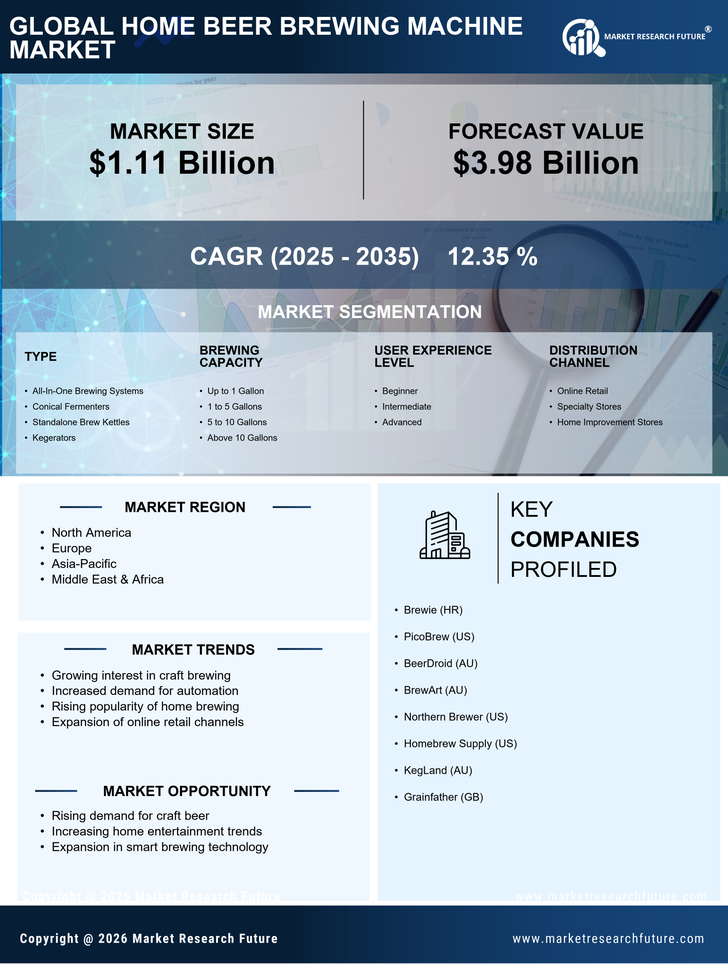

North America : Craft Beer Enthusiast Hub

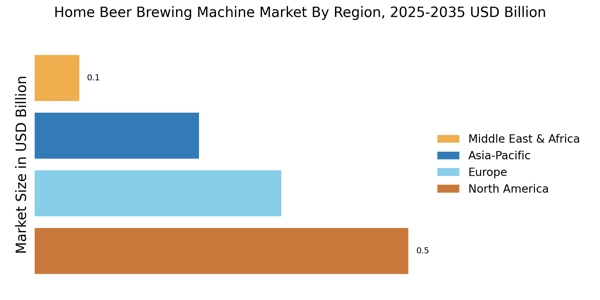

North America leads the home beer brewing machine market, accounting for approximately 45% of global sales. The region's growth is driven by a rising interest in craft beer and home brewing, supported by favorable regulations and a strong community of home brewers. The U.S. is the largest market, followed closely by Canada, which holds about 15% of the market share. Regulatory support for home brewing has further fueled this trend, making it a vibrant sector.

The competitive landscape in North America is robust, featuring key players like PicoBrew and Northern Brewer. These companies are innovating to meet consumer demands for quality and convenience. The presence of a well-established supply chain and a growing number of home brewing clubs contribute to the market's dynamism. As consumers seek personalized brewing experiences, the market is expected to continue its upward trajectory.

Europe : Emerging Craft Beer Market

Europe is witnessing significant growth in the home beer brewing machine market, holding around 30% of the global share. The increasing popularity of craft beer and home brewing, coupled with supportive regulations in countries like Germany and the UK, are key drivers of this trend. The region's diverse beer culture encourages experimentation, leading to a surge in demand for home brewing equipment. Germany is the largest market, followed by the UK, which contributes about 10% to the overall market.

Leading countries in Europe are Germany, the UK, and France, with a competitive landscape featuring brands like Grainfather and BrewArt. The presence of established breweries transitioning to home brewing kits enhances market dynamics. Additionally, local regulations promoting home brewing are fostering innovation and attracting new entrants. This vibrant market is expected to grow as consumers seek unique brewing experiences.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a significant player in the home beer brewing machine market, accounting for approximately 20% of global sales. The region's growth is driven by increasing disposable incomes, a growing interest in craft beer, and a shift towards home-based leisure activities. Countries like Australia and Japan are leading this trend, with Australia holding about 10% of the market share. Regulatory changes are also making home brewing more accessible to consumers, further fueling demand.

Australia is home to key players like BeerDroid and KegLand, which are innovating to cater to local tastes. Japan is also witnessing a rise in home brewing enthusiasts, supported by a growing number of home brewing clubs and workshops. The competitive landscape is becoming increasingly dynamic, with new entrants and established brands vying for market share. As consumer preferences evolve, the market is poised for continued growth.

Middle East and Africa : Untapped Brewing Potential

The Middle East and Africa region is in the nascent stages of the home beer brewing machine market, holding about 5% of global sales. The growth is primarily driven by a young population and increasing interest in craft beer culture. Countries like South Africa and the UAE are leading the way, with South Africa accounting for a significant portion of the market. However, regulatory challenges and cultural factors may limit growth potential in certain areas, making it a complex landscape for home brewing enthusiasts.

In South Africa, local breweries are beginning to offer home brewing kits, creating a competitive environment. The presence of international brands is also increasing, as they seek to tap into this emerging market. As awareness and acceptance of home brewing grow, the region is expected to see gradual expansion, with opportunities for innovation and market entry for new players.