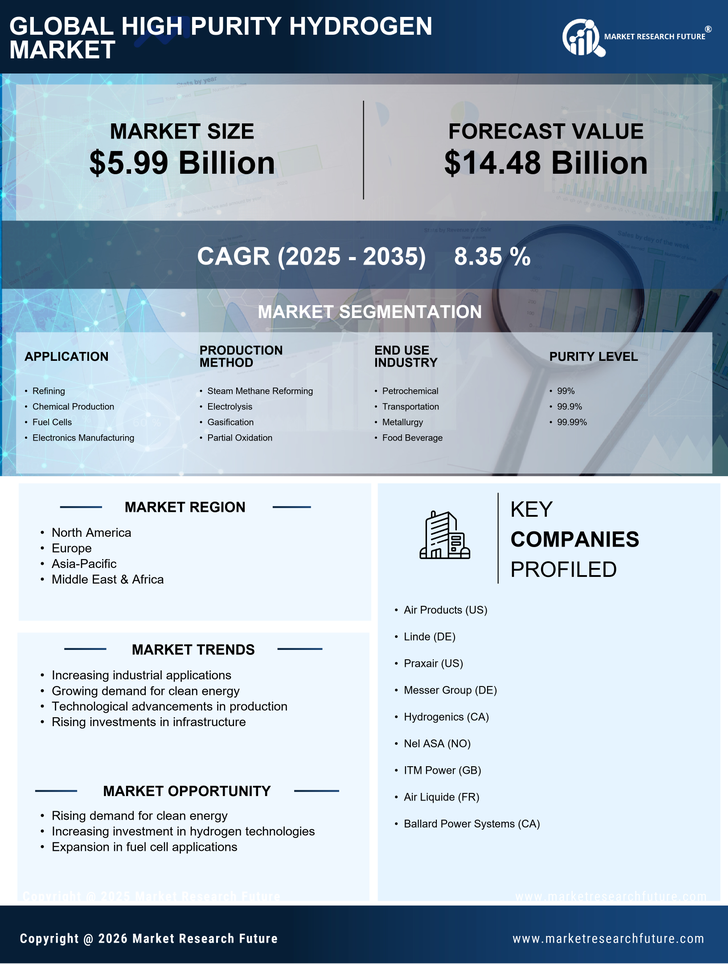

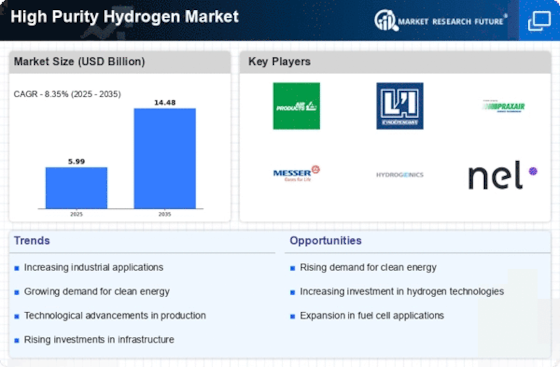

Rising Demand for Fuel Cell Technologies

The increasing adoption of fuel cell technologies is a primary driver for the High Purity Hydrogen Market. Fuel cells, which convert hydrogen into electricity, are gaining traction in various sectors, including transportation and stationary power generation. The market for fuel cells is projected to reach USD 30 billion by 2026, indicating a robust growth trajectory. This surge is largely attributed to the push for cleaner energy solutions and the need to reduce greenhouse gas emissions. As industries seek to transition from fossil fuels to hydrogen-based systems, the demand for high purity hydrogen is expected to escalate. Consequently, this trend is likely to bolster the High Purity Hydrogen Market, as manufacturers strive to meet the stringent purity requirements essential for optimal fuel cell performance.

Growing Investment in Hydrogen Infrastructure

Investment in hydrogen infrastructure is a crucial driver for the High Purity Hydrogen Market. Governments and private entities are allocating substantial resources to develop hydrogen production, storage, and distribution networks. For example, initiatives such as hydrogen refueling stations for fuel cell vehicles are expanding rapidly, with projections indicating a growth to over 1,000 stations by 2030. This infrastructure development is essential for facilitating the widespread adoption of hydrogen technologies. As the availability of high purity hydrogen increases, industries will be better equipped to integrate hydrogen solutions into their operations, thereby propelling the High Purity Hydrogen Market forward.

Supportive Government Policies and Incentives

Supportive government policies and incentives are playing a pivotal role in shaping the High Purity Hydrogen Market. Many countries are implementing regulations and financial incentives to promote hydrogen as a clean energy source. For instance, tax credits and subsidies for hydrogen production and utilization are becoming more common, encouraging investment in this sector. Additionally, international agreements aimed at reducing carbon emissions are further driving the demand for hydrogen solutions. As these policies take effect, they are likely to stimulate growth in the High Purity Hydrogen Market, fostering innovation and encouraging companies to develop high purity hydrogen solutions that align with sustainability goals.

Industrial Applications and Chemical Feedstock

High purity hydrogen serves as a critical feedstock in various industrial applications, particularly in the production of ammonia and methanol. The ammonia market alone is anticipated to grow significantly, with projections suggesting a value of USD 100 billion by 2025. This growth is driven by the increasing demand for fertilizers in agriculture, which relies heavily on ammonia synthesis. Furthermore, methanol production, which utilizes high purity hydrogen, is also on the rise, with applications in energy storage and as a fuel alternative. As these industries expand, the High Purity Hydrogen Market is poised to benefit from the heightened demand for high-quality hydrogen, ensuring that production processes remain efficient and environmentally friendly.

Advancements in Hydrogen Production Technologies

Technological innovations in hydrogen production methods, such as electrolysis and steam methane reforming, are significantly influencing the High Purity Hydrogen Market. These advancements are enhancing the efficiency and cost-effectiveness of hydrogen production, making high purity hydrogen more accessible. For instance, the cost of electrolysis has decreased by approximately 50% over the past decade, facilitating the growth of green hydrogen initiatives. As industries increasingly adopt these technologies, the demand for high purity hydrogen is expected to rise. This trend not only supports the transition to sustainable energy sources but also positions the High Purity Hydrogen Market as a key player in the global energy landscape.