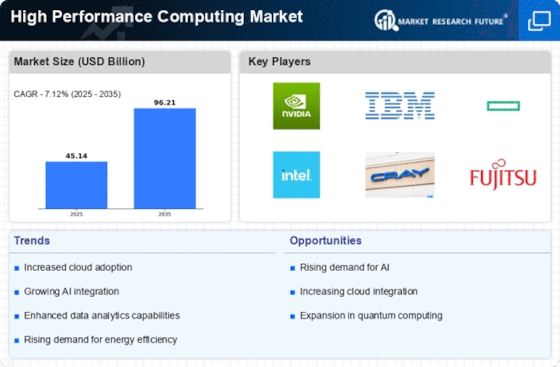

The High Performance Computing Market is currently experiencing a transformative phase, driven by advancements in technology and increasing demand for computational power across various sectors. The green technology market is gaining momentum as industries increasingly adopt eco-friendly and energy-efficient solutions to reduce environmental impact. The green technology and sustainability market is expanding rapidly as governments and enterprises align technology adoption with long-term environmental goals. The sustainability market is witnessing steady growth driven by rising regulatory pressure and increasing consumer preference for environmentally responsible solutions. This sustainability market research provides in-depth insights into market size, technology trends, and competitive dynamics through 2035. This green market report offers comprehensive analysis of technology adoption, application trends, and regional performance in the sustainability sector.

The growing adoption of eco friendly tech is accelerating innovation across renewable energy, waste management, and sustainable infrastructure. Demand for eco technology products is rising as businesses seek cost-efficient and environmentally responsible alternatives to conventional systems. Environmentally friendly technology products are increasingly deployed across energy, water management, and smart infrastructure projects. Green technology products such as solar panels, smart grids, and energy storage systems are driving sustainable transformation across industries. Green tech products are gaining strong adoption as organizations prioritize energy efficiency and carbon reduction strategies.

Moreover, the High Performance Computing Market is characterized by a growing emphasis on sustainability and energy efficiency. Companies are exploring innovative solutions that not only enhance performance but also reduce environmental impact. This trend indicates a shift towards greener technologies, as stakeholders seek to balance performance with ecological responsibility. Sustainable technology products are increasingly integrated into buildings, utilities, and agricultural systems to improve long-term resource efficiency. The green industry is expanding rapidly as renewable energy, sustainable construction, and environmental monitoring gain commercial importance. The sustainability industry continues to evolve as digital technologies enhance environmental monitoring and resource optimization. Green products and technologies are playing a central role in enabling cleaner production processes and sustainable infrastructure development. The green product market is benefiting from rising awareness of environmental protection and increasing regulatory compliance requirements.

The integration of cloud computing and edge computing into high performance systems further suggests a potential for increased accessibility and flexibility, allowing organizations of varying sizes to leverage powerful computing resources. Overall, the landscape of the High Performance Computing Market is evolving rapidly, with numerous opportunities for growth and development on the horizon. Green technology consulting services are gaining traction as organizations seek expert guidance on sustainability strategy and digital transformation. Rising green technology investments are accelerating innovation across renewable energy, hydrogen, and carbon capture technologies. The convergence of HPC and cloud computing is transforming deployment strategies, enabling enterprises to access scalable high performance cloud computing environments without heavy capital investments.

Increased Adoption of Cloud-Based Solutions

The High Performance Computing Market is witnessing a notable shift towards cloud-based solutions. Organizations are increasingly leveraging cloud infrastructure to access powerful computing resources without the need for substantial upfront investments. This trend allows for greater scalability and flexibility, enabling businesses to adapt to changing demands and workloads more efficiently.

Leading HPC cloud providers are enhancing cloud computing performance by offering optimized architectures specifically designed for compute-intensive workloads. Sustainability in the IT industry is driving adoption of energy-efficient data centers, cloud optimization, and digital twins. Sustainability tech is emerging as a critical enabler of smart energy systems, environmental monitoring, and carbon management. Sustainability technology plays a vital role in optimizing energy usage, reducing emissions, and improving environmental performance.

Focus on Energy Efficiency and Sustainability

There is a growing emphasis on energy efficiency within the High Performance Computing Market. Companies are actively seeking solutions that not only enhance computational power but also minimize energy consumption. This focus on sustainability reflects a broader commitment to reducing the environmental impact of high performance computing operations.

Future green technologies such as hydrogen energy, carbon capture, and advanced storage systems are expected to shape the next phase of market growth. The carbon accounting software market is expanding as enterprises adopt digital tools to measure, report, and reduce emissions. Clean technology marketing strategies are helping companies promote sustainable solutions and improve market awareness. The high performance computing market is witnessing rapid transformation as organizations increasingly adopt high-performance computing systems and high performance computers to accelerate scientific research, financial modeling, and artificial intelligence applications.

Integration of Artificial Intelligence and Machine Learning

The integration of artificial intelligence and machine learning technologies into high performance computing systems is becoming increasingly prevalent. This trend suggests that organizations are recognizing the potential of these technologies to enhance data analysis, improve decision-making processes, and drive innovation across various sectors.

Enterprises are increasingly investing in high performance computing infrastructure and advanced high performance computing solutions to achieve greater scalability and faster processing capabilities. The adoption of high-performance compute optimization techniques is enhancing system efficiency and enabling organizations to maximize workload performance.