Rising Demand in Automotive Sector

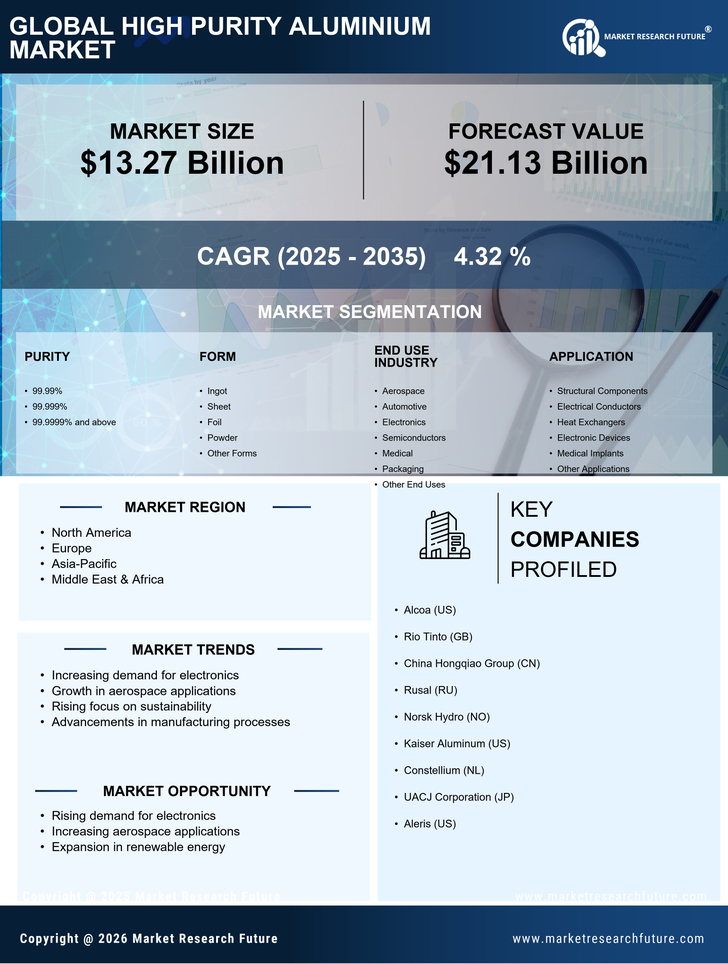

The automotive sector is increasingly recognizing the benefits of high purity aluminium, which is driving growth in the High Purity Aluminium Market. With the automotive industry focusing on lightweight materials to enhance fuel efficiency and reduce emissions, high purity aluminium is becoming a preferred choice for various components. The market for high purity aluminium in automotive applications is expected to grow by approximately 6% annually, reflecting the industry's shift towards sustainable practices. As electric vehicles gain popularity, the demand for high purity aluminium is likely to rise, given its role in battery production and lightweight structures. This trend indicates a robust future for the High Purity Aluminium Market as it aligns with the evolving automotive landscape.

Increasing Applications in Aerospace

The High Purity Aluminium Market is experiencing a notable surge in demand due to its increasing applications in the aerospace sector. High purity aluminium is favored for its lightweight properties and excellent corrosion resistance, making it ideal for aircraft components. The aerospace industry is projected to grow at a compound annual growth rate of approximately 4.5% over the next few years, which could further drive the demand for high purity aluminium. As manufacturers seek to enhance fuel efficiency and reduce emissions, the adoption of high purity aluminium in aircraft design is likely to expand. This trend indicates a robust future for the High Purity Aluminium Market, as aerospace companies increasingly prioritize materials that contribute to performance and sustainability.

Expansion of Electronics Manufacturing

The expansion of electronics manufacturing is significantly influencing the High Purity Aluminium Market. High purity aluminium is essential in the production of electronic components, including semiconductors and circuit boards, due to its excellent conductivity and thermal properties. The electronics sector is projected to grow at a rate of around 7% annually, driven by advancements in technology and increasing consumer demand for electronic devices. This growth is likely to create a substantial demand for high purity aluminium, as manufacturers seek materials that enhance performance and reliability. Consequently, the High Purity Aluminium Market is expected to thrive as it caters to the needs of the rapidly evolving electronics landscape.

Growth in Renewable Energy Technologies

The High Purity Aluminium Market is poised for growth as renewable energy technologies gain traction. High purity aluminium is essential in the production of solar panels and wind turbines, where its lightweight and conductive properties enhance efficiency. The renewable energy sector is expected to witness substantial investments, with projections indicating a market size increase of over 10% annually. This growth is likely to create a ripple effect, boosting the demand for high purity aluminium as manufacturers strive to meet the needs of the expanding renewable energy market. Consequently, the High Purity Aluminium Market may benefit significantly from this trend, as the shift towards sustainable energy solutions continues to evolve.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are transforming the High Purity Aluminium Market. Innovations such as improved refining techniques and enhanced purification methods are enabling producers to achieve higher purity levels, which are crucial for various applications, including electronics and aerospace. The market for high purity aluminium is projected to grow at a rate of around 5% annually, driven by these technological improvements. As manufacturers adopt cutting-edge technologies, the efficiency and cost-effectiveness of high purity aluminium production are likely to improve, making it more accessible to a broader range of industries. This evolution suggests a promising outlook for the High Purity Aluminium Market, as it adapts to meet the demands of modern applications.