South Korea Property Insurance Market

South Korea Property Insurance Market Size, Share and Research Report By Insurance Type (Homeowners Insurance, Renters Insurance, Condo Insurance, Flood Insurance, Earthquake Insurance), By Coverage Type (Actual Cash Value, Replacement Cost, Extended Replacement Cost, Guaranteed Replacement Cost), By End Use (Residential, Commercial, Industrial) and By Distribution Channel (Direct Sales, Brokerage, Online Platforms, Banks)- Industry Forecast Till 2035

South Korea Property Insurance Market Overview

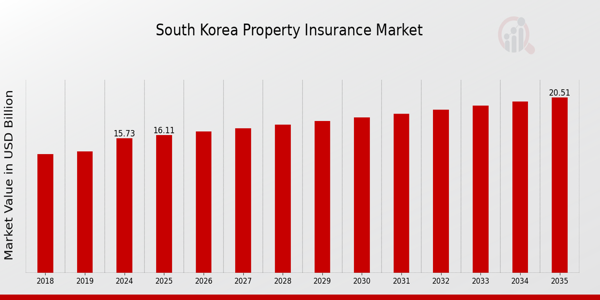

As per MRFR analysis, the South Korea Property Insurance Market Size was estimated at 15.23 (USD Billion) in 2023.The South Korea Property Insurance Market is expected to grow from 15.73(USD Billion) in 2024 to 20.51 (USD Billion) by 2035. The South Korea Property Insurance Market CAGR (growth rate) is expected to be around 2.442% during the forecast period (2025 - 2035).

Key South Korea Property Insurance Market Trends Highlighted

The South Korea Property Insurance Market is experiencing notable trends driven by evolving consumer behavior and regulatory changes. One key driver is the rising awareness of natural disasters, such as typhoons and floods, which are common in South Korea due to its geographic location. This awareness has pushed both individuals and businesses to prioritize property insurance as a means of financial protection, leading to increased demand for comprehensive coverage options.

Additionally, the government’s initiatives to promote disaster-response measures and infrastructure improvements are enhancing consumer confidence in insurance products. Opportunities in the South Korean market include the integration of technology in insurance services.More and more, insurance companies are using digital platforms to make the customer experience better, speed up the claims process, and offer policies that are tailored to each person. This trend toward going digital is especially appealing to younger, tech-savvy customers who like to do things online.

Also, as smart home technology becomes more popular, insurers have a chance to come up with new ways to protect people from cyber threats and damage to their property caused by smart devices. Sustainability has become a big trend in South Korea's property insurance market in the last few years. People are becoming more aware of how important it is to be eco-friendly, and they prefer insurance companies that support green initiatives.

Insurers are responding by developing policies that encourage energy-efficient homes and provide incentives for sustainable practices. As climate change becomes a pressing issue, insurers are likely to create products that address environmental risks more robustly. In summary, awareness of natural disasters, technological advancement, and sustainability initiatives is shaping the future of the property insurance landscape in South Korea.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

South Korea Property Insurance Market Drivers

Increasing Urbanization and Infrastructure Development

South Korea is witnessing rapid urbanization, with more than 81% of its population living in urban areas as of 2021. According to the Ministry of Land, Infrastructure and Transport, large-scale infrastructure projects are underway, including new residential complexes, commercial buildings, and roads.

This increase in urban population leads to a higher demand for property insurance as homeowners and businesses seek to protect their investments against potential risks such as theft, fire, and natural disasters.The South Korea Property Insurance Market will benefit from this trend, as individuals and organizations require insurance policies to secure their properties. With prominent firms like Samsung Fire and Marine Insurance actively expanding their policy offerings, the growth potential in this sector is significant.

Growth in Natural Disasters Awareness

The frequency and intensity of natural disasters in South Korea have raised awareness about the importance of property insurance in recent years. The Korea Meteorological Administration reported that the number of heavy rainfall days has increased by 15% over the last decade, highlighting the need for property owners to safeguard their assets through insurance coverage.

Furthermore, establishments like the Korea Insurance Development Institute are advocating for increased insurance penetration among homeowners, estimated to be around 20% currently, which provides ample growth opportunities for the South Korea Property Insurance Market.This increased awareness and need for protection against natural calamities are expected to drive growth in the insurance sector.

Government Initiatives Promoting Property Insurance

The South Korean government has been implementing favorable policies to encourage property insurance among citizens and businesses. In 2020, the government introduced a subsidy program aimed at increasing the uptake of property insurance, particularly for low-income families.

According to the Ministry of the Interior and Safety, participation in government-endorsed insurance policies has seen a rise of approximately 12% since the introduction of these programs.Such initiatives not only enhance awareness about property insurance but also create a conducive environment for the South Korea Property Insurance Market to thrive, positively influencing market penetration and expanding the demographic of insured properties.

South Korea Property Insurance Market Segment Insights

Property Insurance Market Insurance Type Insights

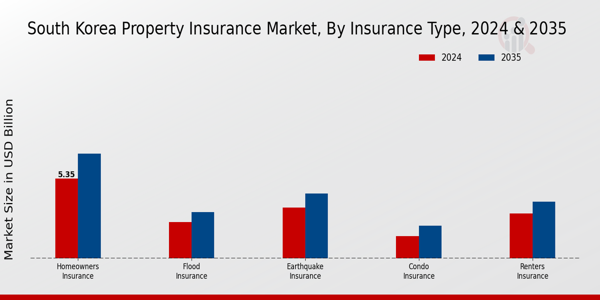

The South Korea Property Insurance Market focuses significantly on various insurance types, responding to the unique needs of homeowners, renters, condo owners, and those concerned about natural disasters. Homeowners' Insurance plays a vital role in providing protection against damage to property and personal belongings, considering the country's mix of urban and suburban living conditions. With increasing urbanization in cities like Seoul and Busan, this segment has seen a growing demand for comprehensive coverage options that include not just structural damage but also liability and personal property coverage.

Renters Insurance has gained traction as awareness of the necessity for personal property protection continues to rise, particularly among younger demographics and transient residents who often lease rather than own. This segment offers essential coverage for belongings and personal liability, fostering a sense of security in rental arrangements.Condo Insurance is particularly significant due to the increasing popularity of condominium living in metropolitan areas, which often have specific coverage needs distinct from standalone homes. Buyers are increasingly aware of the importance of safeguarding their individual units and ensuring that they have adequate coverage for shared spaces and liabilities.

Additionally, Flood Insurance has become a crucial element in the South Korea Property Insurance Market, given the country's vulnerability to climate-related challenges like heavy monsoon rains leading to floods. The government has been actively engaging in initiatives to improve disaster preparedness and raise awareness about the importance of flood coverage. With rising sea levels and unpredictable weather patterns, this segment becomes ever more relevant for property owners in low-lying or flood-prone areas.Earthquake Insurance also commands attention as South Korea experiences seismic activity, prompting a need for policies that address potential damage from tremors and quakes. As the nation recognizes its geographic predisposition to natural disasters, this insurance type is becoming an integral part of property protection strategies.

The insurance landscape in South Korea reflects a growing understanding of multifaceted risks associated with property ownership and the necessity for tailored coverage options. Overall, the segmentation of the South Korea Property Insurance Market around various insurance types illustrates the dynamic nature of property coverage, driven by societal trends, environmental challenges, and evolving consumer awareness. With diverse segments holding significant market share, this approach allows for comprehensive protection for the various forms of property ownership found within the country, catering to diverse consumer needs.

Source: Primary Research, Secondary Research, MRFR Database, and Analyst Review

Property Insurance Market Coverage Type Insights

The South Korea Property Insurance Market demonstrates a diverse range of Coverage Type options, crucial for addressing the unique needs of property owners in the region. Within this landscape, Actual Cash Value, Replacement Cost, Extended Replacement Cost, and Guaranteed Replacement Cost serve as fundamental choices that offer varying levels of financial protection. Actual Cash Value typically appeals to budget-conscious customers, as it allows savings on premiums while acknowledging depreciation in claims.

In contrast, Replacement Cost is favored for its comprehensive approach, fulfilling the need for full replacement of damaged property without considering depreciation.Extended Replacement Cost further enhances this by offering additional coverage that surpasses standard replacement, accommodating rising building costs. Guaranteed Replacement Cost provides the highest level of assurance, ensuring total property replacement irrespective of current market values.

This segment's dynamics reflect a growing awareness of risks such as increasing natural disasters in South Korea and rising property values, driving demand for more comprehensive coverage options, especially among homeowners and businesses invested in safeguarding their assets.The South Korea Property Insurance Market statistics reveal an evolving landscape, where shifting consumer preferences towards more secure insurance solutions are shaping market trends and driving growth opportunities.

Property Insurance Market End Use Insights

The South Korea Property Insurance Market showcases a diverse segmentation focused on End Use, which plays a crucial role in addressing the varying needs of property owners across multiple sectors. Within this segmentation, the Residential sector holds significant importance, as it encompasses the vast majority of housing units in South Korea, prompting a steady demand for insurance products to protect assets from potential risks such as fires and natural disasters.

The Commercial segment reflects the growing economic activity in urban areas, where businesses seek adequate property insurance to safeguard their assets against unforeseen events that could disrupt operations and lead to financial losses.

Meanwhile, the Industrial segment demonstrates increasing significance given South Korea's strong industrial base, where manufacturers and production facilities require comprehensive coverage to ensure continuity of operations in the face of potential hazards. Trends such as urbanization and climate change are driving the development of robust insurance products tailored for these sectors, creating both opportunities and challenges in the market landscape. Overall, the segmentation by End Use not only highlights the unique requirements of property insurance in South Korea but also underscores the interconnectedness of residential, commercial, and industrial interests in fostering economic growth and stability.

Property Insurance Market Distribution Channel Insights

The Distribution Channel in the South Korea Property Insurance Market comprises various methods through which insurance products reach consumers, playing a crucial role in market dynamics. Direct Sales typically dominate this space, allowing companies to maintain control over customer interactions and retention strategies. Brokerage channels serve as essential intermediaries, offering personalized services and professional advice, which can be especially beneficial for complex property insurance products.

Online Platforms are rapidly gaining traction, reflecting a growing digital trend in South Korea where consumers prefer the convenience of comparing policies and purchasing insurance online without face-to-face interactions.Banks also represent a significant channel, leveraging their existing relationships with customers to provide property insurance products as part of broader financial services.

The increasing reliance on digital transformation and technological advancements in the financial sector creates substantial opportunities for innovation within these distribution channels. In this evolving landscape, understanding these channels is vital for companies to optimize their strategies and meet evolving customer expectations in the South Korean property insurance sector.

South Korea Property Insurance Market Key Players and Competitive Insights

The South Korea Property Insurance Market is characterized by a competitive landscape that is constantly evolving due to changing consumer preferences, regulatory environments, and economic conditions. Insurers in this sector are actively looking for ways to differentiate their offerings by leveraging technology, enhancing customer service, and expanding their product portfolios. The market is populated by both local and international players, which fosters a dynamic, competitive environment. Companies are increasingly adopting digital transformation strategies to improve operational efficiency and customer engagement.

With an increasing focus on risk management and financial security, the property insurance segment is witnessing innovations that cater to the unique needs of the South Korean populace. This intensifying competition stimulates product variety while also pushing companies towards offering more competitive pricing structures.

Mirae Asset Daewoo has established a commendable presence in the South Korea Property Insurance Market, attributing its strengths to a client-centric approach and extensive market knowledge. The firm excels in providing tailored property insurance products that address specific customer needs, demonstrating an ability to adapt to market changes effectively. Their strong focus on combining traditional insurance solutions with modern technological advancements empowers them to enhance customer experiences and streamline claims processing.

Furthermore, the company's diverse portfolio includes offerings that cater to both individual and commercial property needs, showcasing its robust investment in understanding and managing risk effectively. Mirae Asset Daewoo's commitment to innovation and customer satisfaction places it in an advantageous position in the competitive landscape of South Korea's property insurance sector.

NongHyup Property & Casualty Insurance stands out in the South Korea Property Insurance Market with a strong emphasis on agricultural and rural insurance products, reflecting its heritage and connection to the farming community. The company offers a variety of key services, including residential and commercial property insurance, as well as specialized agricultural coverage that sets it apart from its competitors.

With the support of a solid financial foundation, NongHyup has also engaged in strategic mergers and acquisitions to enhance its market presence and product offerings. This company not only helps in providing comprehensive insurance options tailored to the unique challenges faced by property owners, but also boasts a strong network that allows it to reach a broad customer base. Its commitment to community engagement and risk management signifies its strengths in creating a resilient insurance framework, making it a formidable player in the South Korean property insurance landscape.

Key Companies in the South Korea Property Insurance Market Include:

- Mirae Asset Daewoo

- NongHyup Property & Casualty Insurance

- Samsung Fire & Marine Insurance

- AIG Korea

- KB Insurance

- Fubon Insurance

- Hyundai Marine & Fire Insurance

- Lotte Insurance

- MG NonLife Insurance

- Daehan Fire & Marine Insurance

- Dongbu Insurance

- Woori Insurance

- Chubb Ltd.

- Hanwha General Insurance

- Meritz Fire & Marine Insurance

South Korea Property Insurance Market Developments

The South Korea Property Insurance Market continues to see significant changes and developments. In October 2023, Mirae Asset Daewoo enhanced its insurance offerings by introducing new compensation policies tailored to local businesses.

Meanwhile, Samsung Fire and Marine Insurance recently expanded its digital solutions, allowing for a smoother claims process for policyholders, reflecting the growing trend towards digital transformation in the sector. In an important merger, Hyundai Marine and Fire Insurance completed its acquisition of Dongbu Insurance in September 2023, which is expected to consolidate itsmarket position and expand customer reach.

Notably, KB Insurance and Fubon Insurance have both reported growth in market valuations due to increased awareness of property coverage among South Korean consumers. The heightened frequency of natural disasters was a major driver for this change, prompting individuals and businesses to seek comprehensive insurance solutions. Over the last two years, the industry has also seen a shift towards product innovation and customer-centric approaches, responding to the evolving needs of the population in an increasingly unpredictable climate.

South Korea Property Insurance Market Segmentation Insights

Property Insurance Market Insurance Type Outlook

- Homeowners Insurance

- Renters Insurance

- Condo Insurance

- Flood Insurance

- Earthquake Insurance

Property Insurance Market Coverage Type Outlook

- Actual Cash Value

- Replacement Cost

- Extended Replacement Cost

- Guaranteed Replacement Cost

Property Insurance Market End Use Outlook

- Residential

- Commercial

- Industrial

Property Insurance Market Distribution Channel Outlook

- Direct Sales

- Brokerage

- Online Platforms

- Banks

FAQs

What is the expected market size of the South Korea Property Insurance Market in 2024?

The South Korea Property Insurance Market is expected to be valued at 15.73 USD Billion in 2024.

What will be the projected market size of the South Korea Property Insurance Market by 2035?

By 2035, the South Korea Property Insurance Market is projected to reach a value of 20.51 USD Billion.

What is the expected compound annual growth rate (CAGR) for the South Korea Property Insurance Market from 2025 to 2035?

The expected CAGR for the South Korea Property Insurance Market from 2025 to 2035 is 2.442%.

Which insurance type has the largest market share in the South Korea Property Insurance Market in 2024?

Homeowners Insurance has the largest market share, valued at 5.35 USD Billion in 2024.

How much is the Renters Insurance segment expected to be valued at in 2035?

The Renters Insurance segment is expected to be valued at 3.8 USD Billion by 2035.

Who are the key players in the South Korea Property Insurance Market?

Major players in the market include Mirae Asset Daewoo, Samsung Fire & Marine Insurance, AIG Korea, and KB Insurance among others.

What is the projected market size for Earthquake Insurance in 2024?

The Earthquake Insurance segment is projected to be valued at 3.41 USD Billion in 2024.

What significant trends are expected to shape the South Korea Property Insurance Market from 2025 to 2035?

Emerging trends include increased digitalization and a growing focus on climate-related risks and coverage options.

How much is the Flood Insurance sector expected to grow by 2035?

The Flood Insurance sector is projected to grow to 3.1 USD Billion by 2035.

What challenges does the South Korea Property Insurance Market face currently?

The market faces challenges such as regulatory changes and increasing competition among key players.

Kindly complete the form below to receive a free sample of this Report

Customer Stories

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”