Growing Demand for Customization

In Japan, the computer aided-design market is witnessing a growing demand for customization across various sectors. Industries such as consumer electronics and automotive are increasingly seeking tailored design solutions to meet specific consumer preferences. This trend is reflected in the rising adoption of CAD tools that allow for personalized design features, which can enhance user experience and satisfaction. As of 2025, it is estimated that the customization segment will account for approximately 30% of the overall CAD market. This shift towards bespoke design solutions is prompting CAD software developers to innovate and offer more flexible tools that cater to diverse client needs. Consequently, the computer aided-design market is evolving to accommodate these demands, fostering a more dynamic and responsive design environment.

Focus on Education and Skill Development

The computer aided-design market in Japan is experiencing a renewed focus on education and skill development. As industries evolve, there is a pressing need for a skilled workforce proficient in the latest CAD technologies. Educational institutions are increasingly incorporating CAD training into their curricula, ensuring that students are equipped with the necessary skills to thrive in the design field. In 2025, it is projected that the demand for CAD professionals will rise by 15%, driven by the expanding market and the need for specialized knowledge. This emphasis on education not only enhances the talent pool but also encourages innovation within the computer aided-design market. As companies seek to hire skilled designers, the collaboration between academia and industry is likely to strengthen, further propelling market growth.

Technological Advancements in CAD Software

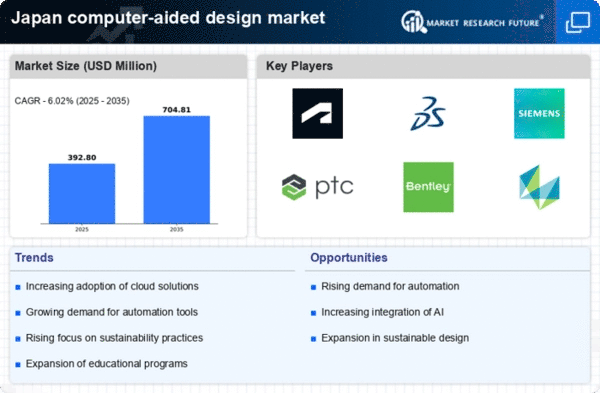

The computer aided-design market in Japan is experiencing a surge due to rapid technological advancements in CAD software. Innovations such as 3D modeling, parametric design, and cloud-based solutions are enhancing design capabilities. In 2025, the market is projected to grow at a CAGR of 8.5%, driven by the increasing demand for sophisticated design tools across various industries, including automotive and architecture. These advancements enable designers to create more complex and efficient designs, thereby improving productivity and reducing time-to-market. Furthermore, the integration of simulation and analysis tools within CAD software allows for better decision-making and optimization of designs, which is crucial in a competitive landscape. As companies in Japan continue to invest in cutting-edge technologies, the computer aided-design market is likely to expand significantly.

Rising Adoption of Virtual Reality in Design

The integration of virtual reality (VR) technology into the computer aided-design market is gaining traction in Japan. As designers and architects seek to create immersive experiences for clients, VR is becoming an essential tool for visualizing designs in a realistic context. This trend is particularly evident in the real estate and interior design sectors, where clients increasingly expect to experience spaces before they are built. By 2025, it is anticipated that the use of VR in CAD applications will grow by approximately 25%, enhancing the design process and client engagement. The ability to simulate environments and make real-time adjustments is revolutionizing how designs are presented and approved. Consequently, the computer aided-design market is evolving to incorporate these advanced technologies, fostering innovation and creativity in design.

Increased Investment in Infrastructure Projects

The computer aided-design market in Japan is benefiting from increased investment in infrastructure projects. The Japanese government has prioritized infrastructure development, allocating substantial budgets for transportation, urban development, and public works. In 2025, the infrastructure sector is expected to contribute significantly to the CAD market, with an estimated growth rate of 7% annually. This investment is driving the demand for advanced CAD solutions that facilitate efficient planning, design, and execution of large-scale projects. As architects and engineers leverage CAD tools to enhance collaboration and streamline workflows, the computer aided-design market is poised for robust growth. The emphasis on smart city initiatives further underscores the importance of innovative design solutions in shaping the future of urban environments.