Growing Focus on Customer Experience

In the competitive landscape of logistics and transportation, enhancing customer experience has become a priority for businesses in India. Companies are increasingly recognizing that timely deliveries and efficient service are critical to customer satisfaction. The route optimization-software market is poised to benefit from this focus, as these solutions enable businesses to streamline their operations and improve delivery accuracy. By optimizing routes, companies can ensure that products reach customers promptly, thereby enhancing overall service quality. As customer expectations continue to rise, the demand for effective route optimization software is likely to grow, further propelling the market forward.

Integration of IoT and Smart Technologies

The integration of Internet of Things (IoT) devices and smart technologies is reshaping the logistics landscape in India. These advancements enable real-time tracking and monitoring of shipments, which is crucial for effective route optimization. The route optimization-software market stands to gain from this trend, as businesses leverage IoT data to make informed decisions about route planning. The ability to analyze traffic patterns, weather conditions, and vehicle performance in real-time enhances the efficiency of logistics operations. As more companies adopt IoT solutions, the demand for sophisticated route optimization software is likely to increase, driving growth in the market.

Surge in Fuel Prices and Operational Costs

The rising fuel prices in India have compelled businesses to seek ways to minimize operational costs. As fuel constitutes a significant portion of logistics expenses, companies are increasingly turning to route optimization software to enhance fuel efficiency. By utilizing advanced algorithms and real-time data, these software solutions can identify the most cost-effective routes, thereby reducing fuel consumption. The route optimization-software market is expected to thrive as organizations recognize the potential for substantial savings. With fuel prices projected to remain volatile, the urgency for cost-effective logistics solutions will likely drive further adoption of route optimization technologies.

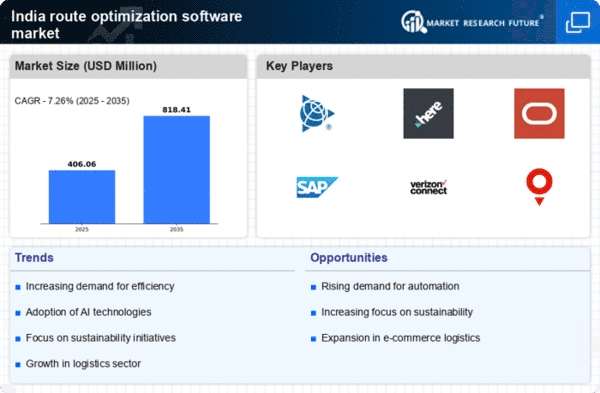

Rising Demand for Efficient Logistics Solutions

The logistics sector in India is experiencing a notable transformation, driven by the increasing demand for efficient delivery systems. As e-commerce continues to expand, businesses are seeking ways to optimize their supply chains. The route optimization-software market is positioned to benefit from this trend, as companies aim to reduce operational costs and improve delivery times. According to recent estimates, the logistics industry in India is projected to reach $215 billion by 2025, highlighting the potential for software solutions that enhance route planning and execution. This growing demand for logistics efficiency is likely to propel the adoption of route optimization software, as organizations strive to meet customer expectations while minimizing expenses.

Government Initiatives Supporting Digital Transformation

The Indian government is actively promoting digital transformation across various sectors, including transportation and logistics. Initiatives such as the Digital India program aim to enhance the use of technology in public services and business operations. This supportive environment is conducive to the growth of the route optimization-software market, as businesses are encouraged to adopt innovative solutions. The government's focus on improving infrastructure and connectivity further complements this trend, as efficient route planning becomes essential for maximizing the benefits of these developments. As a result, the route optimization-software market is likely to see increased investment and adoption, driven by favorable government policies and initiatives.

Leave a Comment