tailored insurance products to mitigate risks associated with property ownership and renting.

This broad segmentation within the insurance sector not only enhances the market’s ability to cater to consumers but also offers a multitude of opportunities for growth and innovation as providers seek to address evolving customer expectations and global challenges. The surge in demand for tailored solutions reflects a shift towards greater consumer-centric offerings, which is likely to define the trajectory of the UK Property Insurance Market in the coming years.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Coverage Type segment of the UK Property Insurance Market plays a crucial role, reflecting the diverse insurance needs of property owners. Within this segment, various types of coverage, including Actual Cash Value, Replacement Cost, Extended Replacement Cost, and Guaranteed Replacement Cost, cater to different levels of risk and financial protection. Actual Cash Value provides a more affordable option, often appealing to cost-conscious individuals, while Replacement Cost is significant for those seeking adequate protection for rebuilding expenses after a loss.Extended Replacement Cost is especially valuable as it safeguards against rising construction costs, ensuring homeowners are not left underinsured.

On the other hand, Guaranteed Replacement Cost stands out as a premium offering that covers the total costs of rebuilding without depreciation, resonating with property owners who prefer certainty in their coverage. As the UK’s housing market continues to evolve, influenced by economic trends and regulatory changes, the importance of these distinct coverage types becomes increasingly pronounced, driving demand for tailored insurance solutions.The segmentation in this market serves to enhance customer satisfaction and ensure diverse financial needs are adequately addressed.

Property Insurance Market End Use Insights

The UK Property Insurance Market reflects a diverse landscape shaped by different end use applications, playing a critical role in the overall economic environment. The residential sector remains pivotal, as it encompasses homeowners' insurance policies protecting against various risks, making it essential for personal financial security.

Following closely, the commercial property insurance segment caters to businesses that require coverage for offices, retail spaces, and industrial sites, safeguarding valuable assets from potential losses. Additionally, the industrial segment focuses on insuring warehouses, manufacturing plants, and other production facilities, which are vital to the UK economy.

The landscape is influenced by market trends such as increased property values and the rising awareness of asset protection. Growth drivers include urbanization, regulatory changes, and innovations in risk assessment and management technologies. However, challenges persist in the form of climate change and natural disasters, prompting insurers to adapt their offerings to meet evolving risks.

Opportunities abound as digital transformation enables insurers to streamline processes, enhance customer engagement, and offer tailored product offerings, ultimately driving the market's effectiveness in addressing the needs of various end users in the UK Property Insurance Market.

Property Insurance Market Distribution Channel Insights

The Distribution Channel segment within the UK Property Insurance Market plays a crucial role in shaping the dynamics of how insurance products reach consumers. It encompasses various methods, including Direct Sales, Brokerage, Online Platforms, and Banks, each contributing uniquely to the market landscape. Direct Sales have become increasingly popular due to the personalized service they offer, allowing insurers to maintain a direct line of communication with policyholders.

Brokerage and intermediary services continue to dominate by providing expertise and diverse options to customers, facilitating informed decision-making.Moreover, Online Platforms are reshaping the way consumers interact with insurance, providing convenience and quick access to multiple policy comparisons. This evolution in distribution is propelled by growing technological adoption and changing consumer preferences towards digitalization.

In the UK, Banks also play a significant role in distributing property insurance products, leveraging their existing customer bases and trust to cross-sell insurance alongside financial products. The advancement of digital technologies and the shift towards e-commerce are key trends shaping this segment, presenting both challenges and opportunities for stakeholders within the UK Property Insurance Market.

UK Property Insurance Market Key Players and Competitive Insights

The UK Property Insurance Market is characterized by a dynamic landscape where a variety of providers compete to capture consumer interest and meet diverse needs. A significant array of companies operates in this sector, each aiming to innovate and enhance its offerings amidst regulatory changes and shifts in consumer behavior.

The market is influenced by factors such as technological advancements, economic fluctuations, and emerging risks like climate change, which challenge insurers to adapt their models and coverages accordingly. Competitive insights reveal that understanding consumer preferences, leveraging digital solutions, and enhancing customer service are paramount for companies aiming to stand out in this crowded field.

Admiral Group has established a solid reputation within the UK Property Insurance Market by utilizing data analytics to offer competitive pricing and tailored products. This company has effectively harnessed its extensive experience in the insurance sector to provide various home insurance options, including buildings and contents insurance. Admiral Group's strengths lie in its innovative approach to underwriting and claims processing, which are designed to simplify the customer experience while maintaining efficiency.

Furthermore, its commitment to customer service is evidenced by consistently high customer satisfaction ratings, bolstered by user-friendly digital interfaces that facilitate quick access to information and services. By actively adjusting its offerings in response to market trends, Admiral Group continues to solidify its position as a leading player in the sector.

Ageas, on the other hand, has carved out a significant niche within the UK Property Insurance Market by focusing on customer-centric products and establishing collaborations through strategic partnerships. This company offers a range of home insurance products, including comprehensive coverage options tailored to varying consumer needs. Ageas is known for its strong market presence supported by a robust distribution network that encompasses brokers and direct channels. One of the strengths of Ageas is its ability to adapt quickly to evolving trends, driven by in-depth market research and consumer insights.

The company has engaged in strategic mergers and acquisitions that have bolstered its operational capabilities and market share, enhancing its competitive edge. By investing in advanced technology and enhancing its digital capabilities, Ageas successfully manages to offer a seamless customer experience while continually improving its service offerings within the UK property insurance landscape.

Key Companies in the UK Property Insurance Market Include:

- Admiral Group

- Ageas

- Direct Line Group

- AXA

- Nationwide Building Society

- LV=

- Wolverhampton & Dudley

- Aviva

- RSA Insurance Group

- Legal & General

- Allianz

- Zurich Insurance Group

- Hastings Direct

- Esure

UK Property Insurance Market Developments

Recent developments in the UK Property Insurance Market have been significant, particularly with growth trends among key players like Admiral Group, Direct Line Group, and Aviva. As of September 2023, the market has seen a rise in property insurance premiums due to increasing claims linked to climate-related damages.

Noteworthy, Admiral Group reported a year-on-year increase in policies, reinforcing its position in the competitive landscape. In terms of mergers and acquisitions, Ageas announced plans for acquisitions to enhance its market share in March 2023, while Legal and General completed its acquisition of the UK Specialist Property Insurance division in May 2023, which has diversified its portfolio.

The increasing awareness of environmental risks is shaping strategies across firms like AXA and Zurich Insurance Group, both adapting their offerings to meet changing consumer demands. Market analysts suggest that the valuation of these companies will continue to rise, driven by the ongoing transformation of products and services to address emerging risks and regulatory changes impacting insurers throughout the region. These trends are poised to affect consumer behavior and industry standards in the coming years.

UK Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the UK Property Insurance Market in 2024?

The UK Property Insurance Market is expected to be valued at 39.33 billion USD in 2024.

What will be the market size of the UK Property Insurance Market by 2035?

By 2035, the UK Property Insurance Market is projected to reach a value of 55.0 billion USD.

What is the expected compound annual growth rate (CAGR) for the UK Property Insurance Market from 2025 to 2035?

The UK Property Insurance Market is expected to achieve a CAGR of 3.096 % from 2025 to 2035.

Which insurance type has the largest market value in 2024?

Homeowners Insurance is projected to have the largest market value at 15.0 billion USD in 2024.

What are the projected market values for Renters Insurance by 2035?

Renters Insurance is expected to reach a market value of 11.0 billion USD by 2035.

Who are the key players in the UK Property Insurance Market?

Major players include Admiral Group, AXA, Aviva, and Direct Line Group among others.

What will the market value of Flood Insurance be in 2035?

Flood Insurance is anticipated to have a market value of 9.0 billion USD by 2035.

What challenges do the competitors in the UK Property Insurance Market face?

Competitors are challenged by changing consumer preferences and regulatory pressures.

What is the projected market size for Earthquake Insurance in 2024?

Earthquake Insurance is expected to reach a market size of 6.0 billion USD in 2024.

What opportunities exist for growth in the UK Property Insurance Market?

Opportunities for growth include developing digital insurance solutions and enhancing customer experience.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”