Growing Emphasis on Data Analytics

The growing emphasis on data analytics is reshaping the Healthcare IT Integration Market. As healthcare organizations increasingly rely on data-driven decision-making, the need for integrated systems that can aggregate and analyze vast amounts of data becomes apparent. Integrated IT solutions enable healthcare providers to harness data from various sources, leading to improved patient outcomes and operational efficiencies. The market for healthcare analytics is expected to expand significantly, with projections indicating a growth rate of approximately 14% over the next few years. This trend underscores the importance of integration in facilitating effective data analytics and enhancing the overall quality of care.

Regulatory Compliance and Standards

Regulatory compliance remains a critical driver in the Healthcare IT Integration Market. Governments and regulatory bodies are implementing stringent standards to ensure data security and interoperability among healthcare systems. Compliance with regulations such as HIPAA and GDPR necessitates robust IT integration solutions that can safeguard patient data while facilitating information exchange. The increasing complexity of these regulations compels healthcare organizations to invest in integrated IT systems that can adapt to evolving compliance requirements. As a result, the market is likely to witness sustained growth as organizations prioritize compliance-driven integration solutions.

Rising Demand for Patient-Centric Care

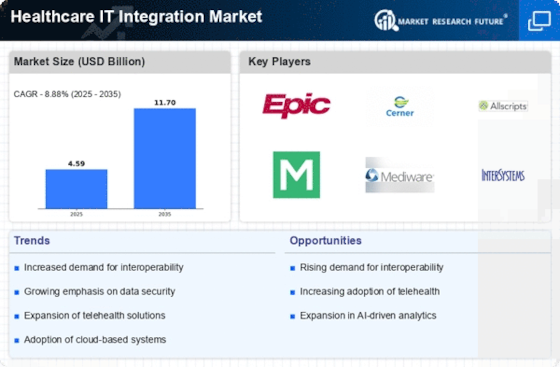

The Healthcare IT Integration Market is experiencing a notable shift towards patient-centric care models. This trend emphasizes the importance of integrating various healthcare systems to provide seamless access to patient information. As healthcare providers increasingly recognize the value of personalized treatment plans, the demand for integrated IT solutions rises. According to recent estimates, the market for healthcare IT integration is projected to grow at a compound annual growth rate of approximately 15% over the next five years. This growth is driven by the need for improved patient outcomes and enhanced operational efficiency, which necessitates the integration of disparate healthcare systems.

Technological Advancements in Healthcare

Technological advancements are significantly influencing the Healthcare IT Integration Market. Innovations such as telemedicine, electronic health records, and mobile health applications are driving the need for integrated IT solutions that can support these technologies. The integration of advanced analytics and machine learning into healthcare systems enhances decision-making processes and improves patient care. As healthcare organizations adopt these technologies, the demand for seamless integration solutions is expected to rise. Market analysts project that the integration of emerging technologies could contribute to a market growth rate of around 12% annually, reflecting the increasing reliance on integrated IT systems.

Cost Efficiency and Operational Optimization

Cost efficiency is a paramount concern for healthcare organizations, making it a significant driver in the Healthcare IT Integration Market. Integrated IT solutions streamline operations, reduce redundancies, and minimize administrative costs. By consolidating various systems into a unified platform, healthcare providers can achieve substantial savings while improving service delivery. Studies indicate that organizations that implement integrated IT solutions can reduce operational costs by up to 20%. This financial incentive encourages healthcare providers to invest in integration technologies, thereby propelling market growth as they seek to optimize their operations and enhance overall efficiency.