Research Methodology on the Jellies and Gummies Market

INTRODUCTION

Jellies and gummies are somewhat different forms of confectionery, which although similar in texture, have very different effects on consumption. Jellies are a type of confectionery often made from fruit juices, syrups and other sweeteners, while gummies are jelly-based confectionery usually coated with sugar or chocolate. The ability to shape the jelly into various forms has extended the market share of these confectionery products, as they have become popular amongst children and adults alike.

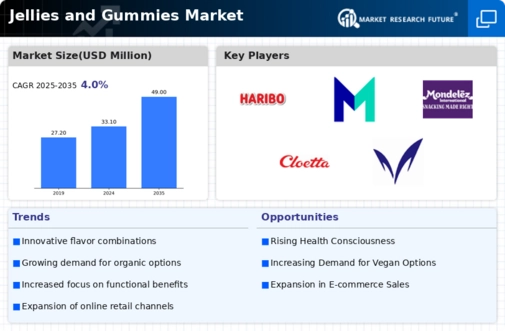

Market Research Future (MRF) has published a comprehensive research report on the global jellies and gummies market, which focuses on the current and changing dynamics of the market, from historical to present figures. The published research report offers a detailed quantitative and qualitative analysis of the global jellies and gummies market over the forecast period (2023-2030).

The market research report offers data on the size and share of the global jellies and gummies market and its growth rate, an analysis of the opportunities and significant drivers and limitations, segmentation of the market by product type, function and region, and profiles of key market players.

RESEARCH METHODOLOGY

The research methodology adopted by Market Research Future (MRF) while conducting this pioneering research report on the global jellies and gummies market is based on a combination of primary and secondary research. Primary research consists of collecting and analyzing data from interviews with industry experts and stakeholders and triangulation. Secondary research involves the collection of industry news, online digital repositories and journals, market intelligence, company documents, and relevant presentations and websites.

The data is then tabulated and sorted in the form of tables and graphs in the final report. All the data points are accurately represented, analyzed, and interpreted.

Primary Research

Primary sources are used to garner information from key stakeholders and players in the global jellies and gummies market. Qualitative interviews were conducted with experts to identify the key trends of the market, regional markets, growth strategies, and regional opportunities in the upcoming years. The market estimation is conducted through secondary research and further validated with primary research to define the market size. The collected data and information are further discussed with sales, purchase and supply personnel, industry experts, and key personnel in the corporate world. Interviews were broadly structured and focused on understanding and reconstructing the underlying factors in the UK and other major countries.

Secondary Research

Secondary research includes an extensive review of secondary sources, such as Market Research Future’s multi-country and multi-country market databases, which track the data points of crucial market components. In addition, the Global Jellies and Gummies Market data were grouped in terms of source, region, product type, production capability and function. The sources employed include market intelligence databases, websites of industry associations, various market reports, business directories, and relevant online and offline resources. Analysts generated a market definition and analyzed it using the industry-standard methodology.

Research Design

The published research report by Market Research Future employs a robust research design that provides appropriate methodologies for achieving the desired results. In order to identify the key drivers, restraints and opportunities of the global jellies and gummies market, a combination of qualitative and quantitative research is used. The size is estimated by scanning the worldwide market and country characteristics such as imports and exports, production, market appeal and consumer attitudes towards the product type. The in-depth market analysis provides market estimations and compares the Year-on-Year (Y-o-Y) growth. A market segmentation analysis is carried out to identify regional pockets of growth in the market and to analyze the product type and function. Various parameters such as market maps, pricing analysis, consumer preferences, demand analysis, and forecast analysis are used in order to arrive at the estimated market performance.

Market Structure

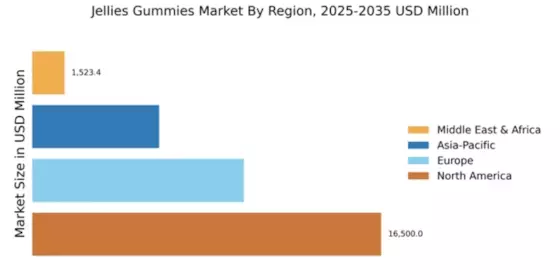

The global jellies and gummies market is segmented by product type and function. Product types of gummies include regular and flavoured, fruit, chocolate, and speciality. By function, the global jellies and gummies market is segmented into nutritional health and immunity, mental health and energy, food and beverage, and other functions. The research report also provides an in-depth analysis of the regional segments of the market and provides an analysis of the trends in each region over the forecast period 2023 to 2030.

Data Collection

In order to provide an accurate overview of the global jellies and gummies market, data is collected from primary, secondary, and expert interviews. Primary data sources comprised suppliers, distributors and major manufacturers in the global jellies and gummies market. Secondary sources include market research reports and literature reviews available on the internet, public and private organizations, market data from international sources, annual reports and regulatory bodies.

Analysis

Analysts conduct market analysis to identify key segments of the global jellies and gummies market and provide a qualitative and quantitative assessment of the market. Market trends, drivers and restraints are analyzed, and certain underlying issues and trends in the market are identified. The data obtained from primary and secondary research is further analyzed by triangulation and classified by segmentation to provide a market-level analysis of the global jellies and gummies market.

Finally, the research report is an amalgamation of various market and forecast analyses, along with the market insights and data provided by the key stakeholders in the global jellies and gummies market. The report provides a comprehensive evaluation of the current and emerging trends in the global jellies and gummies market and offers a comprehensive set of market-level estimates.