Japan Property Insurance Market

Japan Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

Japan Property Insurance Market Overview

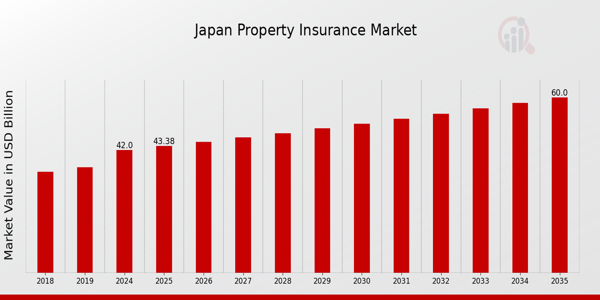

As per MRFR analysis, the Japan Property Insurance Market Size was estimated at 38.09 (USD Billion) in 2023.The Japan Property Insurance Market is expected to grow from 42(USD Billion) in 2024 to 60 (USD Billion) by 2035. The Japan Property Insurance Market CAGR (growth rate) is expected to be around 3.296% during the forecast period (2025 - 2035).

Key Japan Property Insurance Market Trends Highlighted

The Japan Property Insurance Market is witnessing notable trends driven by various factors. One key driver is the increased risk of natural disasters, such as earthquakes and typhoons, which are common in Japan. This has led to a surge in awareness among property owners regarding the necessity of insurance coverage to protect their assets. Additionally, urbanization and rising property values in major cities, coupled with a growing population, have created a heightened demand for comprehensive property insurance.

There are significant opportunities to be explored within this market, particularly in the expansion of tailored insurance products designed for specific sectors such as residential, commercial, and industrial properties.This customization can meet the specific needs of Japan's varied customers, such as the elderly who may want special coverage for their homes. Digitalization is another trend that can be used to your advantage; more and more insurance companies are using technology to speed up the process of issuing policies and improve customer service.

Recently, there has been a lot of talk about how insurance companies should take climate change into account when making their policies. This is in line with Japan's commitment to sustainability and disaster resilience. Insurance companies are now taking climate risks into account when deciding how much coverage to offer on a property. This has led to new ways to help reduce possible losses.

Overall, with Japan's focus on improving community resilience and adapting to evolving market demands, the property insurance sector is set to grow and adapt, ensuring that it remains relevant to the changing landscape.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Japan Property Insurance Market Drivers

Increasing Urbanization Driving Japan Property Insurance Market Growth

Japan has seen a significant urbanization trend, with over 91% of the population living in urban areas according to recent government statistics. This high urbanization rate contributes to a rising demand for property insurance as more individuals and businesses seek financial protection for their assets. Cities like Tokyo and Osaka are densely populated and have some of the highest property values in the world.

According to the Ministry of Internal Affairs and Communications, urban areas are projected to continue growing, leading to increased property acquisitions and, consequently, the necessity for robust property insurance coverage.Notable organizations such as the General Insurance Association of Japan have reported a steady increase in policy subscriptions correlating with urban development projects and infrastructure enhancements. As urbanization pushes property values upward, so does the imperative need for comprehensive property insurance, solidifying the growth trajectory of the Japan Property Insurance Market.

Natural Disaster Preparedness Fueling Demand for Property Insurance

Japan is prone to natural disasters, including earthquakes, tsunamis, and typhoons, necessitating a strong property insurance framework. The Japan Meteorological Agency has reported a consistent trend of increasing natural disasters over the past decade, with an annual average of over 1200 significant seismic events. This risk has raised awareness among property owners about the importance of securing insurance against such catastrophic events.

According to the Tokyo Insurance Institute, approximately 70% of homeowners have insurance tailored to cover earthquake damage, illustrating the growing public consciousness about property protection. This increasing demand for disaster-related insurance coverage is a fundamental driver for the Japan Property Insurance Market, incentivizing insurance providers to develop more comprehensive and accessible policy offerings.

Government Support and Regulatory Framework Enhancing Market Stability

The Japanese government has put in place various policies and initiatives to foster a stable property insurance market. The Financial Services Agency of Japan actively works to oversee and regulate insurance providers, ensuring consumer protection and promoting competitive practices. Furthermore, government-led disaster preparedness programs have incentivized property insurance uptake among citizens.

For instance, the government has implemented subsidies for property insurance premiums in regions prone to natural disasters.According to the Ministry of Economy, Trade and Industry, these measures led to an over 15% increase in policy subscriptions within affected areas. Consequently, the robust regulatory framework not only solidifies public trust in the insurance sector but also propels growth within the Japan Property Insurance Market.

Technological Advancements Increasing Accessibility to Insurance Products

The advent of technological advancements and digital transformation has revolutionized the way consumers access property insurance products in Japan. With a substantial portion of the population engaging in online transactions, insurance companies are increasingly adopting digital platforms for policy sales, claims processing, and customer service.

The Financial Services Agency of Japan reported a 30% increase in online insurance purchases in the last five years, emphasizing a shift in consumer behavior favoring convenience and ease of access.This trend has prompted companies like Tokio Marine and Sompo Japan to invest significantly in digital infrastructure and mobile applications to enhance customer experience. As technology continues to bridge gaps in service delivery, the Japan Property Insurance Market is expected to witness accelerated growth driven by increased consumer engagement and satisfaction.

Japan Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

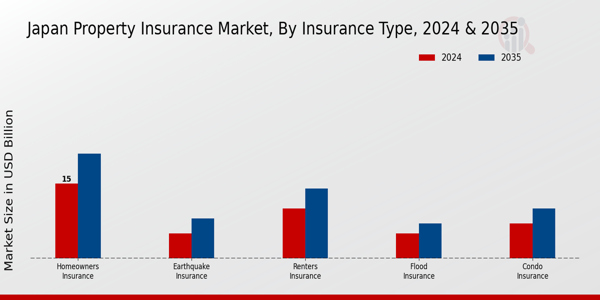

The Japan Property Insurance Market has witnessed significant growth driven by the need for protection against various risks associated with property ownership and rental. Within this market, the Insurance Type segment encompasses several categories that serve distinct consumer needs. Homeowners' Insurance plays a crucial role, encompassing coverage for damages incurred to homes due to unforeseen events such as natural disasters, thefts, and accidents, thus providing homeowners with peace of mind in a region prone to earthquakes.

Additionally, Renters Insurance is increasingly recognized in Japan, offering essential protection for tenants against personal property loss and liability claims, catering to the rising trend of urban living and rental agreements among younger generations. Condo Insurance is another vital segment, particularly within Japan's densely populated urban areas, where condominiums are prevalent. This type of insurance safeguards individual unit owners against damages to their property and ensures that they are covered for personal liabilities.

Flood Insurance holds specific importance given Japan's vulnerability to typhoons and heavy rains, which can lead to significant property damage. This insurance type is vital for homeowners and renters located in flood-prone areas, providing necessary financial support for recovery after such events. Lastly, Earthquake Insurance is particularly significant in Japan, known for its seismic activity, as it offers critical protection against the unique risks posed by earthquakes, thereby contributing to the resilience of communities.

The growing awareness of natural disaster preparedness and the importance of insurance in mitigating risks is fueling the demand across these various Insurance Types, indicating strong market potential. Ultimately, as trends continue to evolve in Japan's property landscape, these insurance categories are expected to remain fundamental to safeguarding property assets and supporting individuals in managing their risk exposure.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The Coverage Type segment within the Japan Property Insurance Market has significant implications for both policyholders and insurers. This segmentation typically includes Actual Cash Value, Replacement Cost, Extended Replacement Cost, and Guaranteed Replacement Cost. In Japan, where natural disasters such as earthquakes and typhoons are common, Replacement Cost coverage is often preferred due to its provision for the full cost of rebuilding or repairing properties without depreciation.

Actual Cash Value coverage may appeal to those looking for lower premiums, but it can lead to insufficient funds in the event of a loss, which may present a challenge for homeowners.Extended Replacement Cost offers added security, allowing for a buffer above policy limits, making it an attractive option for residents in high-risk areas. Guaranteed Replacement Cost is valuable for ensuring that policyholders can fully restore their properties to their original state, further emphasizing the importance of comprehensive coverage amidst Japan’s unique risk landscape. As the market evolves, these coverage types are becoming increasingly vital in addressing the diverse needs of property owners, reflecting the ongoing growth and changing dynamics of the Japan Property Insurance Market.

Property Insurance Market End Use Insights

The Japan Property Insurance Market is diversified across various end-use categories, primarily Residential, Commercial, and Industrial sectors. Each of these segments plays a crucial role in the overall insurance landscape. The Residential segment, given Japan's high urban population density and the growing trend towards home ownership, accounts for a significant portion of insurance uptake, addressing the need for protection against natural disasters and property loss.

The Commercial segment, on the other hand, is vital for businesses ranging from small-scale enterprises to large corporations, offering coverage that protects assets and facilitates growth in a competitive market.Industrial property insurance is also essential, given Japan's prominent manufacturing sector and dense industrial zones, where the risks associated with equipment damage and liability claims are high.

As the economy evolves, each of these segments is expected to adapt to emerging trends and challenges, such as climate change impacts, digital transformation, and regulatory changes, ultimately contributing to the overall market's growth trajectory. The Japan Property Insurance Market segmentation showcases a well-rounded approach to risk management, catering to a diverse clientele while addressing the unique needs and opportunities presented by each sector within the region.

Property Insurance Market Distribution Channel Insights

The Japan Property Insurance Market is influenced significantly by its Distribution Channel segment, which plays a crucial role in bringing insurance solutions to customers. Direct Sales serve as a traditional method, enabling insurers to establish direct relationships with clients, offering tailored coverage to meet specific needs. Brokerage represents another vital pathway, where brokers leverage their expertise to navigate complex policy options for clients, facilitating access to appropriate insurance products.

Online Platforms have transformed the market landscape by offering convenience and comparative tools, particularly appealing to tech-savvy consumers seeking efficiency and transparency.Banks also hold a significant position as distributors, given their established customer relationships and trust. Each channel has seen an ongoing evolution, responding to market trends and consumer preferences, ultimately driving the growth of the Japan Property Insurance Market. This diversification across Distribution Channels not only enhances accessibility but also fosters competition among providers, contributing to a more robust market environment. The increase in awareness and understanding of property insurance products among Japanese consumers further fuels this growth, indicating an optimistic outlook for future developments in this segment.

Japan Property Insurance Market Key Players and Competitive Insights

The Japan Property Insurance Market exhibits a dynamic and competitive landscape characterized by a mix of established players and emerging companies. This sector is driven by various factors, including economic conditions, regulatory frameworks, and evolving consumer preferences. Insurers are continually adapting to changes in technology, particularly with the rise of insurtech, which is making property insurance more accessible and streamlined for consumers. The focus on product innovation, enhanced customer service, and digital transformation is are key strategy applied by companies to maintain market share and attract new customers.

Furthermore, the growing awareness about the importance of property coverage in the aftermath of natural disasters has also heightened competition as companies strive to provide comprehensive policies that cater to diverse needs.SBI Insurance, a notable player in the Japan Property Insurance Market, leverages its strong online presence and advanced digital tools to enhance customer engagement and streamline operations. The company has established a robust market presence by emphasizing its competitive pricing and flexible policy offerings, which resonate well with consumers seeking tailored insurance solutions.

SBI Insurance's strengths lie in its ability to utilize data analytics for risk assessment and policy underwriting, as well as its focus on customer satisfaction. The integration of innovative technology into its services has allowed SBI Insurance to attract a younger demographic while retaining its existing customer base through effective communication and responsive claims processing.Asahi Fire & Marine Insurance stands out in the Japan Property Insurance Market with a strong emphasis on both commercial and residential insurance products. The company has built a reputable market presence through its comprehensive range of services that includes coverage for property damage, liability, and natural disasters.

Asahi Fire & Marine Insurance boasts notable strengths in risk assessment and premium pricing, which ensures competitive offerings that meet various consumer needs. The insurer has also engaged in strategic partnerships and mergers to expand its market reach and enhance service offerings. These strategic moves have bolstered Asahi Fire & Marine Insurance's positioning in the market, allowing it to leverage synergies and strengthen its overall portfolio. Innovation in technology and a commitment to robust customer service further contribute to the company's competitive advantage in the Japan Property Insurance Market.

Key Companies in the Japan Property Insurance Market Include:

- SBI Insurance

- Asahi Fire & Marine Insurance

- Nipponkoa Insurance

- Hiscox Ltd

- Mitsui Sumitomo Insurance

- FWD Group

- Tokio Marine Holdings

- Aioi Nissay Dowa Insurance

- Chubb Limited

- Sompo Japan Insurance

- T&D Holdings

- Liberty Mutual Insurance

- QBE Insurance Group

- Zurich Insurance Group

- AIG Japan Holdings

Japan Property Insurance Market Developments

Recent developments in the Japan Property Insurance Market have seen significant activity and fluctuating valuations among key players. In October 2023, Mitsui Sumitomo Insurance was involved in enhancing its digital capabilities to better serve the evolving market demands driven by climate change and disaster resilience. Meanwhile, Tokio Marine Holdings announced a strategic partnership with FWD Group to improve coverage options for natural disaster insurance, reflecting a growing trend in collaboration among insurers to address regional challenges.

Additionally, in August 2023, Aioi Nissay Dowa Insurance announced its acquisition of a fintech company to bolster its technology offerings, aligning with the industry's shift towards digitalization. Over the past few years, the property insurance segment has experienced an increase in market valuation, with companies like Sompo Japan Insurance reporting robust financial results and expanded service offerings.

The emphasis on sustainable practices and innovative insurance solutions is reshaping market dynamics, while ongoing regulatory updates by the Financial Services Agency of Japan aim to enhance consumer protection and market efficiency. Notable developments from 2022 also highlight the increased investment in risk assessment technologies by Zurich Insurance Group and Hiscox Ltd to better manage potential natural disaster claims.

Japan Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the Japan Property Insurance Market by 2024?

The Japan Property Insurance Market is expected to be valued at 42.0 USD Billion by 2024.

What will be the expected market value of the Japan Property Insurance Market in 2035?

In 2035, the Japan Property Insurance Market is projected to have a value of 60.0 USD Billion.

What is the expected compound annual growth rate (CAGR) for the Japan Property Insurance Market from 2025 to 2035?

The Japan Property Insurance Market is expected to grow at a CAGR of 3.296 % from 2025 to 2035.

Who are the major players in the Japan Property Insurance Market?

Key players include SBI Insurance, Tokio Marine Holdings, and Sompo Japan Insurance among others.

What is the market value of homeowners insurance in Japan by 2024?

Homeowners insurance is expected to reach a market value of 15.0 USD Billion in 2024.

What will be the market value of renters insurance in Japan by 2035?

By 2035, renters insurance is anticipated to be valued at 14.0 USD Billion.

How much is the flood insurance market expected to be worth by 2035?

Flood insurance is projected to reach a market value of 7.0 USD Billion by 2035.

What value will earthquake insurance hold in the market by 2024?

Earthquake insurance is expected to be valued at 5.0 USD Billion in 2024.

What challenges might affect the Japan Property Insurance Market's growth?

The market may face challenges such as increasing natural disaster occurrences and regulatory requirements.

What emerging trends are likely to influence the Japan Property Insurance Market in the coming years?

Emerging trends include digitalization of services and a growing focus on sustainability in insurance practices.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”