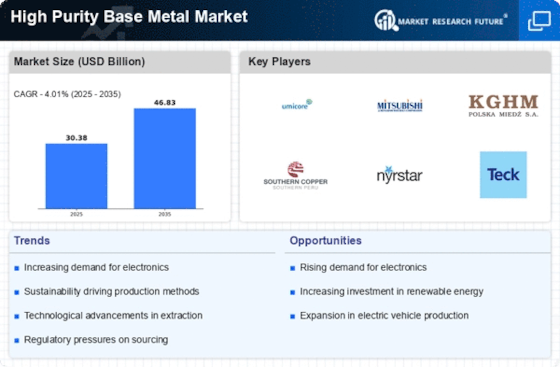

Rising Demand in Electronics

The High Purity Base Metal Market is experiencing a notable surge in demand driven by the electronics sector. As technology advances, the need for high-purity metals, such as copper and aluminum, is becoming increasingly critical for manufacturing semiconductors and electronic components. In 2025, the electronics industry is projected to account for approximately 30% of the total demand for high purity base metals. This trend is likely to continue as the proliferation of smart devices and renewable energy technologies necessitates the use of high-quality materials. Consequently, manufacturers are compelled to invest in high purity base metal production to meet the stringent quality standards required in electronics, thereby propelling the market forward.

Increasing Regulatory Standards

The High Purity Base Metal Market is also shaped by the increasing regulatory standards concerning material purity and environmental impact. Governments and international organizations are implementing stricter regulations to ensure that metals used in various applications meet high purity requirements. This regulatory landscape is compelling manufacturers to enhance their production processes and invest in high purity base metal technologies. In 2025, it is estimated that compliance with these regulations will drive a 15% increase in the demand for high purity base metals across multiple industries, including automotive and aerospace. As a result, companies that prioritize adherence to these standards may find themselves better positioned in the market.

Growth in Renewable Energy Sector

The High Purity Base Metal Market is significantly influenced by the expansion of the renewable energy sector. As countries strive to transition towards sustainable energy sources, the demand for high purity metals, particularly copper and silver, is expected to rise. These metals are essential for the production of solar panels and wind turbines, which are integral to renewable energy systems. In 2025, the renewable energy sector is anticipated to contribute around 25% to the overall demand for high purity base metals. This growth is indicative of a broader shift towards clean energy solutions, which may further stimulate investments in high purity base metal production to support the burgeoning renewable energy infrastructure.

Technological Innovations in Metal Processing

Technological advancements in metal processing are reshaping the High Purity Base Metal Market. Innovations such as advanced refining techniques and improved extraction methods are enhancing the purity levels of base metals, making them more suitable for high-tech applications. For instance, the introduction of hydrometallurgical processes has shown potential in increasing the yield of high purity metals. As these technologies evolve, they are likely to reduce production costs and improve efficiency, thereby attracting more players into the high purity base metal market. This trend suggests a competitive landscape where companies that adopt cutting-edge technologies may gain a significant advantage, further driving the market's growth.

Emerging Applications in Aerospace and Defense

The High Purity Base Metal Market is witnessing growth due to emerging applications in the aerospace and defense sectors. High purity metals, such as titanium and nickel, are increasingly utilized in the manufacturing of aircraft components and military equipment, where material integrity and performance are paramount. The aerospace industry is projected to account for approximately 20% of the total demand for high purity base metals by 2025. This trend is likely to be fueled by advancements in aerospace technology and the need for lightweight, durable materials. Consequently, the high purity base metal market may experience a robust expansion as manufacturers cater to the specific requirements of these critical industries.

.png)