Regulatory Framework Enhancements

The regulatory landscape surrounding the genetic testing market is evolving, which serves as a crucial driver for market growth. Recent enhancements in regulations aim to ensure the safety and efficacy of genetic tests, fostering consumer confidence. These regulations also encourage innovation by providing clear guidelines for companies operating in the genetic testing market. As a result, businesses are more likely to invest in research and development, leading to the introduction of new and improved testing solutions. The regulatory framework is expected to support a market expansion of around 12% annually, reflecting the positive impact of a robust regulatory environment on the genetic testing market.

Rising Demand for Personalized Medicine

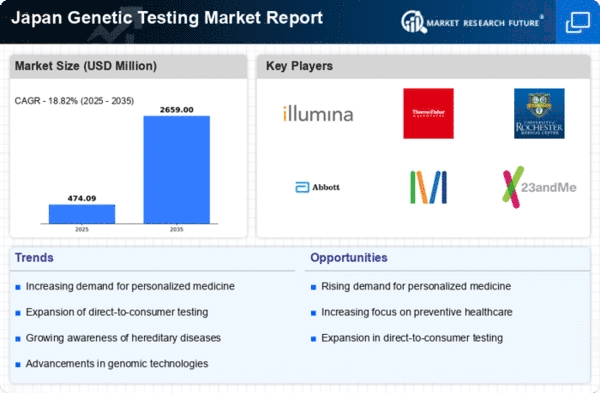

the genetic testing market is experiencing a notable surge in demand for personalized medicine. This trend is driven by an increasing recognition of the importance of tailored healthcare solutions that cater to individual genetic profiles. As healthcare providers and patients alike seek more effective treatment options, the market for genetic testing is projected to grow significantly. According to recent estimates, the market could reach approximately $1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 10%. This shift towards personalized medicine not only enhances patient outcomes but also drives innovation within the genetic testing market, as companies strive to develop more precise and efficient testing methodologies.

Advancements in Genetic Research and Technology

the genetic testing market is significantly influenced by advancements in genetic research and technology. Innovations such as next-generation sequencing (NGS) and CRISPR technology are revolutionizing the capabilities of genetic testing, enabling more accurate and comprehensive analyses. These technological advancements not only enhance the reliability of test results but also expand the range of conditions that can be tested. As a result, the market is expected to grow, with projections indicating a potential increase in market size by 15% annually over the next five years. This growth is indicative of the ongoing evolution within the genetic testing market, driven by continuous research and development efforts.

Growing Aging Population and Genetic Testing Awareness

Japan's aging population is a significant driver for the genetic testing market. As the demographic shifts towards an older population, there is an increasing prevalence of age-related diseases, which necessitates more comprehensive healthcare solutions. Genetic testing offers valuable insights into hereditary conditions, allowing for better management of health risks associated with aging. Furthermore, public awareness campaigns are enhancing understanding of genetic testing's benefits, leading to higher adoption rates among older adults. It is anticipated that the aging population could contribute to a market growth of approximately 20% by 2027, underscoring the critical role of demographic trends in shaping the genetic testing market.

Integration of Genetic Testing in Preventive Healthcare

Preventive healthcare is becoming increasingly integrated with genetic testing in Japan, which is a key driver for the market. As awareness of genetic predispositions to various diseases grows, healthcare professionals are incorporating genetic testing into routine health assessments. This proactive approach allows for early detection and intervention, potentially reducing healthcare costs in the long run. The genetic testing market is likely to benefit from this trend, as more individuals opt for testing to understand their health risks. It is estimated that the preventive healthcare segment could account for over 30% of the overall genetic testing market by 2025, highlighting the importance of this integration in shaping future healthcare practices.